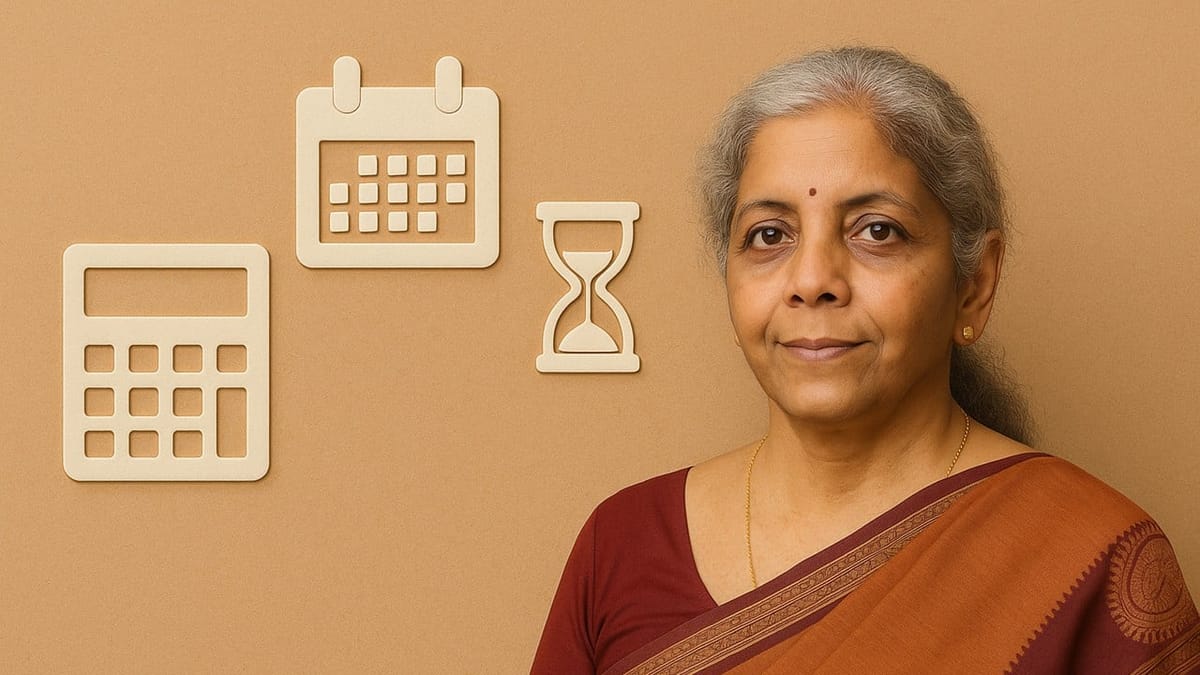

The Government will introduce a more simplified and taxpayer-friendly registration under the Goods and Services Tax (GST) from November 1, 2025, Finance Minister Nirmala Sitharaman announced on Thursday at an inaugurating event in the new CGST Bhawan in Ghaziabad.

Nidhi | Oct 25, 2025 |

GST Registration to be approved within 3 Days From November 2025: FM Nirmala Sitharaman

The Government will introduce a more simplified and taxpayer-friendly registration under the Goods and Services Tax (GST) from November 1, 2025, Finance Minister Nirmala Sitharaman announced on Thursday at an inaugurating event in the new CGST Bhawan in Ghaziabad. She shared that this change will allow most businesses to get approval within just three working days, making it much quicker and easier for new applicants.

This new change is part of GST reforms and aims to ease the compliance for taxpayers and minimise the human interface in the registration process. The new system will use technology to automatically approve GST registrations for most applicants in two cases:

This change is expected to benefit around 96% of new GST applicants and speed up the registration process.

The Finance Minister also highlighted the GST 2.0, where the government cut the GST slabs, simplified return filing and designed an automated refund and risk-based audit system. These steps aim at making the GST system more efficient and easier.

She also cited the recent festive retail sale after the introduction of GST 2.0, observing that the sale went up to 6.05 trillion this Diwali, a 25% increase over the last year. Over 80% of customers preferred buying Indian products. Around 72% of the traders surveyed credited the GST cuts on daily use products, home decor, and footwear for the higher sales.

While speaking after the inauguration, Sitharaman said that the government’s focus was now moving from policy design to field-level execution. She also urged the central and state GST formations to apply the reforms and make sure the system operates by “design” rather than “discretion”.

She also insisted the tax authorities be polite with the taxpayers during tax evasion. Emphasising the importance of the taxpayers, she said that every taxpayer must be treated with honour as they contribute to the nation. She urged the tax authorities not to suspect every taxpayer. She told the officers of the Central Board of Indirect Taxes and Customs (CBIC) that there might be some dishonest people among the taxpayers, but they must be caught after following a proper protocol. She also quoted, “Galat kiya toh khair nahi, sahi kiya toh koi bair nahi,” which means that the ones who do wrong cannot escape, and there is no enmity with those who do right.

To help taxpayers with the registration process, she also directed the GST Seva Kendras to be well-maintained with the proper staff. She also said that these centres will be inspected by the field unit through internal audits and any shortcomings faced by the taxpayers will be resolved.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"