Reetu | Jul 29, 2022 |

GST on Payments made towards FSSAI

The Food Safety and Standards Authority of India(FSSAI) has issued Order referring to GST collected through food businesses License/Registration fee & penalty.

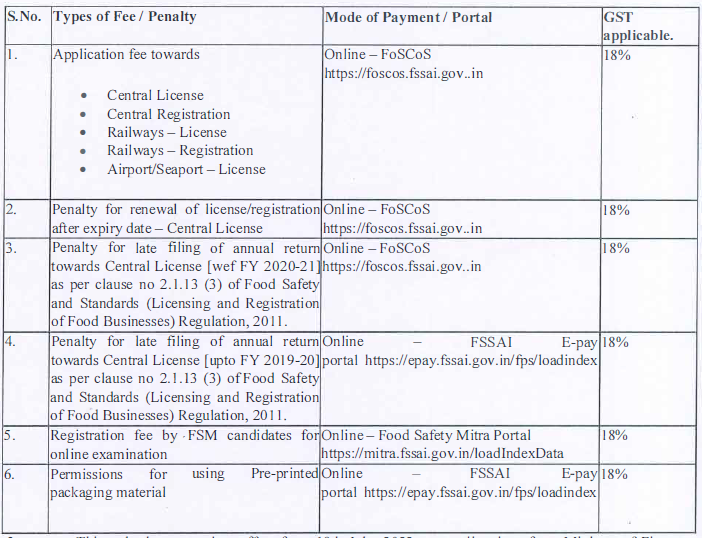

The Order stated that, “This is with reference to Finance Division notice number FA-11023/1/2022-FA-FSSAI/43 dated 20th July 2022, GST on the payments made towards FSSAI will be as per the following:”

GST on Payments made towards FSSAI

According to instructions from the Ministry of Finance’s Department of Revenue Notification number 04/2022 central tax (Rate) dated July 13, 2022, the order became effective on July 18, 2022.

The GST applicable on State License and Registration fee and Penalties are on reverse charge basis. Therefore, NO GST is being charged through FoSCoS portal on State License and Registration fee and the Penalties belonging to States/UTs. The same is also printed on the receipt generated through FoSCoS.

Food Safety and Standards Authority of India (FSSAI) is a statutory body established under the Ministry of Health & Family Welfare, Government of India. The FSSAI has been established under the Food Safety and Standards Act, 2006, which is a consolidating statue related to food safety and regulation in India. FSSAI is responsible for protecting and promoting public health through the regulation and supervision of food safety.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"