CA Pratibha Goyal | Apr 10, 2023 |

Former ICAI Chairman raises concern on hasty arrests of Chartered Accountants

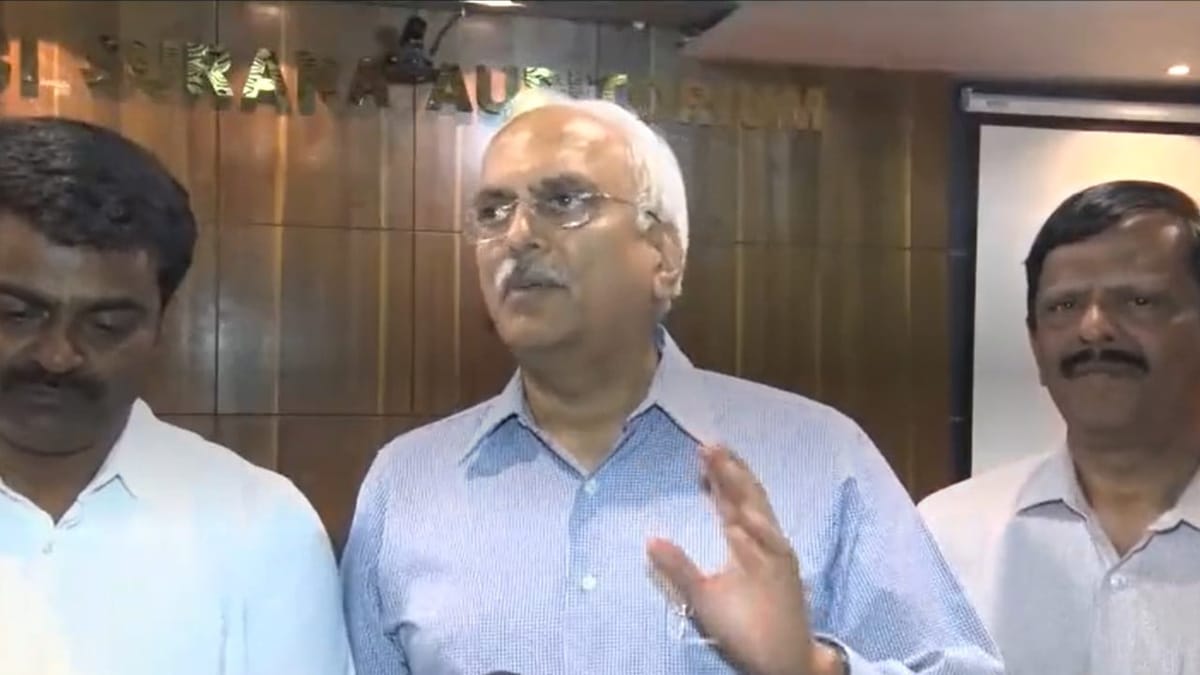

The arrest of some Chartered Accountants by investigative agencies for alleged irregularities concerns former ICAI Chairman C. Murali Krishna. According to him, if procedures are followed, hurried arrests could be prevented.

The ICAI expressed concern about recent “overzealousness shown by various government investigating agencies in interrogating, detaining, and arresting Chartered Accountants (CA) for alleged financial or accounting irregularities in the matters connected with the professional services rendered by Chartered Accountants” during a press conference on Thursday in Hyderabad.

The council further stated that such hurried arrests could have been prevented if the required processes and SOPs were in place prior to any arrests being made.

The ICAI council made it clear, nevertheless, that its goal is not to disrupt the work of the several inquiry and law enforcement bodies involved.

The council continued, “However, there is also a pressing need to prevent its members from being unnecessarily harassed and victimised through unjustified search, seizure, interrogation, detention, and arrest based on mere suspicion of their involvement leading to atmosphere of fear among the members of the profession.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"