GSTN has issued an Advisory on the Proper Entry of RR No./Parcel Way Bill Numbers in the EWB system Post EWB-PMS integration.

Reetu | Oct 5, 2024 |

GSTN issued Advisory on Proper Entry of RR No./Parcel Way Bill Numbers in EWB system Post EWB-PMS integration

The Goods and Services Tax Network (GSTN) has issued an Advisory on the Proper Entry of RR No./Parcel Way Bill Numbers in the EWB system Post EWB-PMS integration. This is the Guidance notified for Accurate Entry of RR No./Parcel Way Bill (PWB) Numbers following the Integration of E-Way Bill (EWB) with Parcel Management System (PMS).

The Advisory Read as Follows:

It is to tell you that the Indian Railways’ Parcel Management System (PMS) has been integrated with the E-Way Bill (EWB) system using Application Programming Interfaces (APIs). This integration enables the seamless transfer of RR No./Parcel Way Bill (PWB) data from railways to the e-way bill portal, resulting in improved traceability and compliance.

In light of this, taxpayers must follow the proper procedure for entering Parcel Way Bill numbers into the EWB system. Adherence to the rules outlined below will help to avoid potential discrepancies and mismatches.

Taxpayers transporting goods using the Indian Railways Parcel Management System (PMS) must ensure that the right Parcel Way Bill (PWB) number or RR No. is entered into the e-way bill Part-B on the EWB Portal. The format for entering RR No./PWB numbers has been standardised to ensure consistency and accuracy.

Suppliers who have a pre-existing E-Way Bill (EWB) for goods moved from the manufacturing location to the railway station and are then transferring goods by train using the Parcel Management System (PMS) must follow these steps:

i. Update Part B of the E-Way Bill using the “Multi-Transport Mode” option on the EWB portal.

ii. In the updated section, select Rail as the mode of transport.

After selecting this option, the system will request you to enter the appropriate RR No./Parcel Way Bill (PWB) number.

The Parcel Way Bill number must be entered in the following format:

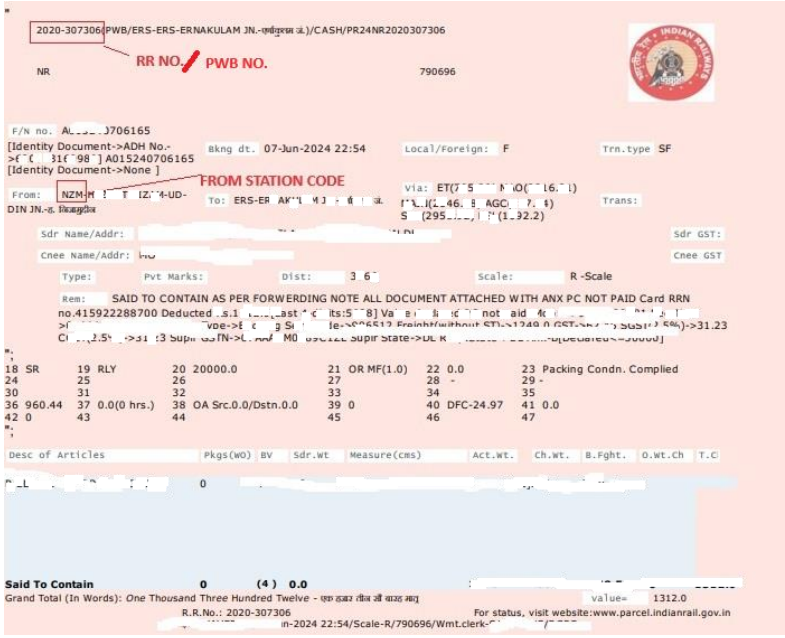

a) PXXXRRNo, where:

i. P stands for the Parcel Management System (PMS).

ii. XXX refers to the From Station Code of the originating railway station.

iii.RRNo is the actual Railway Receipt number issued for the goods.

Example:

To avoid validation issues, enter the Railway Receipt number in the PMS system as PNZM2020-307306, where P represents for PMS, NZM stands for the originating station code, and then the RR No. in the EWB system.

For goods carried via the Freight Operations Information System (FOIS) or Leased Wagons, the process for entering the RR number remains unchanged from earlier advisories. The Railway Receipt number must be entered into the EWB system exactly as it appears on the RR receipt, without any changes or formatting.

After entering the RR No./PWB number into the EWB system:

a) The EWB system will validate the RR No./PWB number against data obtained from the Railways’ Parcel Management System (PMS).

b) If a mismatch is noticed or the RR No./PWB number is not located in the database, an alert will be sent. To avoid future inconsistencies, taxpayers are encouraged to ensure that RR No./PWB numbers are entered correctly.

It is essential for taxpayers to ensure that the Parcel Way Bill number is appropriately put into the EWB system to allow for smooth tracking and verification of goods delivered by Indian Railways. Accurate entry will help make the validation process easier and save unnecessary delays or issues.

For further assistance or if there are any discrepancies in entering RR No./PWB numbers, taxpayers are encouraged to raise a ticket with the support team, clearly mentioning the RR No./PWB number.

A sample image illustrating the correct format for RR No./PWB entry is given below.

We appreciate your cooperation in ensuring compliance with these guidelines.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"