CA Pratibha Goyal | Jul 21, 2021 |

How to download 26AS from Traces

These days Taxpayers are are facing difficulty in Downloading Form 26AS from the Income tax Site. Also in case size of your 26AS is large, you need to download it directly from Traces. Please note that you can download the same from Traces portal directly. In this article steps for downloading 26AS from Traces Directly are given.

Please note that you need to use your PAN login for the same.

How to create PAN Login on Traces?

Please note that not everyone can have a PAN login as it is generally created when you do transactions like Depositing TDS on Immovable Property etc. Otherwise, you need Aadhar Authentification for creating a Login. Steps are discussed in the Article.

Now, this is a bit Technical Step:

You can use 4 Options for Creating Login:

In case you’ve deposited challan recently, please try registration after 3 working days from Date of Challan Deposit.

You Aadhaar should be linked with your Mobile/Email to proceed Authentication through Aadhaar / VID

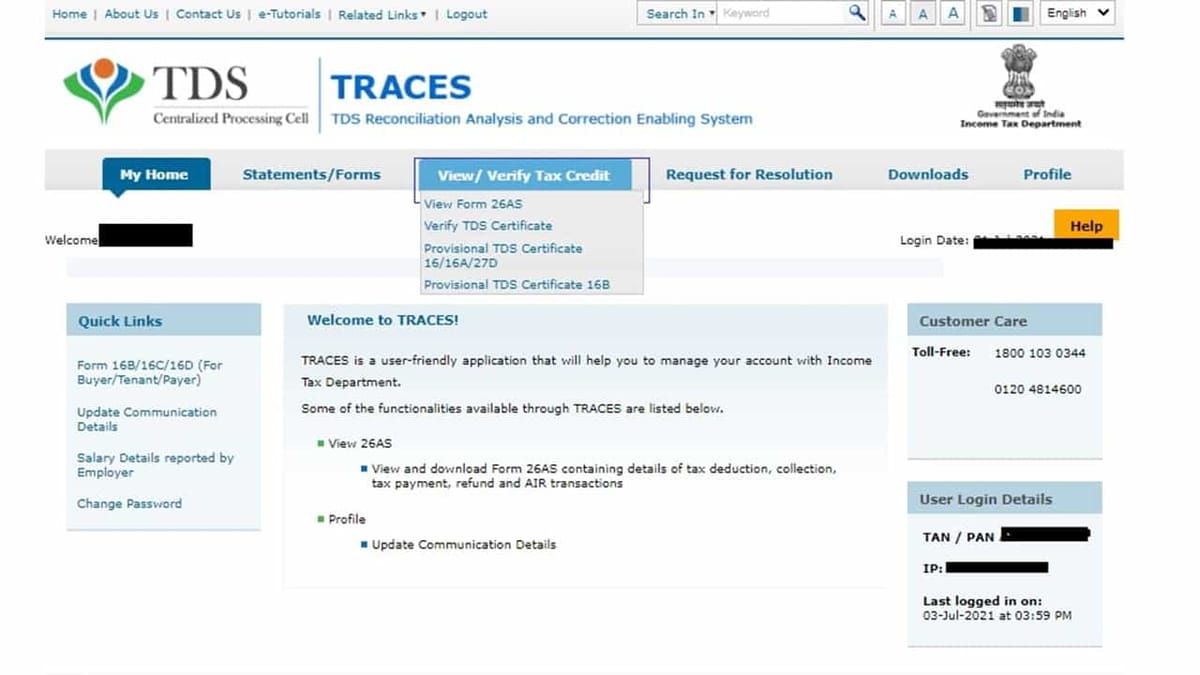

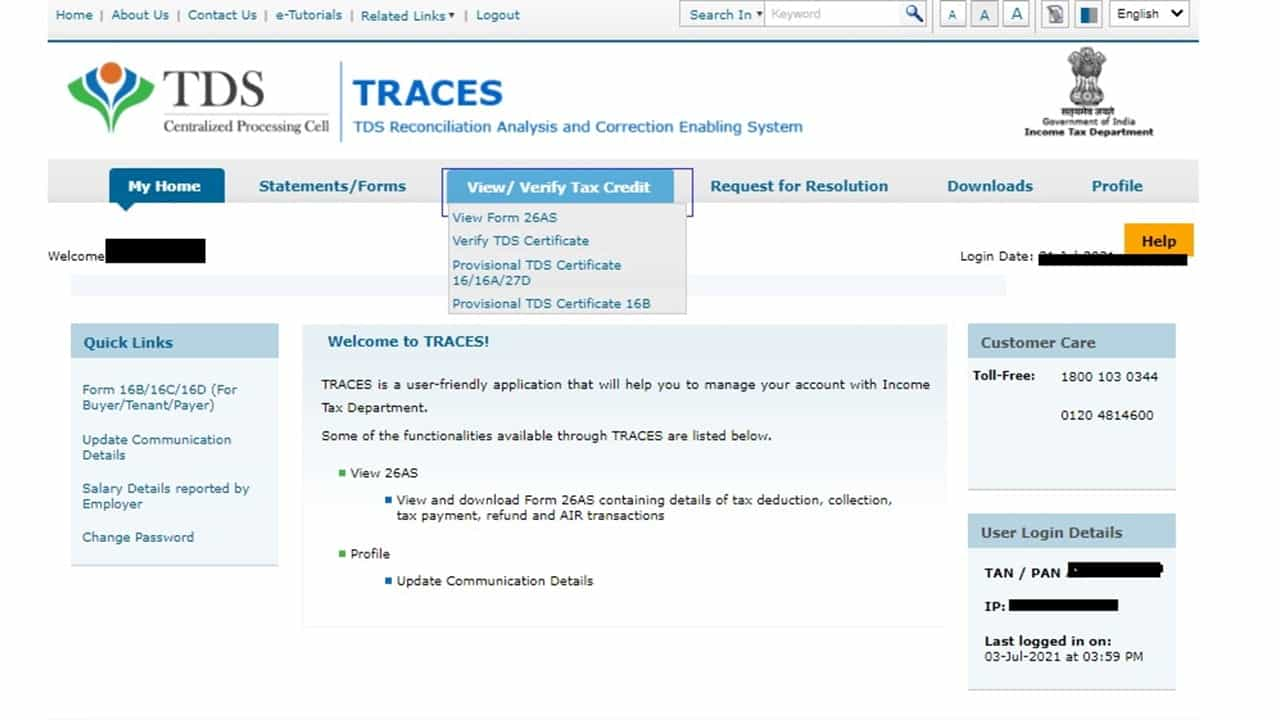

Once your registration is complete, 26As can be downloaded as per the below-mentioned image:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"