Reetu | Jan 4, 2022 |

Food Delivery App required to report supplies under sec 9(5) in Table 3.1(a) of GSTR-3B: clarifies GSTN

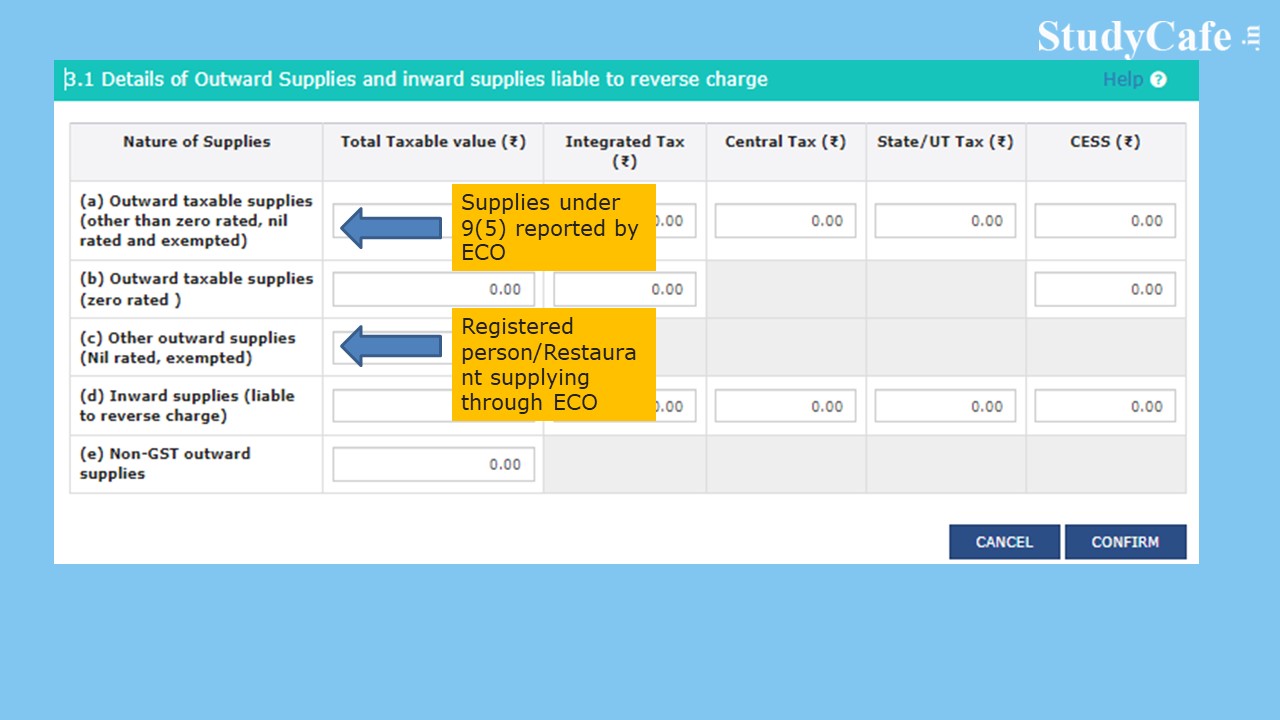

1. Notification No. 17/2021-Central Tax (Rate) and 17/2021-Integrated Tax (Rate) dated 18.11.2021 were issued in response to the GST Council‘s decision to notify “Restaurant Service“ under section 9(5) of the CGST Act, 2017, along with other services notified previously such as motor cabs, accommodation, and housekeeping services, where the tax on such supplies would be paid by the electronic commerce operator if such supplies were made through it. As a result, beginning January 1, 2022, the e-commerce operator will be responsible for paying the tax on supplies of restaurant services provided through e-commerce operators.

Food Delivery App required to report supplies under sec 9(5) in Table 3.1(a) of GSTR-3B: clarifies GSTN

2. In light of the foregoing, E-commerce operators and registered persons should report taxable supply notified under section 9(5) of the CGST Act, 2017 and corresponding provisions in the IGST/SGST/UTGST Act as follows.

Please see CBIC Circular No. 167/23/2021, dated 17.12.2021, for further information.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"