Studycafe | Oct 1, 2020 |

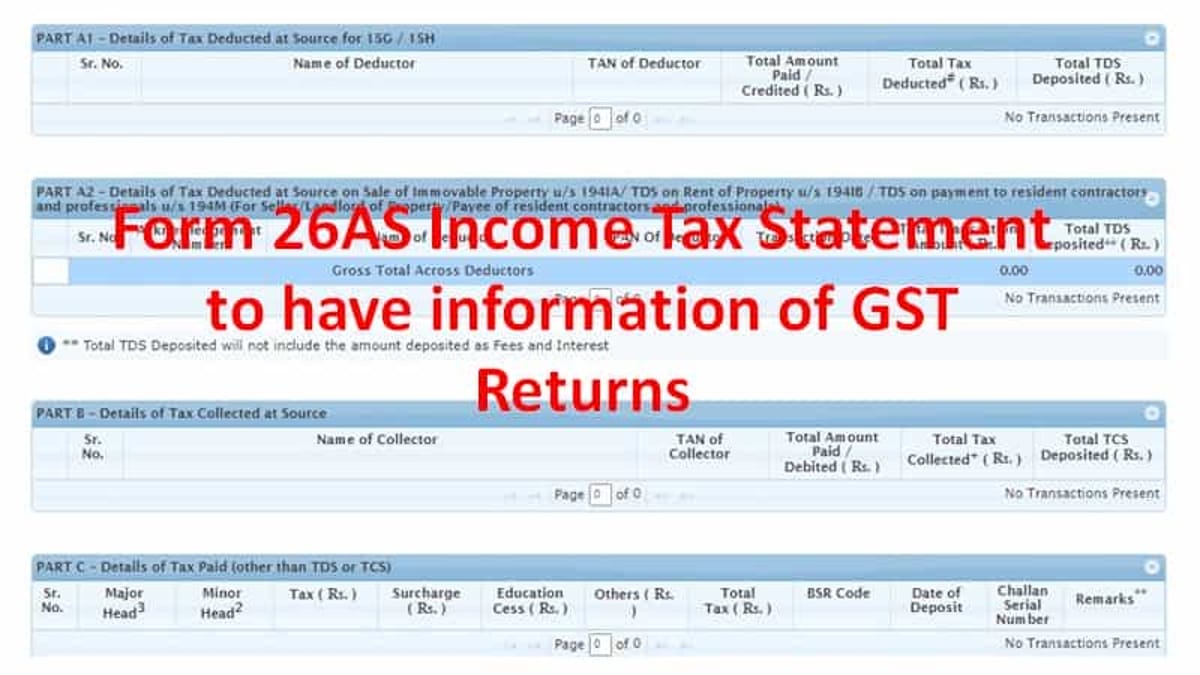

Form 26AS Income Tax Statement to have information of GST Returns

As per the latest news updates, Form 26AS, which is an Income Tax Statement will now have information on GST Returns.

“The Central Board of Direct Taxes (CBDT) authorizes the Principal Director General of Income-tax (Systems) or the Director-General of Income-tax (Systems) to upload information relating to GST returns, which is in his possession, in the Annual Information Statement in Form 26AS, within three months from the end of the month in which the information is received by him,” an order by the CBDT said. Further, it was mentioned that the Principal DG/DG (System) will specify the procedures, formats, and standards for the purposes of uploading of Annual Information Statement in Form 26AS.

Form 26AS, in simple words, is a statement showing all the taxes which have been deducted by a payer, along with the amounts and the sections under which the same has been deducted. It also shows the details regarding the date on which the taxes have been deducted and the date on which the same has been credited to the account of the government. It was notified that now information received from other agencies will be included in form 26AS.

THIS step is taken so as to make the tax system more transparent and to curb tax evasion.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"