Deepak Gupta | Feb 3, 2022 |

GSTN enables the facility to check if the tax has been paid by the seller or not for claiming ITC

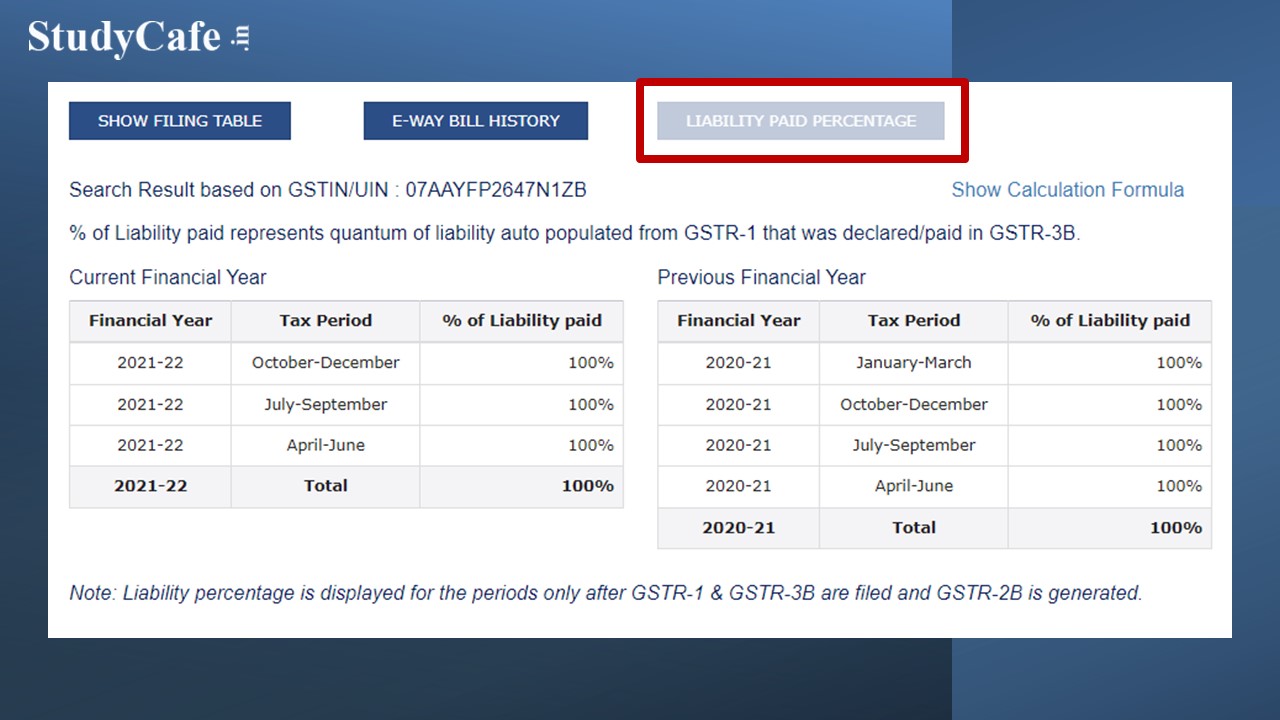

A New Facility has been made available by Goods and Service Tax Network (GSTN) on GST Portal. As per the New Facility, now you can check if the Registered person has paid his Tax Liability of what he has disclosed in GSTR-1 or Not.

As per conditions for claiming Input Tax Credit (ITC) provided in Section 16, one of the conditions for eligibility of taking ITC was that Tax Liability should have been paid by the Seller of goods. As of now, the recipient had no mechanism available on GST Portal to check that. With this new facility, the mechanism has now been made available to the recipient of Goods/Service claiming Input Tax Credit.

You May Also Refer: ITC restriction in GST by Finance Bill 2022 | Final nail in the coffin

As of now, we need to follow the above-mentioned process for each and every GST Number. This would be a difficult process especially if you have a large number of vendors. The process for checking each and every vendor before filing a return is thus time taking.

Also now the responsibility of checking if the Tax Liability is paid by vendor is now shifted to the person taking ITC in true sense as now we cannot say that “We did not have the mechanism”.

Liability paid percentage = (Liability paid / Liability auto-drafted) *100

Liability paid: This is the sum of the total liability (Other than reverse charge and reverse charge) paid by the taxpayer in Form GSTR-3B for a particular period.

This also includes the amount paid by the taxpayer for any period in Form DRC-03 by selecting the ‘Cause of payment’ as Liability mismatch – GSTR-1 to GSTR-3B.

Liability Auto-drafted: This is the sum of total liability which is auto-drafted in Form GSTR-3B for a particular period from GSTR-1/IFF and GSTR-2B.

For taxpayers opting to file return on monthly frequency, the liability paid percentage is computed for each period and for taxpayer opting to file return on quarterly frequency, the liability paid percentage is computed for the quarter.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"