A recent train accident of a goods train collided with the Kanchanjungha Express near Jalpaiguri in West Bengal, highlights the significance of having travel insurance. However not every one has personal travel insurance, you may be covered by IRCTC's optional insurance policy on e-ticket purchases.

Reetu | Jun 22, 2024 |

How 45 paisa Travel Insurance can provide Relief Up to Rs. 10 lakh

In a recent train accident, a goods train collided with the Kanchanjungha Express near Jalpaiguri in West Bengal, and this highlighted the significance of having a travel insurance.

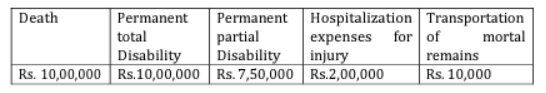

If you do not have personal travel insurance, you may be covered by IRCTC’s optional insurance policy on e-ticket purchases. This policy covers up to Rs.10 lakh for death, disability, and hospitalization in the case of a train accident. It is issued by one of three empanelled insurance companies: Liberty General Insurance, Royal Sundaram General Insurance, and United India Insurance.

In its travel insurance terms and conditions document, IRCTC said, “Optional Travel Insurance is only available for CNF/RAC/PartCNF tickets at the time of booking. The premium is 45 paise per passenger, inclusive of all taxes, effective February 17, 2024.”

As per the travel insurance terms and conditions documents accessible on the Indian Railway Catering and Tourism Corporation’s (IRCTC) website as of June 22, 2024, this optional travel insurance policy provides the following benefits in the event of a train accident:

IRCTC said in the terms and conditions document, “Hospitalization expenses for injuries are covered in addition to death, permanent total disability, or partial disability benefits.”

The insurance company sends you an SMS and email with the policy number and other details. The policy number can also be found in the ticket booking history on the IRCTC e-ticket website. Experts advise informing close family members about train travel information. Without the policy number, PNR number, and other important information, it may be difficult to confirm the claim’s authenticity.

The train traveller, his or her nominee, or legal heir must deliver the necessary documentation to the nearest insurance company office. This process must begin within four months of the accident.

Here are the documents that are required to be delivered to the insurance company’s office:

The claim form must be completed and signed by either the nominee or the legal heir, together with the NEFT mandate details and a cancelled cheque. The following documents are also needed:

Death Claims will only be awarded to the nominee stated while purchasing insurance through the IRCTC portal. In the absence of a nominee, the claim will be paid only to the Legal Heir – as specified on the Legal Heir / Succession Certificate.

Please remember to update the nominee information in your IRCTC travel insurance policy. According to the IRCTC website, you can locate the link to update your information in the email or SMS received by the insurance company.

However, if you have not updated the nominee information, the process gets slightly more complicated.

Clause 6 of the policy’s terms and conditions states that if a claim arises and nominee information is not provided after the ticket is bought, settlement with the legal heirs shall take place. According to experts, acquiring a succession certificate in India is a formal legal process that requires strict adherence to particular processes and documents.

It has been stated that optional travel insurance-related complaints, disputes, and grievances would be handled in accordance with two specific clauses.

As a consequence, these clauses collectively establish New Delhi as the appropriate forum for resolving any disagreements or complaints about the IRCTC insurance policy, providing a clear structure for dealing with legal concerns.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"