Deepak Gupta | Mar 4, 2022 |

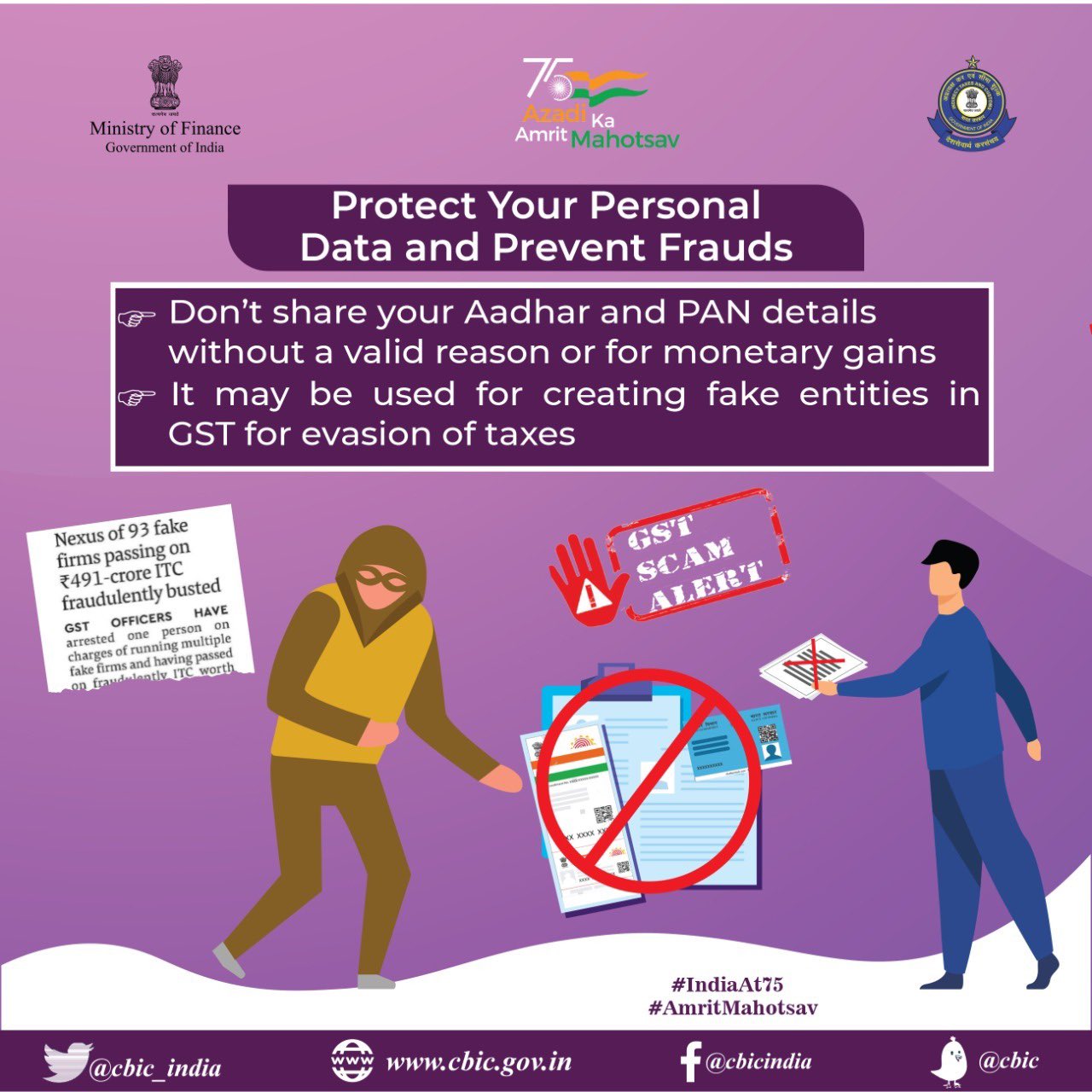

GST Fraud: Be Cautions before Sharing Aadhaar, PAN Details without Valid Reasons says CBIC

The Central Board of Indirect Taxes and Customs (CBIC) has warned the public against sharing Aadhaar and PAN numbers without a Valid purpose or for monetary gain, claiming that the information might be used by fraudsters to commit GST evasion.

According to the CBIC, Aadhaar and PAN details can be exploited to create fictitious firms in GST for tax fraud, hence people should not share them without a solid purpose.

GST Fraud: Be Cautions before Sharing Aadhaar, PAN Details without Valid Reasons says CBIC

“Protect your personal data which may be used for creating fake entities in GST for evasion of taxes,” the CBIC Twitted.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"