Former Shark Tank India Judge, Ashneer Grover Critised Income Tax Department for giving him a Income Tax Notice where he was given less than 48 hours to reply.

CA Pratibha Goyal | Mar 13, 2024 |

Goli hi maar do seedha: Former Shark Criticizes Income Tax Department for Timing of Notice

On Tuesday, former Shark Tank India Judge, Ashneer Grover Critised Income Tax Department for giving him very less time to reply for Income Tax Notice. He was issued an income tax notice at 8 AM and was asked to reply at 12:28 PM tommorow.

“Tax terrorism or vendetta ? Take your pick…Come on folks – now there is not even an attempt to make things seem genuine. Goli hi maar do seedha”: he wrote on his twitter account showing the Income Tax Notice. He However later deleted his tweet.

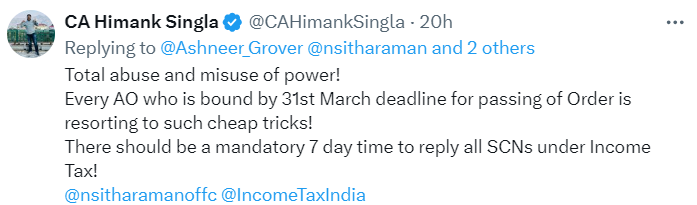

Many Tax Professionals and Chartered Accountant agreed with him on this. One of the CA wrote: Total abuse and misuse of power! Every AO who is bound by 31st March deadline for passing of Order is resorting to such cheap tricks! There should be a mandatory 7 day time to reply all SCNs under Income Tax!

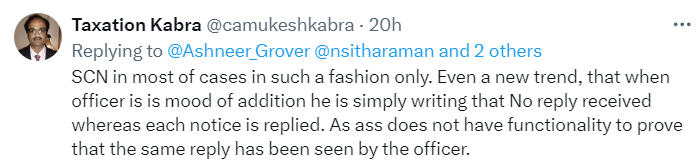

Another Professional wrote: SCN in most of cases in such a fashion only. Even a new trend, that when officer is is mood of addition he is simply writing that No reply received whereas each notice is replied. As ass does not have functionality to prove that the same reply has been seen by the officer.

These Days the Income Tax Department is busy is aggressively issuing Show Cause Notices and passing Income Tax Orders for Financial Year 2021-22 (Assessment Year 2022-23). The period of limitation for passing the Income Tax Order for Assessment Year 2022-23 is 31st March 2024.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"