Deepak Gupta | Oct 19, 2016 |

GST: Four-tier GST structure proposed

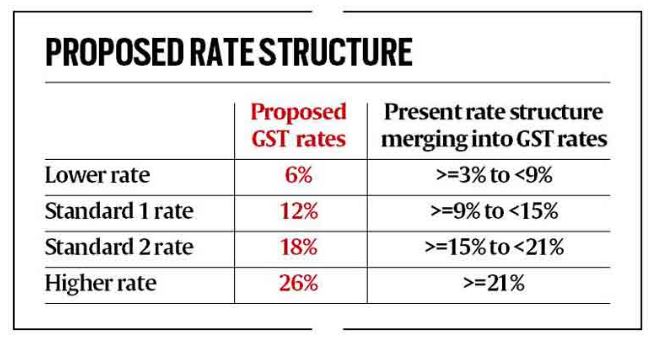

“Summary: YesterdayThe GST Council began its three day meeting. The meeting Centre has proposed four tier GST Rate structure with two standard rates of 12% and 18%. Food items and other necessities would be taxed at 6% while luxury products would be taxed at 26%.”

The Centre has proposed four slabs for the goods and services tax (GST) in addition to a cess on sin and luxury goods that will help it mop up close to Rs 50,000 crore to compensate states for any possible revenue loss under the new tax regime.

At a meeting of the GST Council on Tuesday, the Union finance ministry proposed slabs of 6%, 12%, 18% and 26%, along with a 4% levy on gold. For environmentally sensitive items such as coal (where a cess is already in place), sin goods such as aerated drinks, tobacco and pan masala and luxury cars and watches, a cess has been suggested, revenue secretary Hasmukh Adhia told reporters.

“The principle is clear, the rate should be inflation neutral, it should generate adequate resources for the Centre and the states and the taxpayer should not be burdened,” finance minister Arun Jaitley said after the meeting.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"