Reetu | Mar 25, 2022 |

Govt Notifies New E-Way Bill Rule in Madhya Pradesh; will take effect from 15th April 2022

The Government of Madhya Pradesh (M.P) introduced new e-way bill rule in state via Notification No. FA3-08/ 2018/1/V(18) dated 23.03.2022.

The Notification is Given Below:

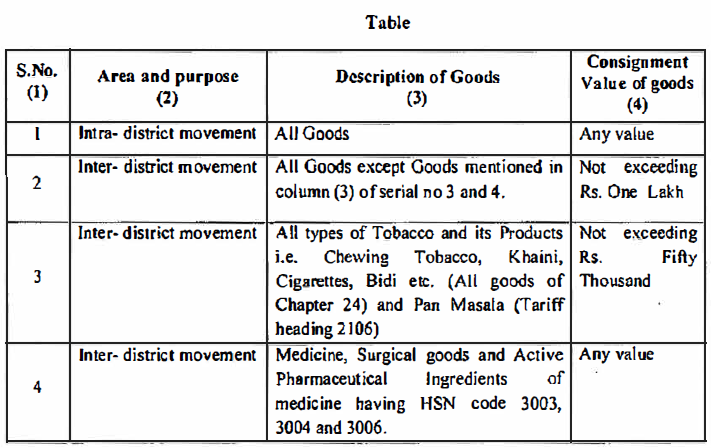

The Commissioner of State Tax Madhya Pradesh in consultation with the Chief Commissioner of Central Tax Madhya Pradesh, in exercise of the powers conferred by clause (d) of sub-rule (14) of Rule 138 of the Madhya Pradesh Goods and Services Tax Rules, 2017, and in supersession of this department’s notification no. F-A-3-08-2018-1-V(43) Bhopal, dated 24th April, 2018 as amended from time to time, hereby notifies that no E-way bill is required to be generated for the movement of the goods as mentioned in the Table below:-

2. Now, therefore, E-way bill is required to be generated in case of intra-state movement of all goods other than referred to at Sr. No. 1, 2, 3 and 4 in the Table above. However, all the provisions and the procedures laid down in rules 138, 138A, 138B, 138C, 138D and 138E shall apply mutatis mutandis for the intra-state movement in the State.

3. This Notification shall come into force from 15.04.2022.

For Official Notification Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"