Reetu | Oct 12, 2022 |

ICAI issued Handbook on Returns and Payments under GST

The Institute of Chartered Accountants of India(ICAI) has issued Handbook on Returns and Payments under GST.

The GST & Indirect Taxes Committee of ICAI has always been proactive in providing the needed support to the members and honing their skills by organising courses, conferences and programmes, live webcasts, e-learning etc. on GST. Further, it has been regularly bringing out useful technical publications on various aspects of GST.

I am happy to note that the Committee has revised its existing publication namely, “Handbook on Returns and Payments under GST” to incorporate the recent amendments made in the provisions relating to various returns prescribed under GST law and payment of taxes. The various forms for filing GST returns and for making payment have been thoroughly discussed in this Handbook. Topics like who is required to file a particular return, what are the due dates to file a particular return and from where details may be captured to fill the fields of a particular return etc. have been discussed in this Handbook.

Section 59 of the Central Goods and Services Tax Act, 2017 (hereinafter referred to as ‘ the Act’ or ‘the CGST Act’) states that “every registered person shall self-assess the taxes payable under the Act”.

Self-assessment means that the registered person himself has to assess and discharge his tax liability and not an assessment conducted or carried out by the Proper Officer. Every registered person would be required to assess his tax dues in accordance with the provisions of the Act and report the basis of calculation of tax dues to the tax administrators, by filing periodic tax returns.

The term ‘return’ is defined in Section 2(97) of the Act thus: – “It means any return prescribed or otherwise required to be furnished by or under this Act or the Rules made thereunder”. Hence, furnishing the prescribed returns with true and correct particulars in accordance with the Act and the Central Goods and Services Tax, Rules 2017 (hereinafter referred to as ‘the Rules’ or ‘the CGST Rules’) amounts to proper compliance with the provisions of self -assessment.

Every person who is registered under GST should furnish returns as prescribed by the Act and the Rules at the prescribed frequency.

Provisions related to Registration are detailed under Chapter VI of the Act, wherein the provisions containing details of the persons liable to take registration are provided specifically under Sections 22, 24 and certain portions of Section 25 of the Act.

To briefly summarise, the following persons are termed as ‘registered persons’ under GST:

1. Those persons whose aggregate turnover in a financial year exceeds the threshold limit (registration is applicable once the turnover exceeds the threshold limit; however, the small taxpayers can opt to get registered as composition taxpayers). This category also includes Special Economic Zone Unit (SEZ Unit) and Special Economic Zone developer (SEZ developer).

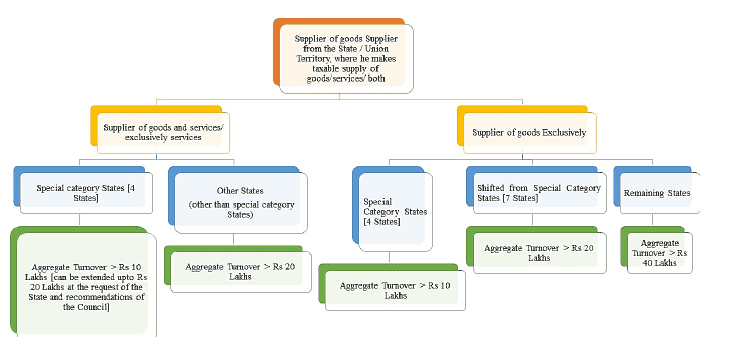

The threshold limit applicable for registration varies depending on the following variables:

a. States / Union Territories from where the supply is taking place.

b. Supply undertaken by the supplier – whether exclusively supplier of goods or supplier of both goods and services or exclusively supplier of services.

The threshold limit has been increased from Rs. 20 Lakh to Rs. 40 Lakh vide N.No.: 10/2019 dated 07/03/2019 for the suppliers who exclusively deals in the supply of goods. However, for remaining suppliers, the threshold limit is Rs. 20 Lakh.

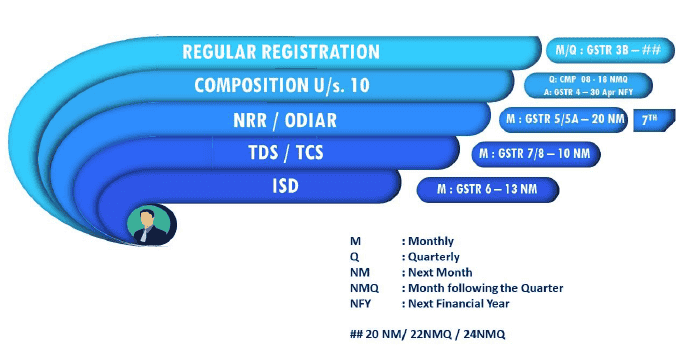

A. REGULAR TAXPAYER

A person who has obtained registration as a regular taxpayer is granted such registration without any condition to pay advance tax and such registration is valid till cancelled. When it comes to the filing of the returns, this class is divided into two (2) segments; which are as follows:

→ Person who has opted for Quarterly Return Filing and Monthly Payment of Taxes scheme (hereinafter referred to as “QRMP” Scheme)

→ Others

B. COMPOSITION TAXPAYERS:

A taxable person, whose aggregate turnover did not exceed one crore fifty Lakhs [Rs. 1.5 cr] in the preceding financial year, has an option to pay an amount (known as composition tax) in lieu of the tax payable under Section 9(1) of the Act. The Composition scheme is a very simple, hassle-free scheme devised for small taxpayers. The provisions of the said composition levy have been provided under section 10 of the Act.

As per Rule 7 of the Rules, a taxpayer under a composition levy scheme must pay an amount equal to a fixed percentage of his annual turnover as tax, to the government, not exceeding the following:

a. 0.5 % in case of a manufacturer

b. 2.5 % in case of a person engaged in supplies referred to in para 6(b) of Schedule II

c. 0.5% in case of other supplier of goods

d. 3% in case of supplier engaged only in supply of services [having annual turnover in the preceding financial year is upto Rs. 50 lakhs]

Similar rates are also applicable under the State Goods and Services Tax Act, 2017 / Union Territory Goods and Services Tax Act, 2017.

To Read More Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"