Reetu | Jul 24, 2024 |

Budget 2024: Deduction for Employer Contribution to NPS increased

The Union Budget 2024 was presented in the Parliament on 23rd July by the finance minister. She proposed many changes to taxation and other sectors.

Changes from an increase in the limit of standard deduction to a change in the new tax regime slab rate etc. Let’s have a look at this proposed change.

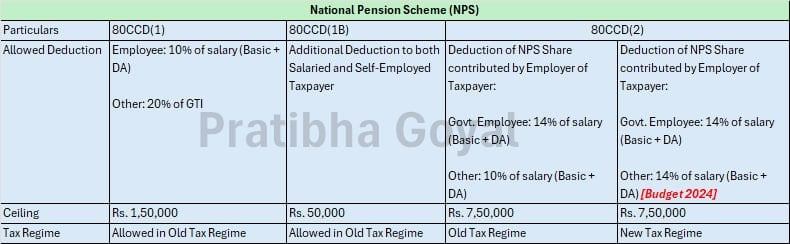

Section 36 of the Act addresses other deductions allowable for computing income under the heading ‘Profits and gains of business or profession’. Clause (iva) of sub-section (1) of said section states that any sum paid by the assessee as an employer as a contribution to a pension scheme, as defined in section 80CCD of the Act, on behalf of an employee, to the extent it does not exceed 10% of the employee’s salary in the previous year, shall be allowed as a deduction to the employer.

It is proposed to amend clause (iva) of sub-section (1) of section 36 of the Act, to increase the amount of employer contribution allowed as a deduction to the employer, from the extent of 10% to the extent of 14% of the salary of the employee in the previous year.

Section 80CCD deals with deduction in respect of contributions to the pension scheme of the Central Government. Sub-section (2) of section 80CCD states that any contribution by the Central Government or State Government or any other employer to the account of an employee referred to in subsection (1), shall be allowed as a deduction as does not exceed ––

(a) 14% (where such contribution is made by the Central Government or State Government); and

(b) 10% (where such contribution is made by any other employer)

of the employee’s salary in the previous year.

It is proposed to change sub-section (2) of section 80CCD of the Act to stipulate that where such payment has been provided by any other employer (other than the Central Government or the State Government), the employee shall be allowed a deduction of not more than 14% of their salary.

This is being increased only in the case where the employee’s salary is chargeable to tax under sub-section (1A) of section 115BAC of the Act.

The amendments will take from the 1st day of April 2025 and will accordingly apply from assessment year 2025-2026 onwards.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"