Reetu | Aug 1, 2022 |

GSTN Enabled New Table 3.1.1 in GSTR-3B for reporting supplies notified u/s 9(5) of the CGST Act

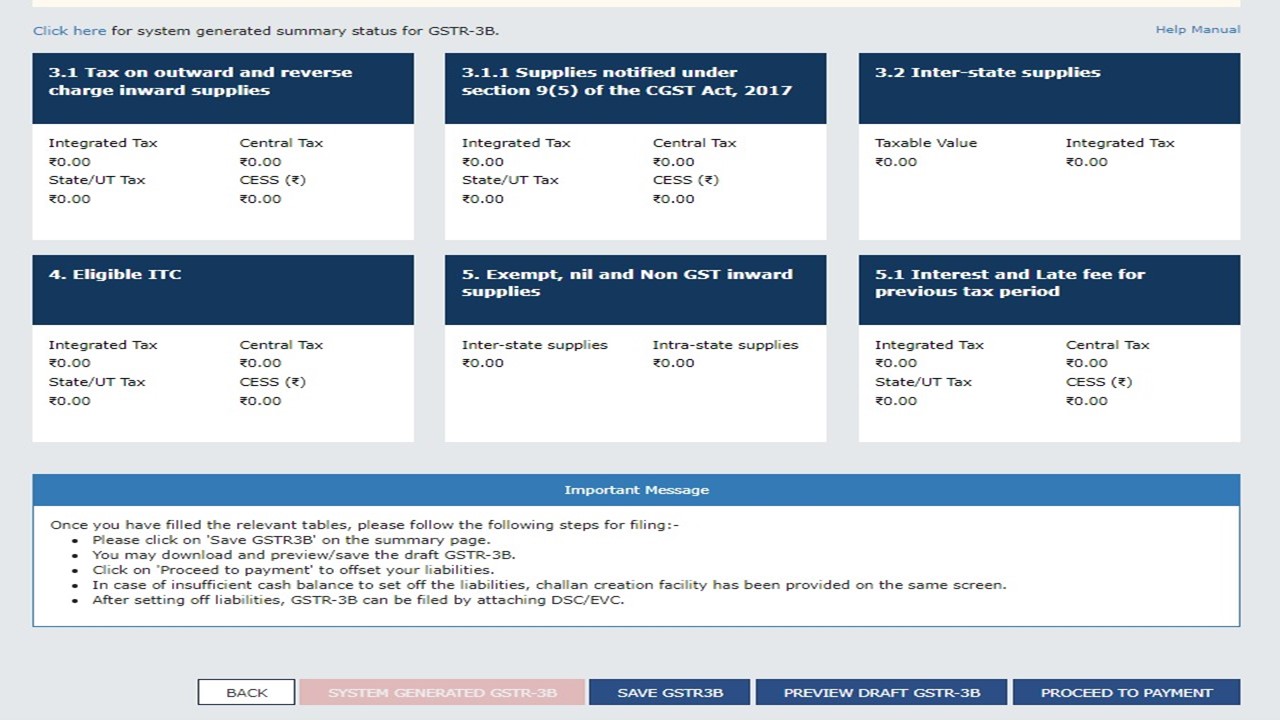

The Goods and Services Tax Network (GSTN) introduced New Table 3.1.1 in GSTR-3B for reporting supplies notified u/s 9(5) of the CGST Act made live by GSTN.

A self-declared summary GST return, or GSTR-3B, is submitted each month (quarterly for the QRMP scheme). The summaries of sales, ITCs claimed, and net tax due must be reported by taxpayers in GSTR-3B. Every GSTIN requires its own GSTR-3B to be submitted.

Table 3.1.1

Table 3.1.1 GSTR3B

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"