CA Pratibha Goyal | Mar 12, 2024 |

Going to Moon is Easier than Getting GST No; Irrelevant Queries of GST Department demands Govt. intervention

Getting GST Registration is not an easy job these days. Government to tighten scrutiny and norms for getting GST Numbers to curb Fake GST Registrations meant only for passing on Input Tax Credit (ITC). In an Advisory, GSTN wrote that it will take 30 days to get a GST Number even if your Adhaar Authentication is successful. Although the motive behind this is just to curb the menace of Bogus GST Registrations, it is the common man, who is suffering in all this.

Read More at GST Registration Process to take 30 Days even after Successful Aadhaar Authentication

Irrelevant queries from the GST Department have made the situation worse. The situation has become so poor that many times GST Officers are also seen demanding Bribes for giving GST Numbers.

Read more at GST Officer held for Accepting Bribe of Rs. 3000 for providing GST number

Many times GST Officer is seen sending a Show Cause Notice (SCN) to present already uploaded documents to get GST Registration.

CA Kanan Bahl writes “GST officer sends a Show Cause Notice to present already uploaded docs. This is after rejecting an application. We all know why and it’s extremely unfortunate. Making a company was very smooth but GST registration is very opaque.

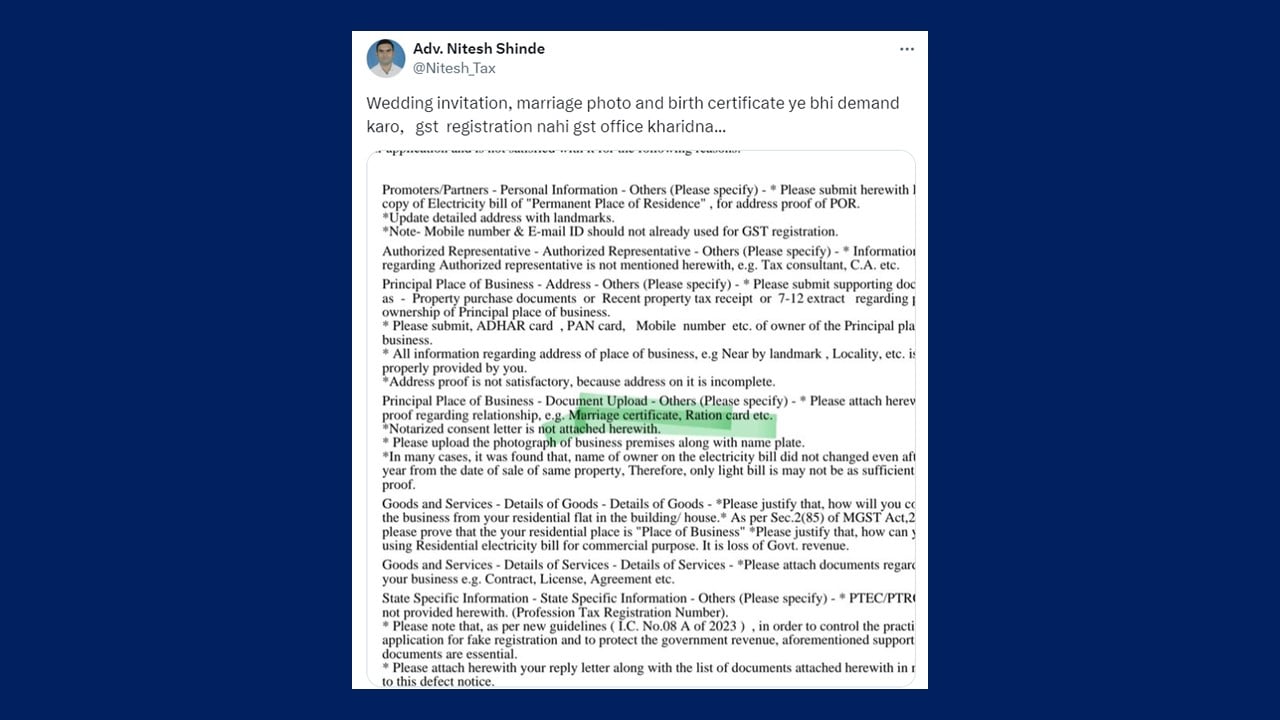

It is heights when GST Officers started demanding Marriage certificates, Ration cards etc. as relationship proof to give GST Registration.

Advocate Nitesh Shinde writes: Wedding invitation, marriage photo and birth certificate ye bhi demand karo, gst registration nahi gst office kharidna…

CA Rohit Jain writes on Twitter “GST registration can take up to 30 days. Now GST Officers will cause more delay”

