ITAT Delhi upholds CIT(A)’s deletion of multiple additions in Omax Autos Ltd. case, holding Rule 46A objections unsustainable where AO verified evidence in remand.

Meetu Kumari | Jan 18, 2026 |

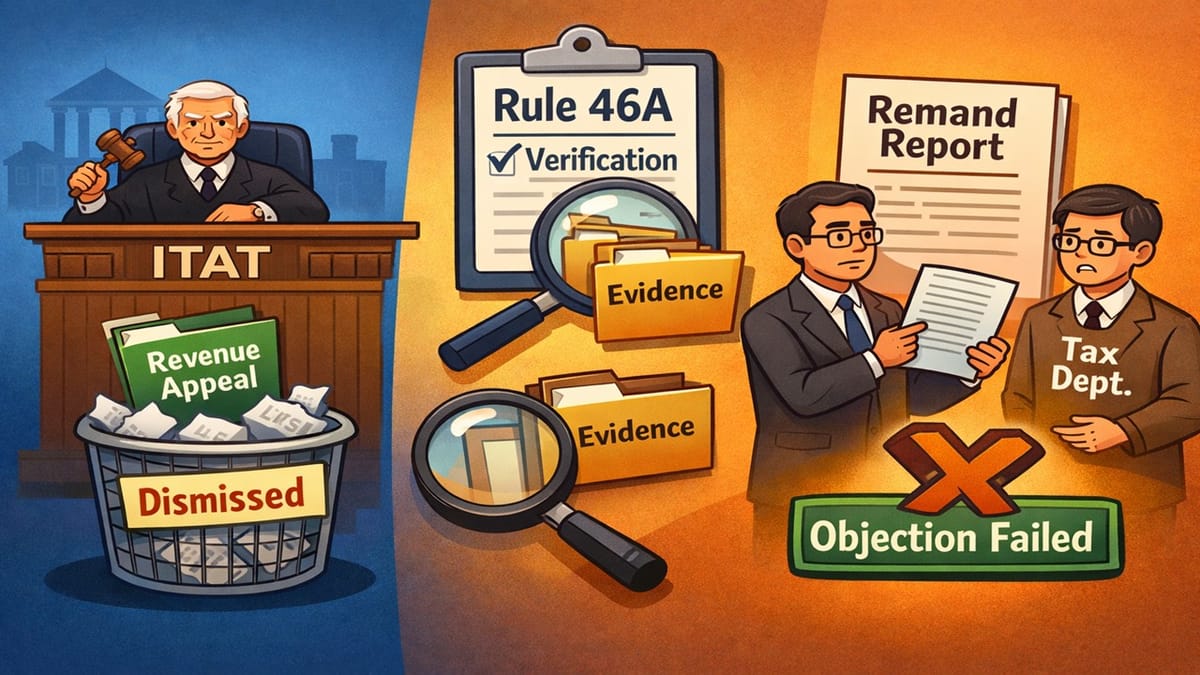

ITAT Dismisses Revenue Appeal; Rule 46A Objection Fails After Remand Verification

Omax Autos Ltd., engaged in manufacturing auto and non-auto components, filed its return for AY 2020-21, declaring income of Rs. 26.89 crore. The case was selected for complete scrutiny, and the Assessing Officer passed an order under Section 143(3) assessing income at Rs. 125.74 crore after making multiple disallowances, including unverified deductions, trade advances written off, bad debts, inventory write-off, long-term capital gains on sale of land, and other borrowing costs.

The CIT(A) partly allowed the assessee’s appeal, deleting all major additions after admitting additional evidence and calling for remand reports from the AO. Aggrieved, the Revenue appealed before the ITAT, primarily objecting to the admission of additional evidence under Rule 46A.

Issue Before Court: Whether the CIT(A) erred in deleting multiple additions after admitting additional evidence, allegedly in violation of Rule 46A, despite the AO having examined such evidence in remand proceedings.

Tribunal’s Ruling: The ITAT dismissed the Revenue’s appeal in its entirety. It noted that for each disputed issue, the AO had been given full opportunity to verify additional evidence through one or more remand reports. After verification, the AO did not record any adverse findings on merits and only objected on the technical ground that the evidence was not produced during the assessment.

The Tribunal held that such objections could not invalidate the CIT(A)’s order, especially when the claims stood substantiated on record. It further reiterated settled legal principles on the allowability of bad debts, inventory valuation under IND AS 2, valuation reports by registered valuers, and bank guarantee charges as revenue expenditure. Finding no merit in the Revenue’s grounds, the appeal was dismissed.

To Read Full Order, Download the PDF Given Below

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"