Taxpayers can submit the rectification for Section 80G deduction claim within four years from the end of the relevant assessment year

Nidhi | Dec 22, 2025 |

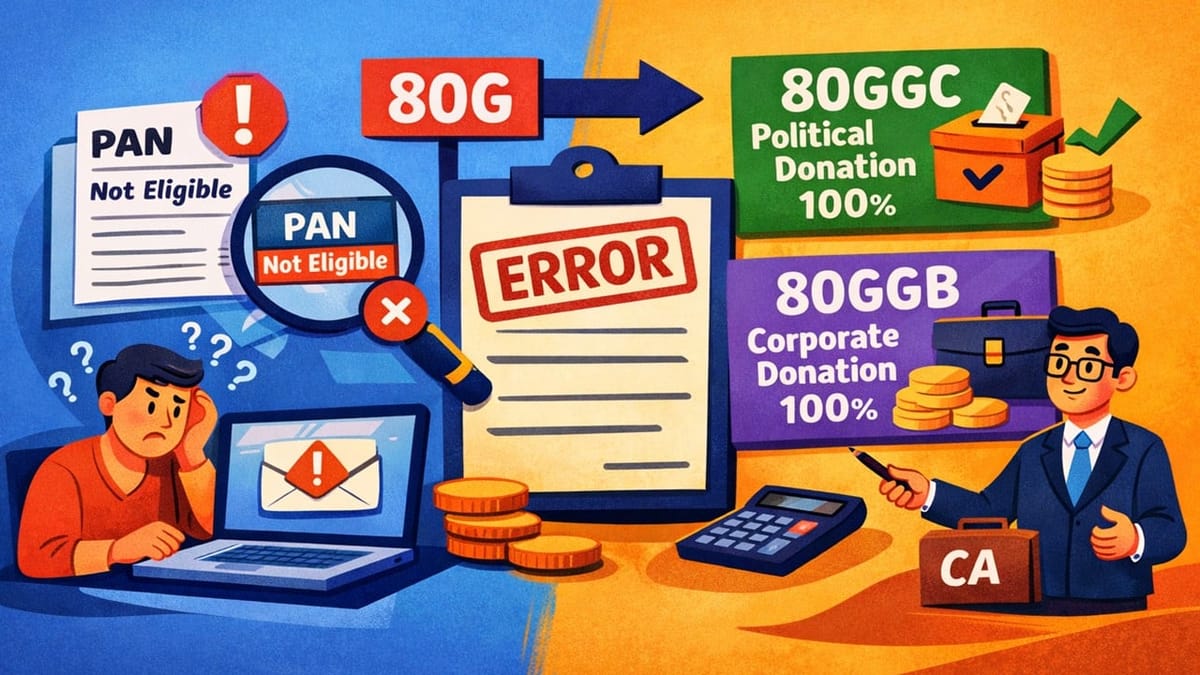

Got intimation that Donee PAN is not eligible for Section 80G deduction: CA shares solution for correction

A chartered accountant has recently shared an important issue regarding tax deductions claimed under Section 80G. Many taxpayers have received emails from the income tax department saying that the deductions claimed by them under Section 80G are not eligible because the Donee PAN is not eligible for deduction.

CA Abhas Halakhandi claims that this is a classification error, where the political donation eligible under Section 80GGC or 80GGB (100% Deduction) has been wrongly claimed under Section 80G. Halakhandi highlighted that this issue can be solved, helping taxpayers save time and effort.

He said that this is a mistake and it can be corrected under section 154 of the Income Tax Act. It will allow the taxpayers to correct the column from 80G to 80GGC or 80GGB. Taxpayers can submit the rectification within four years from the end of the relevant assessment year. He also suggested that taxpayers file the rectification before the jurisdictional Assessing Officer (AO) if the rectification is not accepted on the income tax e-filing portal.

He added that if the above do not work, the last option left for the taxpayers is filing an updated return under Section 139(8A). However, the same will require the taxpayers to report any additional income and payment of additional tax, even if the deduction is valid.

The @IncomeTaxIndia has issued emails for earlier FYs stating that deductions claimed under Section 80G are not eligible as Donee PAN entered is not eligible for deduction.

In almost all cases, this is a classification error, where a political donation eligible under Section… pic.twitter.com/cBpPguDijy

— Abhas Halakhandi (@AbhasHalakhandi) December 20, 2025

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"