Reetu | Mar 2, 2022 |

Google Location is Now Compulsory for GST Registration

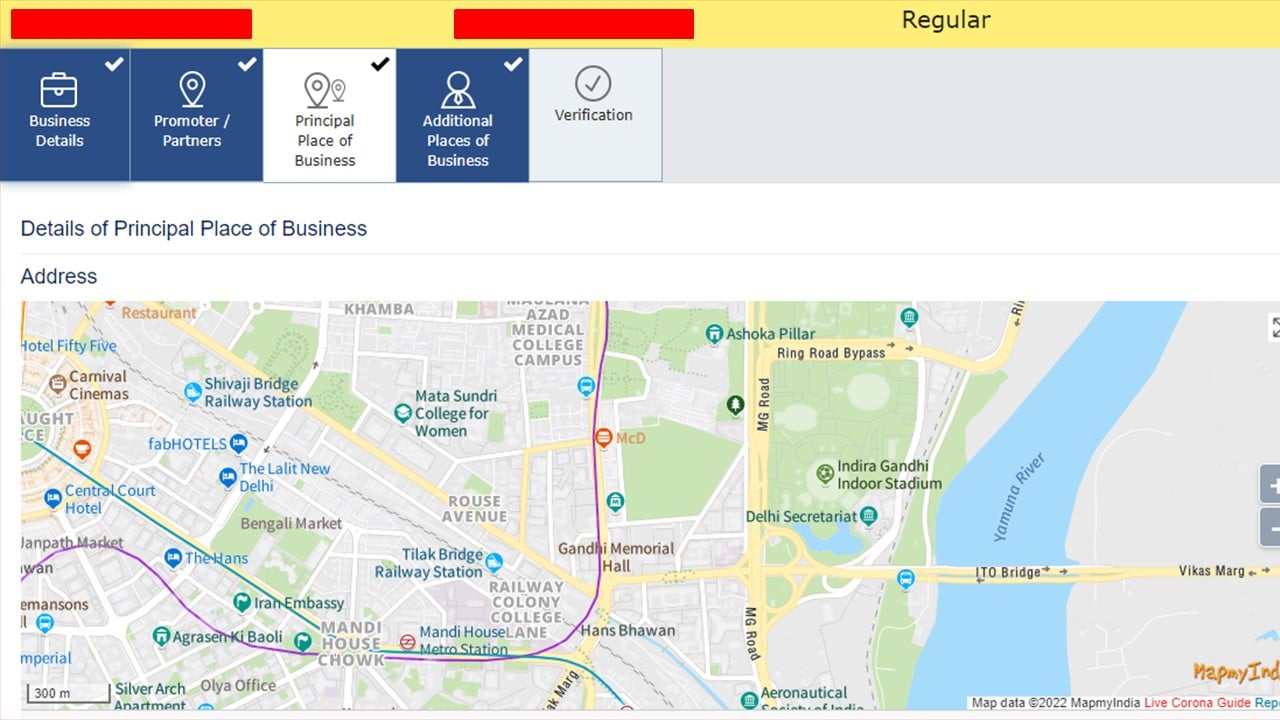

The Goods & Service Tax (GST) Department has made it compulsory to enter the exact google location of premises while doing new GST Registration or while Adding a New Place of Business at the time of Amendment in GST Registration. A screenshot of the tab that would appear while doing GST Registration is given below for reference.

The Map Data has been taken from https://maps.mapmyindia.com/

GST registration is the procedure through which a taxpayer becomes registered under the Goods and Services Tax (GST). After completing the registration process, the Goods and Services Tax Identification Number (GSTIN) is supplied. The Central Government provides the 15-digit GSTIN, which aids in determining if a business is required to pay GST.

A business with a turnover of more than Rs. 40 lakh is required by GST rules to register as a regular taxable entity. This is known as the GST registration process. For firms in hill states and North-Eastern states, the turnover is Rs.10 lakh. The GST registration process can be completed within 6 working days.

GST registration can be completed quickly and conveniently through the GST portal. Business owners can register for GST by filling out a form on the GST portal and submitting the required documentation. GST registration must be completed by businesses. It is a criminal violation to do business without registering for GST, and there are severe penalties for non-registration.

The following is a step-by-step procedure that persons must follow to complete GST Registration:

Step 1: Go to the GST website at https://www.gst.gov.in.

Step 2: Go to the ‘Taxpayers’ tab and click on the ‘Register Now’ link.

Step 3: Click on ‘New Registration.’

Step 4: Fill in the following information:

Step 5: On the following screen, input the OTP that was supplied to the email address and mobile number into the appropriate fields.

Step 6: Once all of the information has been entered, click the ‘Proceed’ button.

Step 7: The Temporary Reference Number (TRN) will be displayed on the screen. Make a mental note of the TRN.

Step 8: Return to the GST portal and select ‘Register’ from the ‘Taxpayers’ option.

Step 9: Click the ‘Temporary Reference Number (TRN)’ button.

Step 10: Enter the TRN and captcha information.

Step 11: Press the ‘Proceed’ button.

Step 12: An OTP will be sent to your registered email address and cell phone number. On the next page, enter the OTP and click ‘Proceed.’

Step 13: On the following screen, you will be able to view the status of your application. There will be an Edit icon on the right side; click on it.

Step 14: The following page will have ten sections. All pertinent information must be entered, and all required documents must be submitted. The following are the papers that must be uploaded:

Step 15: Go to the ‘Verification’ page and review the declaration, then submit the application using one of the options listed below:

Step 16: When finished, a success message will appear on the screen. The Application Reference Number (ARN) will be emailed to the registered mobile phone number and email address.

Step 17: Use the GST portal to check the status of the ARN.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"