ITR filing deadline approaches soon and taxpayers are filing their returns as soon as they can. But, the IT portal is not working with the efficiency that is needed to file almost crores of returns.

Reetu | Jul 9, 2024 |

Income Tax Portal issues, Shorter Deadline; Should ITR Filing Due Date Permanently Extended

Filing the Income Tax Return in India is a significant task for persons who earn income from any source and touch the threshold limit set in a Financial Year. As the deadline for filing ITR approaches soon, the taxpayers are filing their returns as soon as they can. But, the income tax portal is not working with the efficiency that is needed to file almost crores of returns.

Taxpayers are still facing issues and glitches in the tax portal while filing their Income Tax Returns. And, if the taxpayers would not be able to file the return on time they will leave with the penalty to pay.

The Income Tax India account has been actively responding to user concerns and complaints about a variety of difficulties, including incorrect PAN figures, ITR processing errors and refund delays. Users have complained about problems in resolving concerns through official channels, citing the complexity of the tax filing procedure and a lack of quick responses.

The Income Tax India team has directed users to submit their details via email for further assistance. Additionally, there are discussions on typical ITR issues and FAQs for filing returns for the financial year 2023-24, emphasizing the importance of transparent communication and rapid settlement of taxpayer complaints.

Many Taxpayers and Users are tweeting on their Social media accounts regarding the difficulties and issues they are currently facing and not able to do anything about it.

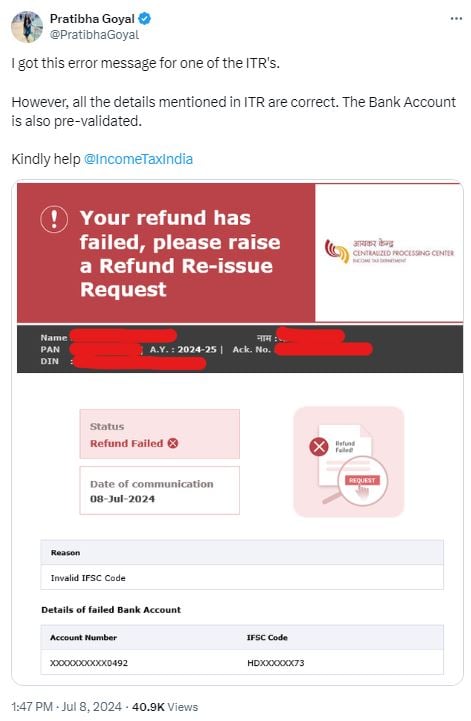

CA Pratibha Goyal Wrote, “I got this error message for one of the ITR’s. However, all the details mentioned in ITR are correct. The Bank Account is also pre-validated. Kindly help @IncomeTaxIndia”

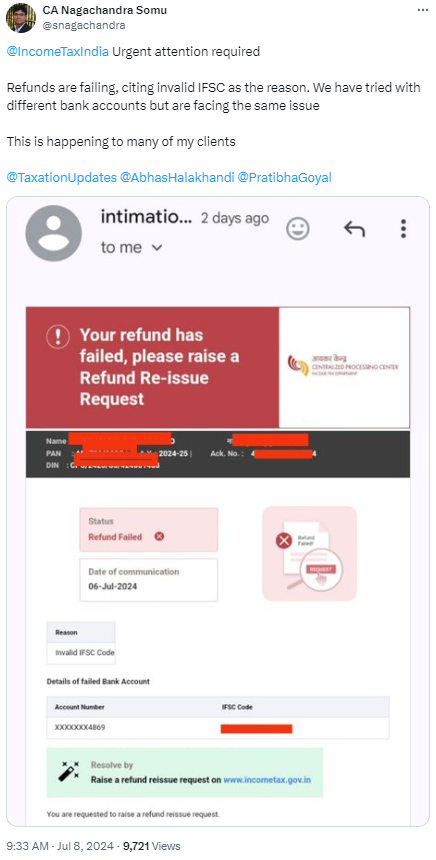

Another Chartered Accountant tweeted, “@IncomeTaxIndia Urgent attention required Refunds are failing, citing invalid IFSC as the reason. We have tried with different bank accounts but are facing the same issue. This is happening to many of my clients @TaxationUpdates @AbhasHalakhandi @PratibhaGoyal”

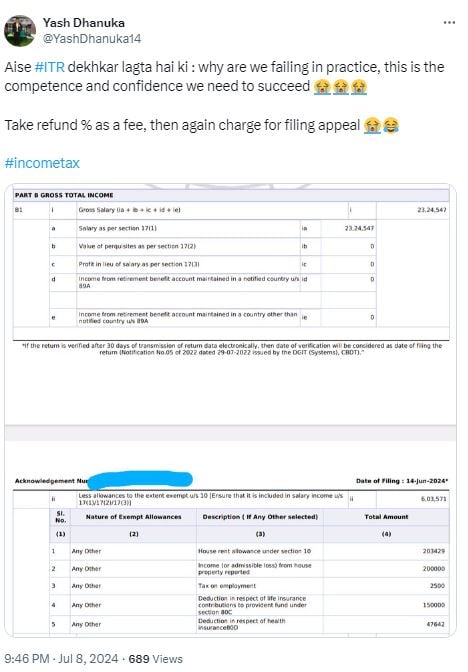

One user wrote, “Aise #ITR dekhkar lagta hai ki: why are we failing in practice, this is the competence and confidence we need to succeed 😭😭😭 Take refund % as a fee, then again charge for filing appeal 😭😂 #incometax”

People are also tagging Income Tax India in their posts with the Grievance Acknowledgment No. So that this could reach to the tax department and they will resolve the issues ASAP.

One person posted, “Getting error while submitting Form 35 for w.r.t Appeal. Grievance Acknowledgment No.: 17357518 @IncomeTaxIndia”

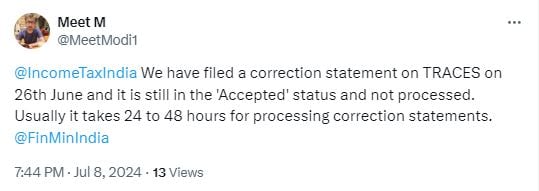

Another person tweeted, “@IncomeTaxIndia We have filed a correction statement on TRACES on 26th June and it is still in the ‘Accepted’ status and not processed. Usually it takes 24 to 48 hours for processing correction statements.@FinMinIndia”

The filing deadline or due date seems to be shorter as a time period. The reason for the same is that the actual ITR Filing starts only after 1st week of June when the TDS Certificates are made available by the deductees. So although Tax Filing utilities are released very early, Taxpayers and Tax professionals do not even get two months for ITR Filing.

We think that most people would agree on this to permanently extend the ITR Filing Deadline.

Do comment on all of you out there who are filing the tax return, what’s your viewpoint on this?? Whether the deadline should be extended or not?

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"