Reetu | Nov 12, 2022 |

GST Applicable on fees remitted to SEBI

The Securities and Exchange Board of India(SEBI) has notified a Circular regarding Applicability of GST on fees remitted to SEBI for issue and listing of Non-convertible Securities, Securitised Debt Instruments, Security Receipts, Municipal Debt Securities and Commercial Paper.

The Circular Stated, “Chapter XX of the Operational Circular ref. no. SEBI/HO/DDHS/P/CIR/2021/613 dated August 10, 2021 (updated as on April 13, 2022) (NCS Operational Circular), regarding ‘Bank account details for payment of fees’, inter alia, provides the procedure to be followed for payment of fees, as applicable, under the SEBI (Issue and Listing of Non-Convertible Securities) Regulations, 2021 and the SEBI (Issue and Listing of Securitised Debt Instruments and Security Receipts) Regulations, 2008.”

SEBI vide circular ref. no. SEBI/HO/GSD/TAD/CIR/P/2022/0097 dated July 18, 2022, w.r.t. Levy of Goods & Services Tax (GST) on the fees payable to SEBI, informed Market Infrastructure Institutions (MIIs), intermediaries registered with SEBI and companies which have listed/ are intending to list their securities on the Stock Exchange(s) and persons who are dealing in the securities market, that the fees and other charges payable to SEBI shall become subject to GST at the rate of 18% w.e.f. July 18, 2022.

Accordingly, the following amendment is being made to Chapter – XX (Bank account details for payment of fees) of the NCS Operational Circular:

Paragraph b of the said chapter shall be replaced with the following:

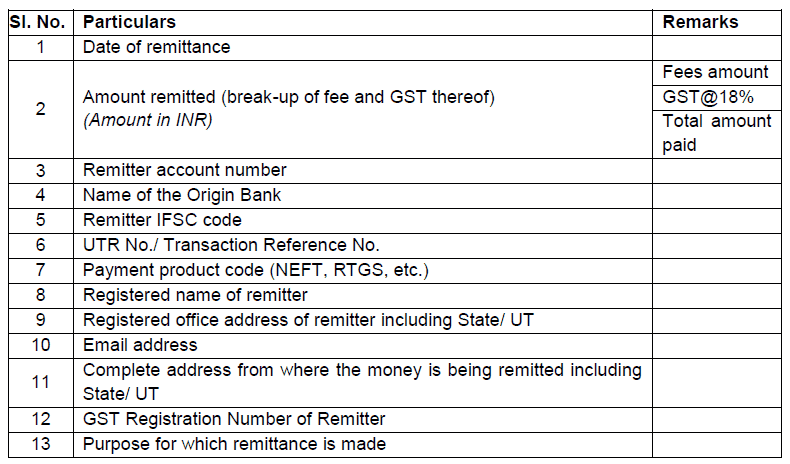

“Provide the remittance particulars by email at od-ddhs@sebi.gov.in, immediately after the remittance is made, in the following format:

The provisions of this circular shall come into force with immediate effect.

The Circular is issued in exercise of the powers conferred under Section 11(1) of the Securities and Exchange Board of India Act, 1992, read with Regulation 55 (1) of the SEBI (Issue and Listing of Non-convertible Securities) Regulations, 2021 and Regulation 48 of the SEBI (Issue and Listing of Securitised Debt Instruments and Security Receipts) Regulations, 2008, to protect the interest of investors in securities and to promote the development of, and to regulate the securities market.

For Official Circular Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"