Reetu | May 12, 2023 |

GTA Tax Payment Option Extended by CBIC to May 31, 2023

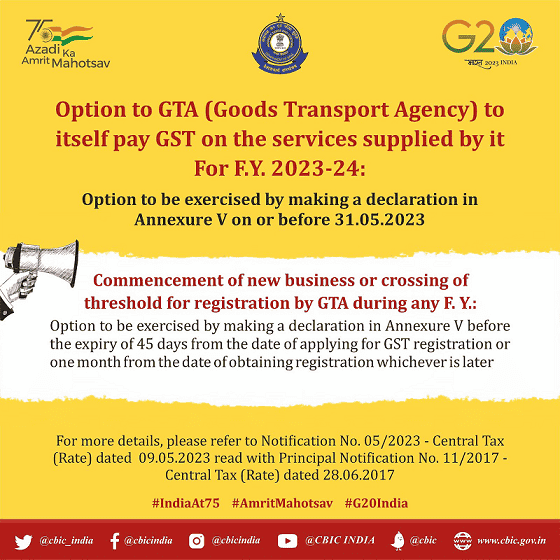

The Central Board of Indirect Taxes and Custom(CBIC) has issued a notification stating that the option to pay tax under Forward Charge by Goods Transport Agency (GTA) for the Financial Year 2023-2024 must be activated on or before May 31, 2023. Previously, this option had to be exercised before March 15, 2023.

It is also provided that a GTA that starts a new business or crosses the registration threshold during any Financial Year may exercise the option to pay GST on the services it provides during that Financial Year by filing a declaration in Annexure V before the expiry of forty-five days from the date of applying for GST registration or one month from the date of obtaining registration, whichever is later.

A declaration / consent in Annexure V FORM is required to be submitted on the GST Portal by the GTA (Goods Transport Agencies) every year before the commencement of the Financial Year. And option once exercised cannot be withdrawn or changed during the year.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"