Reetu | May 12, 2023 |

GST E-Invoice: New GST Rules mandatory from August 01, 2023

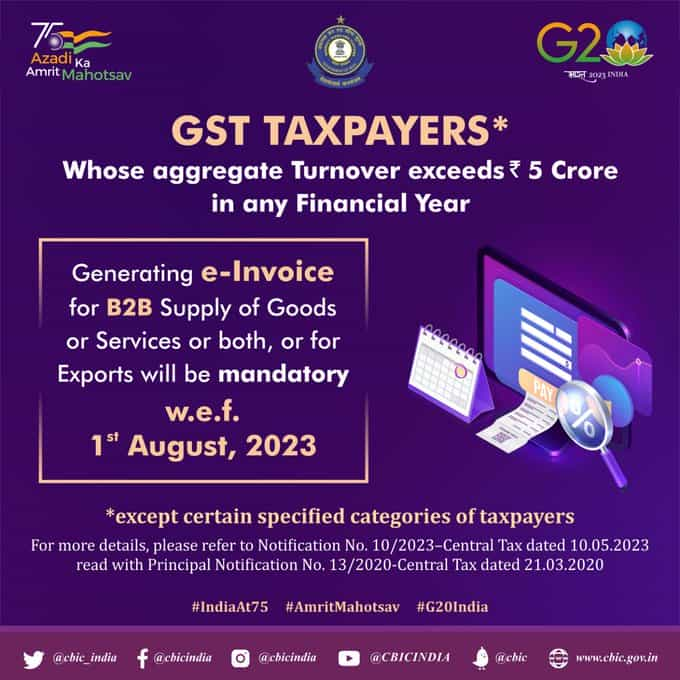

Attention GST Taxpayers whose aggregate turnover exceeds Rs.5 crore in any Financial Year!

For those Taxpayer, generating of e-Invoice for B2B Supply or Goods or Services or both, or for Exports will be mandatory w.e.f August 01, 2023, except certain specified category of taxpayers.

CBIC via a recent notification issued 2 days back, announced a further reduction in the aggregate turnover threshold limit (reduced from Rs.10 crore to Rs.5 crore) for ‘e invoicing’ of B2B transactions which will be effective form 01.08.2023, which means e-invoicing made mandatory for more taxpayers with turnover above Rs.5 crores, as part of the initiative to replace physical invoices with e-invoices, which would ultimately aid in dispensing with the e-way bill system.

The introduction of the digital invoice for goods and services offered by the business company created at the government GST portal is known as GST e-invoice. The notion of a GST e-invoice generation system has been considered in order to reduce GST evasion.

The GST authorities have reached a decision by giving companies with a mechanism that would require them to create a ‘e-invoice’ for every sale on the government GST portal. This approach will only apply to individuals whose turnover threshold above the stated limit, i.e. those for whom the government will set a threshold limit.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"