CA Pratibha Goyal | Sep 28, 2022 |

Finance Act provisions of sections 100 to 114 related to GST notified w.e.f. 1st Oct 2022

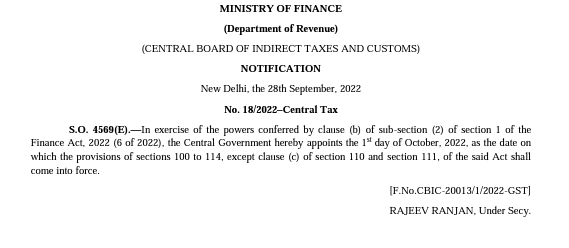

In exercise of the powers conferred by clause (b) of sub-section (2) of section 1 of the Finance Act, 2022 (6 of 2022), the Central Government hereby appoints the 1st day of October 2022, as the date on which the provisions of sections 100 to 114, except clause (c) of section 110 and section 111, of the said Act shall come into force.

Sections of the Finance Act 2022 Notified are given below for reference:

Central Goods and Services Tax

100. Amendment of section 16: In the Central Goods and Services Tax Act, 2017 (hereinafter referred to as the Central Goods and Services Tax Act), in section 16,-

(a) in sub-section (2),–

(i) after clause (b), the following clause shall be inserted, namely:–

(ba) the details of input tax credit in respect of the said supply communicated to such registered person under section 38 has not been restricted;

(ii) in clause (c), the words, figures and letter “or section 43A” shall be omitted;

(b) in sub-section (4), for the words and figures “due date of furnishing of the return under section 39 for the month of September”, the words “thirtieth day of November” shall be substituted.

101. Amendment of section 29: In section 29 of the Central Goods and Services Tax Act, in sub-section (2),–

(a) in clause (b), for the words “returns for three consecutive tax periods”, the words “the return for a financial year beyond three months from the due date of furnishing the said return” shall be substituted;

(b) in clause (c), for the words “a continuous period of six months”, the words “such continuous tax period as may be prescribed” shall be substituted.

102. Amendment of section 34:

In section 34 of the Central Goods and Services Tax Act, in sub-section (2), for the word “September”, the words “the thirtieth day of November” shall be substituted.

103. Amendment of section 37:

In section 37 of the Central Goods and Services Tax Act,-

(a) in sub-section (1),-

(i) after the words “shall furnish, electronically,”, the words “subject to such conditions and restrictions and” shall be inserted;

(ii) for the words “shall be communicated to the recipient of the said supplies within such time and in such manner as may be prescribed”, the words “shall, subject to such conditions and restrictions, within such time and in such manner as may be prescribed, be communicated to the recipient of the said supplies” shall be substituted;

(iii) the first proviso shall be omitted;

(iv) in the second proviso, for the words “Provided further that”, the words “Provided that” shall be substituted;

(v) in the third proviso, for the words “Provided also that”, the words “Provided further that” shall be substituted;

(b) sub-section (2) shall be omitted;

(c) in sub-section (3),-

(i) the words and figures “and which have remained unmatched under section 42 or section 43” shall be omitted;

(ii) in the first proviso, for the words and figures “furnishing of the return under section 39 for the month of September”, the words “the thirtieth day of November” shall be substituted;

(d) after sub-section (3), the following sub-section shall be inserted, namely:-

(4) A registered person shall not be allowed to furnish the details of outward supplies under sub-section (1) for a tax period, if the details of outward supplies for any of the previous tax periods has not been furnished by him:

Provided that the Government may, on the recommendations of the Council, by notification, subject to such conditions and restrictions as may be specified therein, allow a registered person or a class of registered persons to furnish the details of outward supplies under sub-section (1), even if he has not furnished the details of outward supplies for one or more previous tax periods.

104. Substitution of new section for section 38:

For section 38 of the Central Goods and Services Tax Act, the following section shall be substituted, namely:–

38. Communication of details of inward supplies and input tax credit:

(1) The details of outward supplies furnished by the registered persons under sub-section (1) of section 37 and of such other supplies as may be prescribed, and an auto-generated statement containing the details of input tax credit shall be made available electronically to the recipients of such supplies in such form and manner, within such time, and subject to such conditions and restrictions as may be prescribed.

(2) The auto-generated statement under sub-section (1) shall consist of,-

(a) details of inward supplies in respect of which credit of input tax may be available to the recipient; and

(b) details of supplies in respect of which such credit cannot be availed, whether wholly or partly, by the recipient, on account of the details of the said supplies being furnished under sub-section (1) of section 37,-

(i) by any registered person within such period of taking registration as may be prescribed; or

(ii) by any registered person, who has defaulted in payment of tax and where such default has continued for such period as may be prescribed; or

(iii) by any registered person, the output tax payable by whom in accordance with the statement of outward supplies furnished by him under the said sub-section during such period, as may be prescribed, exceeds the output tax paid by him during the said period by such limit as may be prescribed; or

(iv) by any registered person who, during such period as may be prescribed, has availed credit of input tax of an amount that exceeds the credit that can be availed by him in accordance with clause (a), by such limit as may be prescribed; or

(v) by any registered person, who has defaulted in discharging his tax liability in accordance with the provisions of sub-section (12) of section 49 subject to such conditions and restrictions as may be prescribed; or

(vi) by such other class of persons as may be prescribed.

