Reetu | Oct 22, 2024 |

ICAI Empanelment to act as Observers at Examination Centres for CA Examination Jan 2025

The Institute of Chartered Accountants of India (ICAI) has announced the empanelment of members to serve as observers for the next Chartered Accountants (CA) examinations, which will take place from January 11 to 21, 2025. This opportunity is offered to ICAI members who meet certain eligibility criteria, such as being under 65 years old and not teaching CA students.

ICAI in an announcement said, “It is proposed to empanel members to act as Observers for the forthcoming JANUARY -2025 Chartered Accountants Examinations.”

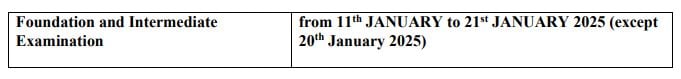

The Schedule of the CA Examination is given as under:

Observers will play an important role in maintaining the integrity of the examination process. Their responsibilities include ensuring the secure collection and distribution of question papers, as well as supervising the handling of answer sheets. Members interested in empanelling can apply through the ICAI’s official site beginning October 25, 2024, with a November 20, 2024 submission deadline.

Kindly note that the Examination Committee in its 648th Meeting held on 8th and 9th January 2024 among others has decided that there should be a cooling off period for one attempt after three (3) consecutive attempts for Observership duties. The same is applicable w.e.f. May 2024 with retrospective details.

Members who fulfill the following criteria are eligible for empanelment, to act as Observers.

i) He/she should not be more than 65 years of age as on the date of empanelment, i.e. 25th October 2024.

ii) His/her name should have been borne on the Register of Members as of 1st July 2022 and continues to be so;

iii) Neither he/she nor his/her relatives* or dependant* is / will be appearing in the ensuing Chartered Accountants Examinations for students / Post – Post-Qualification Course Examinations in January 2025 in any examination centres in India or Abroad. However, applying or appearing in ISA–AT will not be considered a disability for observership for CA Examinations.

[* the term “relative” or “dependant” for the purpose shall include, in relation to an individual, the wife, husband, son, daughter-in-law, daughter, son-in-law, grandson, granddaughter, brother, brother’s wife, brother’s son, brother’s daughter, sister, sister’s husband, sister’s son, sister’s daughter, wife’s brother, wife’s sister and husband’s brother and husband’s sister]

iv) He/she is not coaching students for any of the examinations/tests conducted by the Council of the Institute in any institutions/organization including Regional Councils / Branches of the Institute and also private coaching.

v) He/she has not been convicted by any court of Law and no disciplinary proceedings are pending against him/her, either by the ICAI / Disciplinary Directorate or by any other organization, both in India or abroad.

vi) He/she is not associated with the Institute as an elected/co-opted member of the Council/ Regional Council / Managing Committee of any Branch of the ICAI.

vii) He/she shall abide by the Guidelines for Observer and/or any other instructions.

This initiative demonstrates the ICAI’s commitment to maintaining high levels of examination security and transparency. Selected members will be paid a daily honorarium and reimbursement for local transportation, giving this an outstanding chance to contribute to the profession.

To Read More Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"