Reetu | Sep 3, 2022 |

GSTN issued Advisory for Changes in Table 4 of GSTR-3B; Reporting of ITC availment, reversal and Ineligible ITC

The Government vide Notification No. 14/2022 – Central Tax dated 05th July, 2022 has notified few changes in Table 4 of Form GSTR-3B for enabling taxpayers to correctly report information regarding ITC availed, ITC reversal and ineligible ITC in Table 4 of GSTR-3B.

The Notified changes of Table 4 of GSTR-3B have been incorporated in GSTR-3B and are available on GST Portal since 01.09.2022. For the GSTR-3B to be filed for the period starting in August 2022 onwards, taxpayers are urged to record their ITC availment, ITC reversal, and ineligible ITC accurately using the new format of Table 4 of GSTR-3B at GST Portal.

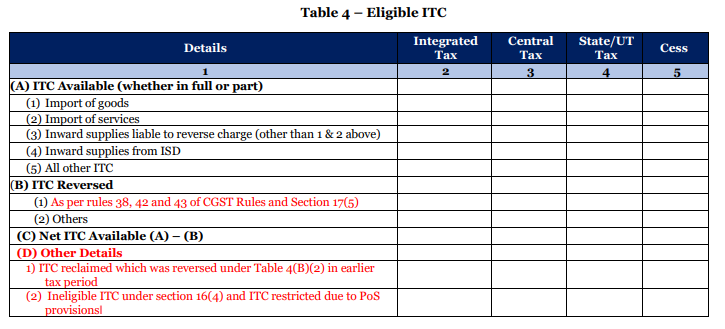

Changes introduced in the format of Table 4 of GSTR-3B at the GST Portal are depicted in Red font in the table below:

3. From the format of Table 4, following is noteworthy:

I. All non-reclaimable reversal of ITC needs to be reported in table 4(B)(1)

II. All reclaimable ITC reversals may be reported in table 4(B)(2). It should be noted that ITC reversed under 4(B)(2) can be reclaimed in table 4(A)(5) at appropriate time and the break-up detail of such reclaimed ITC should be provided in 4(D)(1) in the same return.

III. The ITC not-available mentioned in GSTR-2B of the taxpayer has to be reported in 4(D)(2) of table 4.

IV. Any ITC availed inadvertently in Table 4(A) in previous tax periods due to clerical mistakes or some other inadvertent mistake maybe reversed in Table 4(B)2.

The taxpayer should amend the pre-filled entries in the GSTR-3B return to reflect the necessary modifications in order to appropriately self-assess the GSTR-3B return. Corresponding adjustments in GSTR-2B and auto-population of GSTR-3B are currently being developed. In due future, these updates will be accessible on the GST Portal.

For more information on reporting ITC availment, ITC reversal, and Ineligible ITC in GSTR-3B, taxpayers may also refer to CBIC Circular No. 170/02/2022-GST, dated 06th July 2022.

For Official Advisory Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"