Deepak Gupta | Nov 14, 2025 |

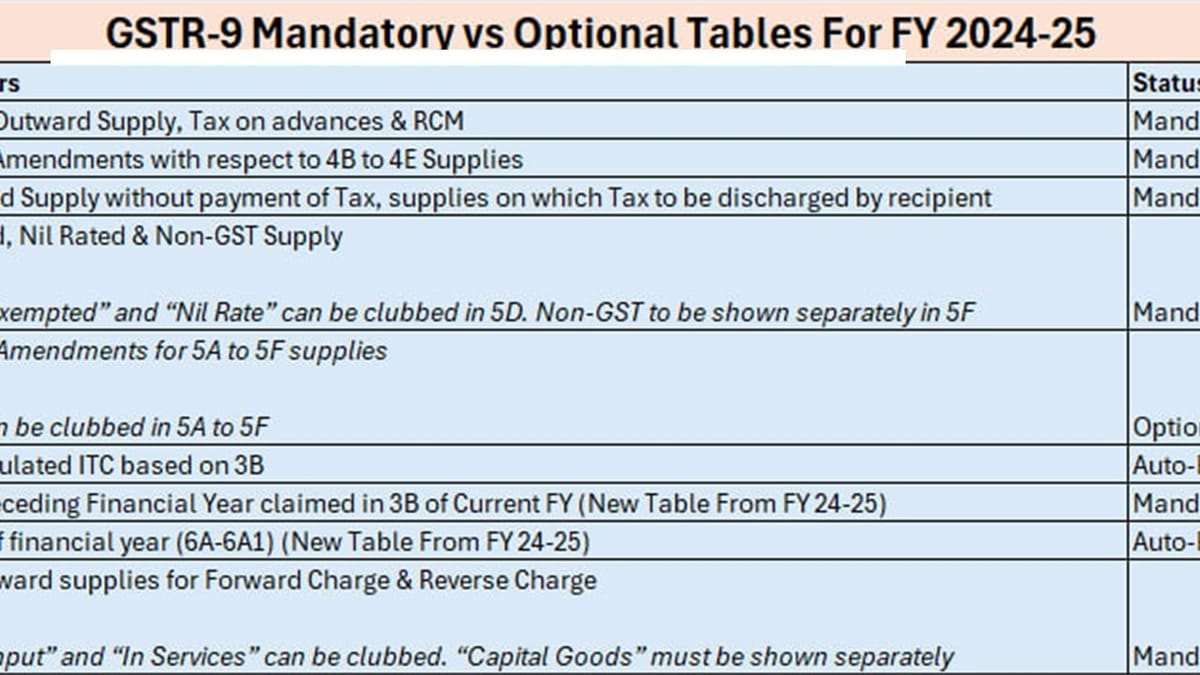

GSTR-9, 9C Mandatory vs Optional Tables For FY 2024-25

Here are the GST Annual return, GSTR-9 Mandatory and Optional Tables For FY 2024-25

| Table | Particulars | Status |

| 4A to 4G | Taxable Outward Supply, Tax on advances & RCM | Mandatory |

| 4I to 4L | CN, DN, Amendments with respect to 4B to 4E Supplies | Mandatory |

| 5A to 5C1 | Zero-rated Supply without payment of Tax, supplies on which Tax to be discharged by recipient | Mandatory |

| 5D to 5F | Exempted, Nil Rated & Non-GST Supply Note: “Exempted” and “Nil Rate” can be clubbed in 5D. Non-GST to be shown separately in 5F | Mandatory |

| 5H to 5K | CN, DN, Amendments for 5A to 5F supplies Note: Can be clubbed in 5A to 5F | Optional |

| 6A | Auto populated ITC based on 3B | Auto-Populated |

| 6A1 | ITC of Preceding Financial Year claimed in 3B of Current FY (New Table From FY 24-25) | Mandatory |

| 6A2 | Net ITC of financial year (6A-6A1) (New Table From FY 24-25) | Auto-Populated |

| 6B to 6D | ITC on inward supplies for Forward Charge & Reverse Charge Note: “Input” and “In Services” can be clubbed. “Capital Goods” must be shown separately | Mandatory |

| 6E | Import of Goods | Mandatory |

| 6F to 6M | Other ITCs (Import of Services, ISD, Rule 37/37A/42/43, TRAN-1/2A, etc.) | Mandatory |

| 7A, 7A1, 7A2 to 7E | ITC Reversal due to Rule 37, 37A, 38, 39, 42, 43, Sec. 17(5) (New table 7A1 & 7A2 from FY 24-25) | Mandatory |

| 7F & 7G | ITC Reversal under TRAN1 & TRAN2 | Mandatory |

| 8A to 8K | ITC Related Information (New Table 8H1 from FY 24-25) | Mandatory |

| 9 | Details of Tax Payable & Tax Paid | Mandatory |

| 10 & 11 | Liability of FY 2024-25 shown/reduced in FY 2025-26 till Nov 30, 2025 | Mandatory |

| 12 & 13 | ITC of FY 2024-25 reversed/shown in FY 2025-26 till Nov 30, 2025 Note: Do not net off 12 & 13 | Mandatory |

| 15 & 16 | Info of Demands & Refunds, Inward supplies | Optional |

| 17 | HSN for outward supply Turnover > 5 Cr → 6-digit HSN | Mandatory |

| 18 | HSN for inward supply | Optional |

GSTR-9C Mandatory vs Optional Tables

| Table | Particulars | Status |

| 5A | Turnover as per Audited Books | Mandatory |

| 5B to 5O | Adjustments related to turnover | Optional (may be clubbed in 5O) |

| 7A to 7F | Reco from Total Turnover to Taxable Turnover | Mandatory |

| 9A to 9Q | Reco of Tax Paid | Mandatory |

| 12A to 12D | Reco of ITC between Books and GSTR-9 | Mandatory |

| 14 | Expense head wise ITC reconciliation | Optional |

Taxpayers should note that the due date to file GSTR-9 and GSTR-9C for Financial Year 2024-25 is 31st Deccember 2025. Also Following Taxpayers are exempted to file GST Annual Return for Financial Year 2024-25.

| Turnover | GSTR-9 | GSTR-9C |

| Less then 2 Cr | Exempt | Exempt |

| More than 2 Cr but upto 5Cr | Mandatory | Exempt |

| More than 5 Cr | Mandatory | Mandatory |

| Relevant Rule/ Notification | Source: NN 15-2025 CT dated 17-09-2025 | Source: Rule 80(3) |

Turnover has to be calculated PAN wise.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"