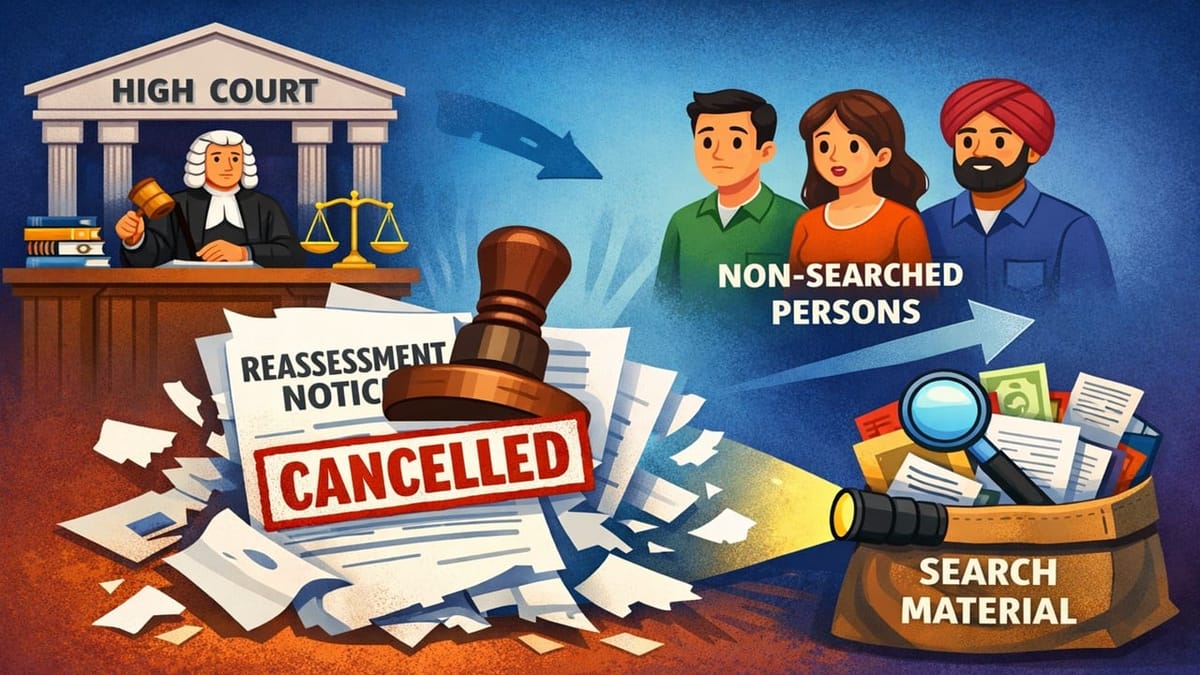

High Court quashes Section 148 notices issued to non-searched persons, holding that search-based material must be assessed only under Section 153C.

Meetu Kumari | Jan 18, 2026 |

High Court Quashes Reassessment Notices Issued to Non-Searched Persons Using Search Material

A batch of writ petitions was filed by several taxpayers, including Paras Chandreshbhai Koticha and entities connected with the K. Star, Navratna, and Flamingo groups, challenging reassessment notices issued under Section 148 of the Income Tax Act. The impugned notices were founded entirely on documents and information seized during search operations conducted under Section 132 in the cases of third parties, referred to as the “searched persons”.

The petitioners contended that where incriminating material belonging to or relating to a person other than the searched person is unearthed during a search, the statute mandates invocation of the special procedure under Section 153C. The Revenue bypassed this mandatory mechanism and directly resorted to the general reassessment provisions under Sections 147/148, without recording the statutory satisfaction required for proceedings against “other persons”.

Central Issue: Whether the Income Tax Department can initiate reassessment proceedings under Section 148 on the basis of material seized during a search, or whether it is compulsory to follow the special procedure prescribed under Section 153C in the case of persons other than the searched person.

HC Decided: The Gujarat High Court allowed the petitions and held that Sections 153A and 153C constitute special provisions which override the general reassessment regime under Sections 147 and 148. The Court ruled that once material seized during a search pertains to a third party, the statutory trigger for Section 153C is automatic and mandatory. This special scheme carries built-in safeguards, including recording of satisfaction, approval by higher authorities, and specific limitation periods, which cannot be diluted or circumvented by invoking Section 148.

The Court observed that permitting the Revenue to choose between Section 148 and Section 153C would render the latter otiose and defeat the legislative intent. Thus, the reassessment notices issued under Section 148 were quashed as being without jurisdiction.

To Read Full Judgment, Download PDF Given Below

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"