105. Amendment of section 39:

In section 39 of the Central Goods and Services Tax Act,-

(a) in sub-section (5), for the word “twenty”, the word “thirteen” shall be substituted;

(b) in sub-section (7), for the first proviso, the following proviso shall be substituted, namely:-

Provided that every registered person furnishing return under the proviso to sub-section (1) shall pay to the Government, in such form and manner, and within such time, as may be prescribed,-

(a) an amount equal to the tax due taking into account inward and outward supplies of goods or services or both, input tax credit availed, tax payable and such other particulars during a month; or

(b) in lieu of the amount referred to in clause (a), an amount determined in such manner and subject to such conditions and restrictions as may be prescribed.

(c) in sub-section (9),-

(i) for the words and figures “Subject to the provisions of sections 37 and 38, if”, the word “Where” shall be substituted;

(ii) in the proviso, for the words “the due date for furnishing of return for the month of September or second quarter”, the words “the thirtieth day of November” shall be substituted;

(d) in sub-section (10), for the words “has not been furnished by him”, the following shall be substituted, namely:–

or the details of outward supplies under sub-section (1) of section 37 for the said tax period has not been furnished by him:

Provided that the Government may, on the recommendations of the Council, by notification, subject to such conditions and restrictions as may be specified therein, allow a registered person or a class of registered persons to furnish the return, even if he has not furnished the returns for one or more previous tax periods or has not furnished the details of outward supplies under sub-section (1) of section 37 for the said tax period.

106. Substitution of new section for section 41:

For section 41 of the Central Goods and Services Tax Act, the following section shall be substituted, namely:–

41. Availment of input tax credit:

(1) Every registered person shall, subject to such conditions and restrictions as may be prescribed, be entitled to avail the credit of eligible input tax, as self-assessed, in his return and such amount shall be credited to his electronic credit ledger.

(2) The credit of input tax availed by a registered person under sub-section (1) in respect of such supplies of goods or services or both, the tax payable whereon has not been paid by the supplier, shall be reversed along with applicable interest, by the said person in such manner as may be prescribed:

Provided that where the said supplier makes payment of the tax payable in respect of the aforesaid supplies, the said registered person may re-avail the amount of credit reversed by him in such manner as may be prescribed.

107. Omission of sections 42, 43 and 43A:

Sections 42, 43 and 43A of the Central Goods and Services Tax Act shall be omitted.

108. Amendment of section 47:

In section 47 of the Central Goods and Services Tax Act, in sub-section (1),–

(a) the words “or inward” shall be omitted;

(b) the words and figures “or section 38” shall be omitted;

(c) after the words and figures “section 39 or section 45”, the words and figures “or section 52” shall be inserted.

109. Amendment of section 48:

In section 48 of the Central Goods and Services Tax Act, in sub-section (2), the words and figures “, the details of inward supplies under section 38” shall be omitted.

110. Amendment of section 49:

In section 49 of the Central Goods and Services Tax Act,-

(a) in sub-section (2), the words, figures and letter “or section 43A” shall be omitted;

(b) in sub-section (4), after the words “subject to such conditions”, the words “and restrictions” shall be inserted;

(c) for sub-section (10), the following sub-section shall be substituted, namely:-

(10) A registered person may, on the common portal, transfer any amount of tax, interest, penalty, fee or any other amount available in the electronic cash ledger under this Act, to the electronic cash ledger for,-

(a) integrated tax, central tax, State tax, Union territory tax or cess; or

(b) integrated tax or central tax of a distinct person as specified in sub-section (4) or, as the case may be, sub-section (5) of section 25, in such form and manner and subject to such conditions and restrictions as may be prescribed and such transfer shall be deemed to be a refund from the electronic cash ledger under this Act:

Provided that no such transfer under clause (b) shall be allowed if the said registered person has any unpaid liability in his electronic liability register.

(d) after sub-section (11), the following sub-section shall be inserted, namely:-

(12) Notwithstanding anything contained in this Act, the Government may, on the recommendations of the Council, subject to such conditions and restrictions, specify such maximum proportion of output tax liability under this Act or under the Integrated Goods and Services Tax Act, 2017 which may be discharged through the electronic credit ledger by a registered person or a class of registered persons, as may be prescribed.

111. Amendment of section 50: In section 50 of the Central Goods and Services Tax Act, for sub-section (3), the following sub-section shall be substituted and shall be deemed to have been substituted with effect from the 1st day of July, 2017, namely:–

(3) Where the input tax credit has been wrongly availed and utilised, the registered person shall pay interest on such input tax credit wrongly availed and utilised, at such rate not exceeding twenty-four per cent. as may be notified by the Government, on the recommendations of the Council, and the interest shall be calculated, in such manner as may be prescribed.

112. Amendment of section 52:

In section 52 of the Central Goods and Services Tax Act, in sub-section (6), in the proviso, for the words “due date for furnishing of statement for the month of September”, the words “thirtieth day of November” shall be substituted.

113. Amendment of section 54:

In section 54 of the Central Goods and Services Tax Act,-

(a) in sub-section (1), in the proviso, for the words and figures “the return furnished under section 39 in such”, the words “such form and” shall be substituted;

(b) in sub-section (2), for the words “six months”, the words “two years” shall be substituted;

(c) in sub-section (10), the words, brackets and figure “under sub-section (3)” shall be omitted;

(d) in the Explanation, in clause (2), after sub-clause (b), the following sub-clause shall be inserted, namely:–

(ba) in case of zero-rated supply of goods or services or both to a Special Economic Zone developer or a Special Economic Zone unit where a refund of tax paid is available in respect of such supplies themselves, or as the case may be, the inputs or input services used in such supplies, the due date for furnishing of return under section 39 in respect of such supplies;

114. Amendment of section 168:

In section 168 of the Central Goods and Services Tax Act, in sub-section (2), the words, brackets and figures “sub-section (2) of section 38,” shall be omitted.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"