Saloni Kumari | Jun 7, 2025 |

![Government Imposes Anti Dumping Duty on Insoluble Sulphur [Read Notification]](/cdn-cgi/image/fit=contain,format=webp,gravity=auto,metadata=none,quality=80,width=1200,height=730/wp-content/uploads/2025/06/ANTI-DUMPING-DUTY-ON-INSOLUBLE-SULPHUR-1.jpg)

Government Imposes Anti Dumping Duty on Insoluble Sulphur [Read Notification]

The Ministry of Finance released an official notification dated June 6, 2025, regarding the matter the “Insoluble Sulphur”. The Ministry has announced the imposition of anti-dumping duties on imports of Insoluble Sulphur originating from China and Japan, following an investigation by the Directorate General of Trade Remedies (DGTR).

The final findings of the DGTR, published vide notification F. No. 06/01/2024-DGTR, dated the 7th March 2025, published in the Gazette of India, Extraordinary, Part I, Section 1, dated the 7th March 2025, have revealed that:

(i) The product has been sold to India at prices lower than its usual value in the exporting countries, which is considered dumping.

(ii) This dumping has caused serious harm to Indian companies making the same product.

(iii) The damage to Indian companies is clearly linked to the dumped imports.

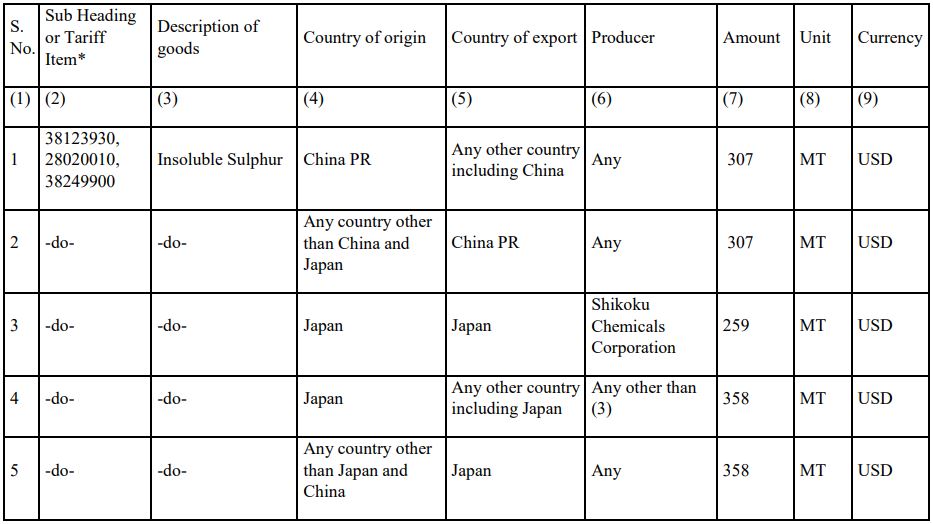

According to the DGTR, there is a direct link between the dumped imports and the injury faced by Indian producers. The investigation covered products classified under tariff codes 38123930, 28020010, and 38249900 of the Customs Tariff Act, 1975.

In response to these findings, the Central Government has imposed an anti-dumping duty on these imports to provide relief and a level playing field to Indian manufacturers. The move aims to prevent further damage and ensure fair competition in the domestic market. This measure is expected to safeguard the interests of local producers and discourage unfair trade practices by foreign exporters.

Now, therefore, under the exercise of powers given under Section 9A(1) and (5) of the Customs Tariff Act and Rules 18 and 20 of the 1995 Anti-Dumping Rules, the Central Government, after reviewing the final findings of the designated authority, has decided to impose anti-dumping duty on the product.

This duty will be applied to protect Indian manufacturers from unfairly low-priced imports.

The anti-dumping duty imposed under this notification is for the period of five years (unless it is cancelled, replaced, or changed earlier) from the date of notification publication in the Official Gazette and will be payable in Indian currency.

Explanation:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"