Reetu | Apr 11, 2024 |

GST Portal Glitch on Due Date leaves Taxpayers Suffering

The GST portal has been facing technical problems due to heavy demand for the past few days, posing major obstacles for taxpayers attempting to file their returns, most especially GSTR-1 for March 2024.

This has spurred a lot of debate on social media, with many demanding for the deadline to be extended to address these concerns. Concerns have been raised about who is responsible for potential late fee notices and whether or not input tax credit can be claimed.

Authorities have been requested to look into the matter and extend the GSTR-1 due date. The Last Date to file GSTR-1 for taxpayers who do not opt for the QRMP scheme or have a total turnover above Rs.5 crore is on or before the 11th of the next month. And the taxpayers who have opted to file quarterly returns under the QRMP scheme or have a total turnover of upto Rs.5 crore, the due date to file GSTR-1 is the 13th of the month following the relevant quarter.

Despite repeated complaints and concerns made by taxpayers, the government has yet to solve this reoccurring issue, prompting a call for immediate action to ensure a seamless filing procedure.

Taxpayers who are filing their GST Return for the due date of 11th April, are not happy with the functioning of the GST portal as the portal still not working as per its capacity. Angry and fearful taxpayers are continuously tweeting about this issue so that the authorities will get a wake-up call.

One post reads, “The GST Portal has recently been facing some challenges. Anyone else facing an issue like this? #GSTportal #GST”

CA AK Mittal wrote, “It’s taking more than an hour just to Log In and Upload the JSON file of GSTR-1. GST is going to complete 7 Years after 2 months and still, they couldn’t provide a glitch-free portal. Ridiculous”

Taxation Updates post, “GSTN Portal is not working. Date 10/04/24. Date 11/04/24 @Infosys_GSTN @cbic_india”

Another post read, “Please #extended due date of filing the #GSTR1 because portal shows many errors and portal not properly working. #WaiveGSTLateFees #gstr1 #SimplyfyGstReturn #GST #ReviseGSTReturn #gst #GSTportal @nsitharaman @FinMinIndia @Infosys_GSTN @narendramodi @PMOIndia @GST_Council”

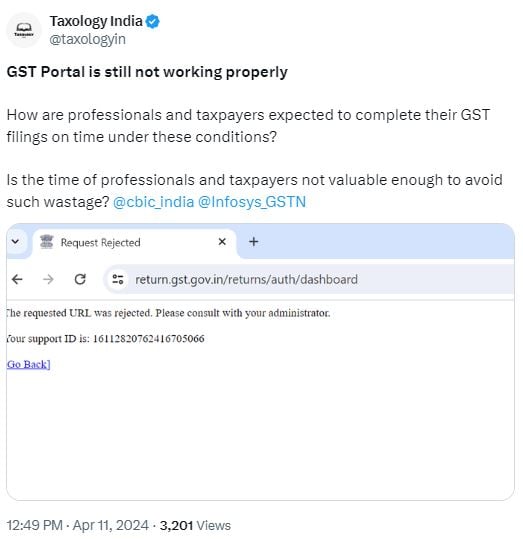

Taxology India shared, “GST Portal is still not working properly. How are professionals and taxpayers expected to complete their GST filings on time under these conditions? Is the time of professionals and taxpayers not valuable enough to avoid such wastage? @cbic_india @Infosys_GSTN”

CA Jagannath Sharma tweeted, “Not able to file or login #gstportal. Very good strategies to not allowing mar gstr 1 and not tf to itc to vendors. You will see this on Mar 24 collection. Worse govt for taxation handling @RATANSINGH_CA @CA_SACHINGROVER @CAPrashantagrwl @advdeepaksoni01”

CA Pratibha Goyal Tweeted, “This calls for a Due Date Extension. Non-filing of GSTR-1 on time will block the ITC of the vendor, creating cash crunch issues.”

Following are late fees to be charged (for other than nil GSTR-1 filing cases):

Late fee to be charged in case of nil GSTR-1 filing:

If the registered taxpayer fails to file the GSTR-1 return by the deadline, he may suffer severe consequences. If you fail to file the GSTR-1 return by the deadline, your vendor will be unable to claim the ITC for the upcoming GSTR-3B return filing.

It means that it may limit the ability of the recipient to offset the payment of tax on purchases against their output tax liability, resulting in higher taxes, which will be an extra difficulty for you. Also, if you fail to file the GSTR-1 return on time, the recipients of your supply will be unable to claim the Input Tax Credit on the invoices you provided to them.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"