Reetu | Jan 20, 2022 |

FM Authorises Release of Advance Installment of Tax Devolution to State Governments Amounting to Rs.47,541 Crore

Smt. Nirmala Sitharaman, Union Minister of Finance and Corporate Affairs, today authorised the release of a Rs. 47,541 crore advance instalment of tax devolution to state governments. This is in addition to the monthly devolution for January 2022, which was also revealed today.

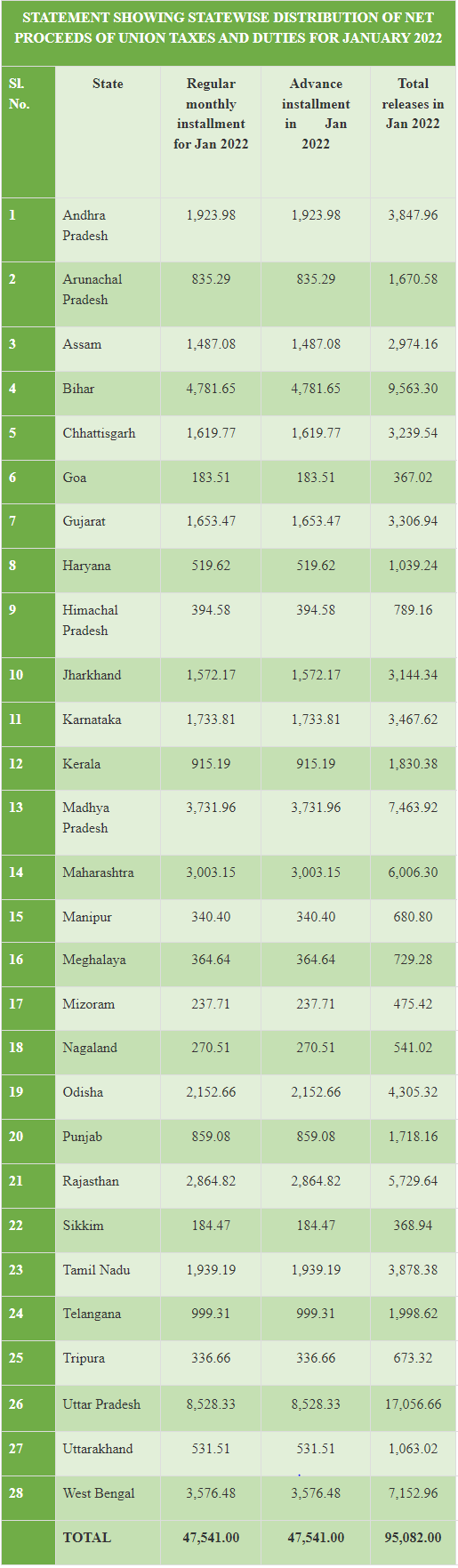

As a result, for the month of January 2022, States will receive a total of Rs.95,082 crore, or double their respective allotment. An appendix has a state-by-state breakdown of the amounts being distributed.

On November 22, 2021, the Government of India released the first advance instalment of tax devolution to States, totaling Rs. 47,541 crore. With today’s distribution of the second advance instalment, the States will receive an additional sum of Rs 90,082 crore in tax devolution over and above what was projected to be released until January 2022.

It’s also worth noting that the Government of India finalised the release of a back-to-back loan of Rs. 1.59 lakh crore to State Governments in lieu of GST Compensation shortfall in FY 2021-22 by the end of October 2021.

This is in keeping with the Indian government’s goal to empower states to increase capital and development spending in order to mitigate the negative consequences of the COVID-19 pandemic.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"