Reetu | Jan 4, 2025 |

ICAI UPDATE: Addendum to FAQs on Unique Document Identification Number (UDIN)

The Institute of Chartered Accountants of India (ICAI) has issued an addendum to FAQs on Unique Document Identification Number (UDIN).

FAQs on UDIN

Ans. The data type for capturing the figure of the parameters has been changed from alphanumeric to numeric under all categories, namely, Certificate, GST and Tax Audit and Audit and Assurance Functions in a phased manner at the UDIN portal. They have come to the force from the dates as under:

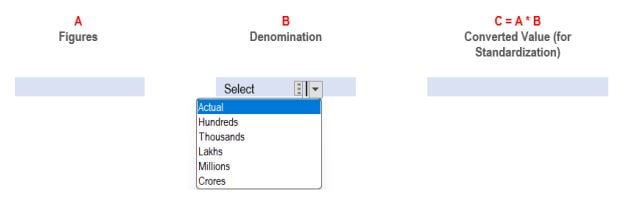

The functionality to be used by the members is demonstrated as:

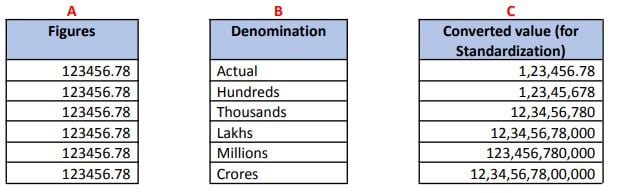

The following example is demonstrated for better clarity-

The change will allow members to enter absolute numbers up to two decimal places and choose a denomination from a dropdown menu. The entered figure will be multiplied by the chosen denomination, and the final value will be displayed in the third column, entitled “Converted Value (for standardisation).”

The figures will be displayed in this format under the List UDIN, and the same format will also be shown to the verifier in the Verifier.

Ans. There are three fields that are required to be filled in during the generation of UDIN for certificates. Out of these three fields, two are mandatory in nature, however, the third field is optional/non-mandatory. The two mandatory fields will accept numeric values, whereas the third one, optional/non-mandatory field, will accept alphanumeric values. Extra fields can be added by the “Add More” option, which will accept alphanumeric values.

Ans. Since the data type has been changed from alphanumeric to numeric under the GST and tax audit category, the mandatory fields will accept numeric values, whereas the optional/non-mandatory field will accept alphanumeric values. Extra fields can be added by the “Add More” option, which will accept alphanumeric values.

Ans. Since the data type has been changed from alphanumeric to numeric under the Audit and Assurance Functions category, the mandatory fields will accept numeric values, whereas the optional/non-mandatory field will accept alphanumeric values. Extra fields can be added by the “Add More” option, which will accept alphanumeric values.

Ans. No, the change specifically pertains to the data type for capturing numerical figures only. Other parameters, including those for comments and additional details related to the document, will remain unchanged. Members can continue to enter comments and other relevant information in the existing format.

Ans. No, the change will apply only to new entries made after the transition is implemented for each category.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"