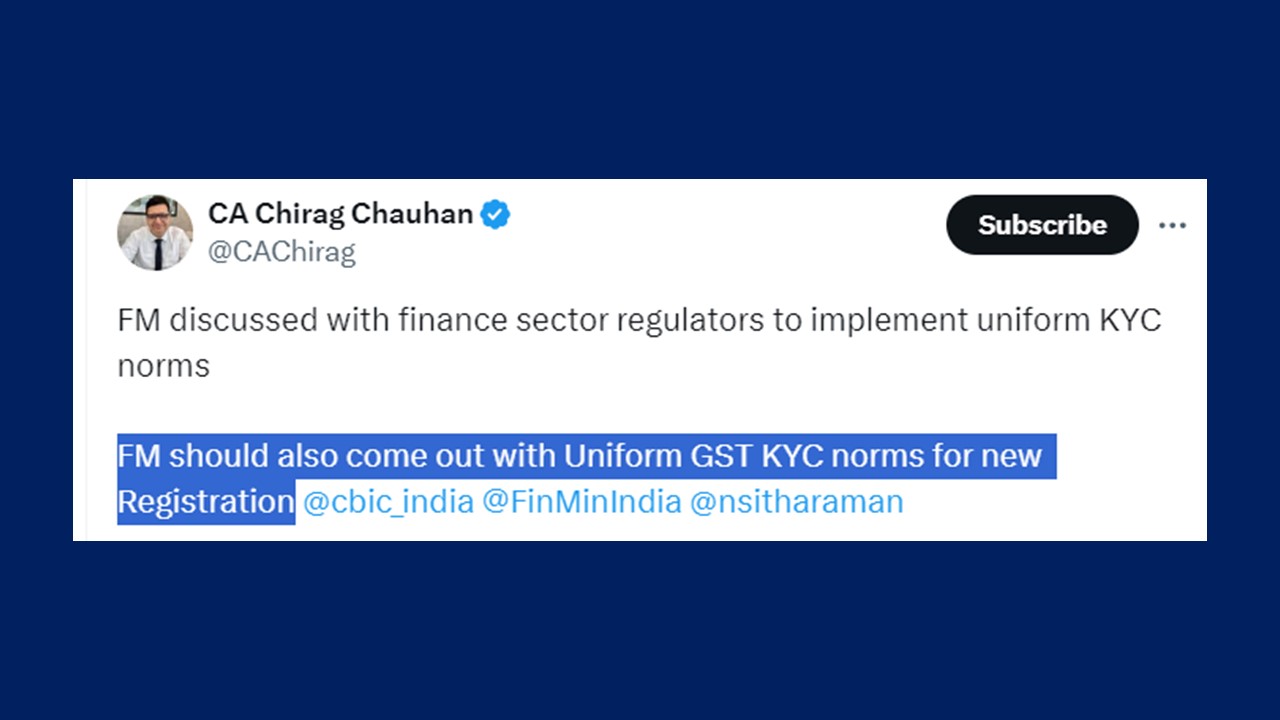

It is a long pending demand of Tax Professionals and Chartered Accountants that Central Government should come up with Uniform GST KYC norms for getting new GST Registration. CA Chirag Chauhan writes “FM should also come out with Uniform GST KYC norms for new Registration”

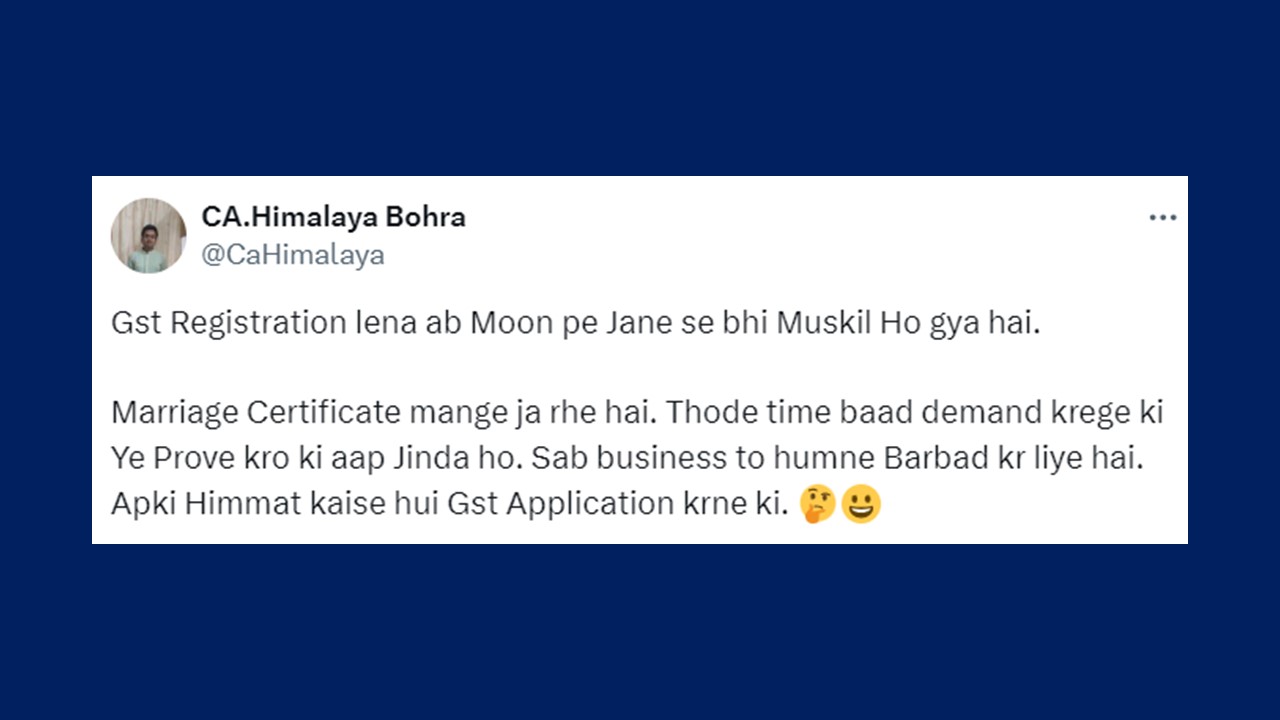

CA Himalaya Bohara Writes “Gst Registration lena ab Moon pe Jane se bhi Muskil Ho gya hai. Marriage Certificate mange ja rhe hai. Thode time baad demand krege ki Ye Prove kro ki aap Jinda ho. Sab business to humne Barbad kr liye hai. Apki Himmat kaise hui Gst Application krne ki.”

Going to Moon is Easier than Getting GST Registration? What do you think? Do share your thoughts

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"