Sushmita Goswami | Feb 17, 2022 |

ICAI Campus Placement Feb-Mar 2022 for Newly Qualified CA’s

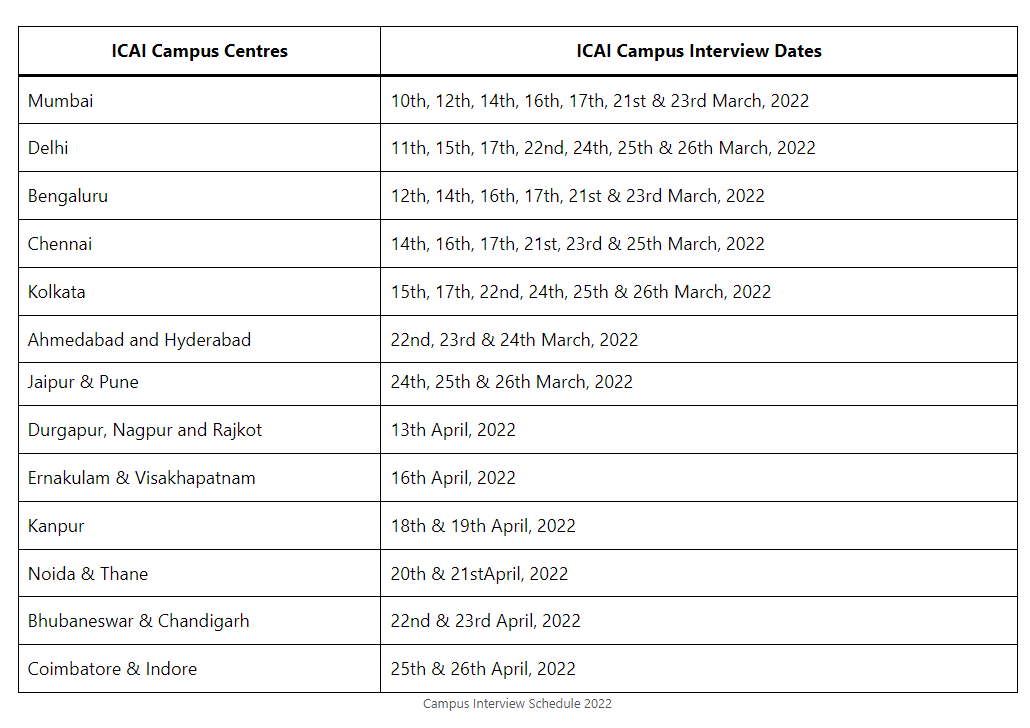

Institute of Chartered Accountants of India Campus placement February- March 2022 for Newly Qualified Chartered Accountants (NQCAs) has started.

The Campus placement is for the candidates, who would be passing the CA Final Examination held on December 2021, and also for those who have qualified earlier and are fulfilling the criteria mentioned in the Announcement.

If candidate passed CA Final Exams prior December 2021 but could not appear regular campus then you may also register for the Campus placement programme 2022.

ICAI organizes campus placement twice a year for newly qualified CAs in May and November. In a dynamic and challenging business environment, Chartered Accountants are looked upon as complete Business Solution Providers. In Campus they are thoroughly trained practically in all avenues of Finance and Accounting.

Candidates needs to make sure that they need this job before applying for Campus Placement. Any delay or refusal after been selected or accepting any offer may cause job loss to other needy candidates.

Committee for Professional Accountants in Business and Industry (CPABI) earlier known as Committee for Members in Industry (CMII) of ICAI takes care of the interest of the members who are in industry and organizes Campus Placement Programmes for them.

CPABI announced the next Campus Placement Programme for Newly Qualified Chartered Accountants during Feb – Mar 2022.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"