Income Tax India issued a reminder for taxpayers regarding showing or filling the income amounts earned mainly from foreign land and to fill Foreign Asset Schedule.

Reetu | Jul 16, 2024 |

Fill Foreign Assets (FA) Schedule in ITR for A.Y. 2024-25; Know Why?

In India, Filing an Income Tax Return (ITR) is a mandatory task for people in every financial year. The deadline for filing an income tax return for FY23-24 is 31st July 2024.

Individuals who are filing their tax returns for the current year need to disclose all the income earned in the year and can claim deductions as well for which they are eligible to reduce their tax liability. Disclosing all income means, showing income earned in the domestic country or earned in foreign land in their respective ITR.

Recently, Income Tax India issued a reminder for taxpayers regarding showing or filling the income amounts earned mainly from foreign land along with the income earned through their profession or job in ITR.

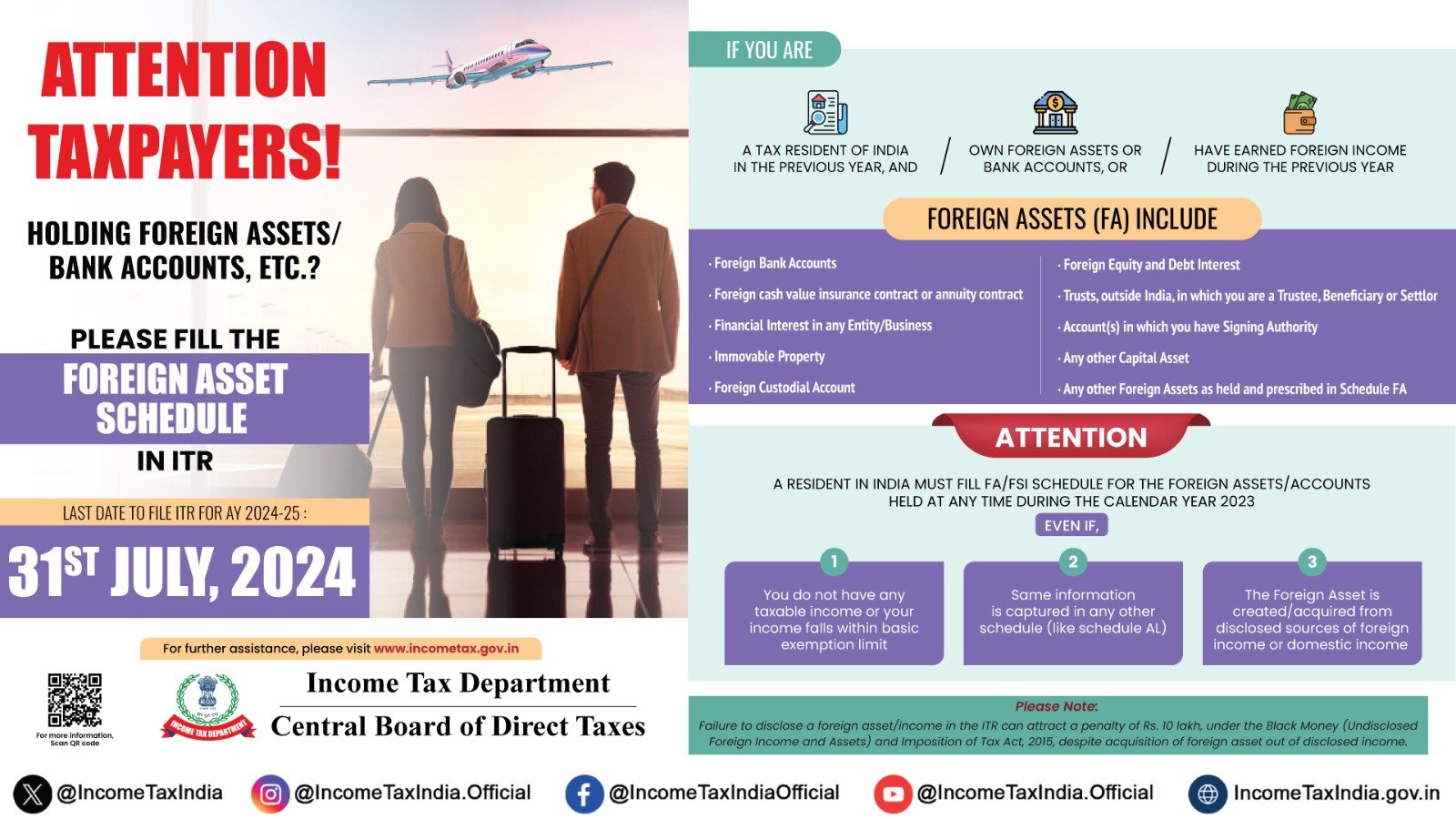

Income Tax India wrote on its offical Twitter handle, “Kind Attention: Holders of foreign bank accounts, assets & income! Please fill the Foreign Asset Schedule in the Income Tax Return (ITR) for A.Y. 2024-25 and disclose all Foreign Assets (FA)/ Foreign Source of Income (FSI) if you have foreign bank accounts, assets or income. Due Date to file ITR for A.Y. 2024-25: 31st July 2024. #FileNow”

Taxpayers who are holding foreign assets, bank accounts etc., then they need to fill the Foreign Asset Schedule in ITR. The last date to file is July 31, 2024.

Taxpayers who are-

Click Here to Know Who has to mandatory file a Return of Income Tax

A Resident in India must fill FA/ FSI Schedule for the Foreign Assets/ Accounts held at any time during the Calendar Year 2023.

Even If:-

Failure to disclose the foreign asset/ income in the ITR can attract a penalty of Rs.10 Lakh under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015, despite the acquisition of foreign assets out of disclosed income.

So, if you are eligible and under the category of the above-mentioned details, do fill your Foreign Asset Schedule in ITR for FY 2023-24 before the deadline.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"