Reetu | Feb 25, 2023 |

GST Council has not made any recommendation for inclusion of Petroleum under GST

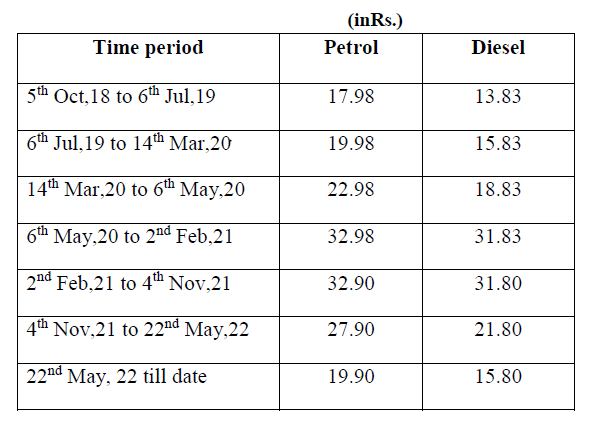

The Minister of State in the Ministry of Finance, Shri Pankaj Chaudhary in a written reply to a question in the Lok Sabha stated that “State/UT wise information with respect to state taxes is not centrally maintained. However, the details of total central excise duty, cesses and surcharges levied and collected per litre on petrol and diesel, in the last five years, is as under-”

In the last 2 years, the Road and Infrastructure Cess (RIC) on petrol and diesel have been reduced by Rs. 13 per litre on petrol and Rs 15 per litre on Diesel. No change has been made in other cesses.

As per Article 271 of the Indian Constitution, all taxes and duties, except cesses levied for specified purposes, shall be distributed between the Union and the States. Devolution to State Governments is made out of the Basic Excise Duty component on the basis of the formula prescribed by the Finance Commission from time to time. The various Cesses collected by the Central Government is inter alia used for funding various Centrally Sponsored schemes, whereby funds are transferred to the States for implementing these schemes for the development of States.

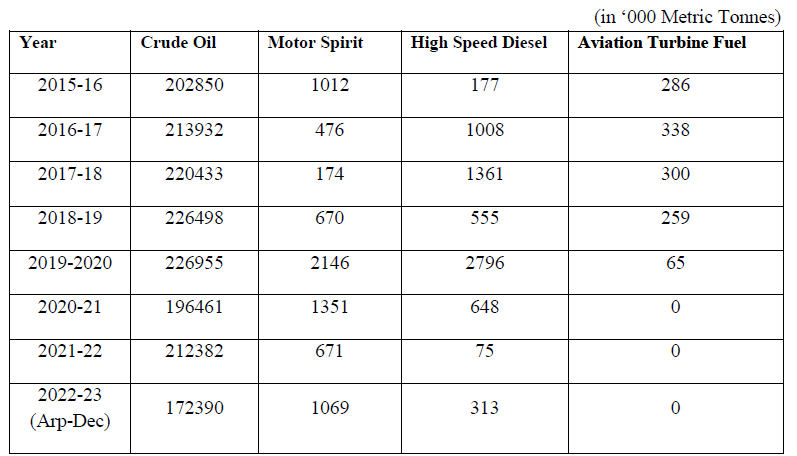

Import data for petroleum products is given as under:

Article 279 A (5) of the Constitution prescribes that the Goods and Service Tax Council shall recommend the date on which the goods and services tax be levied on petroleum crude, high speed diesel, motor spirit (commonly known as petrol), natural gas and aviation turbine fuel (ATF). Also, as per the section 9(2) of the CGST Act, inclusion of these products in GST will require recommendation of the GST Council. So far, the GST Council, in which the States are also represented, has not made any recommendation for inclusion of these goods under GST.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"