ICAI has released CA Intermediate Amendments for Nov 2023 Examinations applicable for all subjects including accounting, corporate and other laws, taxation, advanced accounting, auditing and assurance etc.

Reetu | Jul 14, 2023 |

ICAI releases Standards/ Guidance Notes/ Legislative Amendments Applicable for CA Intermediate November 2023 Exam

The Institute of Chartered Accountants of India(ICAI) has released CA Inter Amendments for Nov 2023 Examinations applicable for all subjects including accounting, corporate and other laws, taxation, advanced accounting, auditing and assurance etc.

The ICAI conducts the Chartered Accountancy examinations of Intermediate Course twice in a year i.e. May and November. CA Institute publishes the authorized list of Accounting Standards, Guidance Notes, and Legislative Amendments, among other things, for each term of CA Intermediate examinations well in advance before the commencement of exams.

Let’s look into the amendments given below:

List of Applicable Accounting Standards

AS 1 : Disclosure of Accounting Policies

AS 2 : Valuation of Inventories

AS 3 : Cash Flow Statements

AS 10 : Property, Plant and Equipment

AS 11 : The Effects of Changes in Foreign Exchange Rates

AS 12 : Accounting for Government Grants

AS 13 : Accounting for Investments

AS 16 : Borrowing Costs

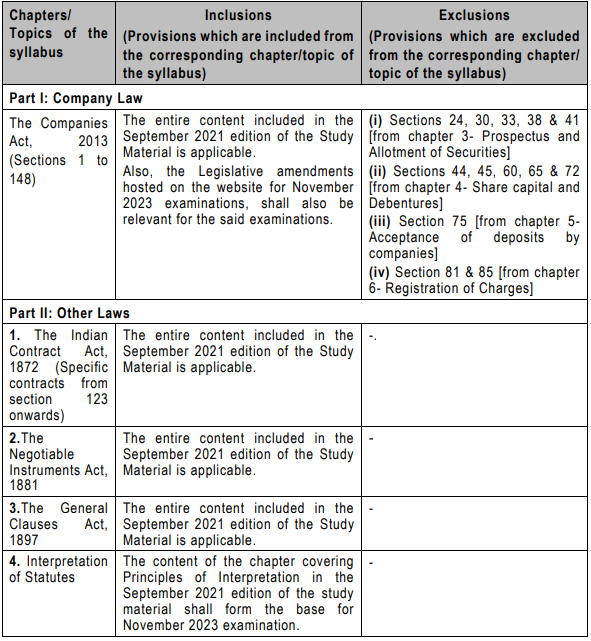

Applicability of the Companies Act, 2013 and other Legislative Amendments for November, 2023 Examination

The relevant notified Sections of the Companies Act, 2013 and legislative amendments including relevant Notifications / Circulars / Rules / Guidelines issued by Regulating Authorities up to 30th April, 2023 will be applicable for November, 2023 Examination.

Non-Applicability of Ind AS

The Ministry of Corporate Affairs has notified Companies (Indian Accounting Standards) Rules, 2015 on 16th February, 2015, for compliance by certain class of companies. These Ind AS do not form part of the syllabus and hence are not applicable.

The provisions of the Companies Act, 2013 along with significant Rules/ Notifications/ Circulars/ Clarification/ Orders issued by the Ministry of Corporate Affairs and the laws covered under the Other Laws, as amended by concerned authority, including significant notifications and circulars issued up to 30th April, 2023 are applicable for November 2023 examination.

Inclusions /Exclusions from the syllabus

Note: September 2021 edition of the Study Material is relevant for November 2023 examinations. The amendments made after the issuance of this Study Material for the period of 1 st May 2021 to 30th April, 2023– are also relevant for November 2023 examinations. The Relevant Legislative amendments will be available on the BoS Knowledge Portal.

Section A: Income-tax Law

The provisions of income-tax law, as amended by the Finance Act, 2022, including significant circulars, notifications, press releases issued and legislative amendments made upto 30th April, 2023, are applicable for November, 2023 examination. The relevant assessment year for income-tax is A.Y. 2023-24.

Note – The May, 2022 edition of the Study Material for Intermediate (New) Paper 4A, based on the provisions of income-tax law, as amended by the Finance Act, 2022, is relevant for November, 2023 examination. The said Study Material is available at ICAI Official website. The Study Material has to be read along with the Statutory Update for November, 2023 examination, webhosted at the BoS Knowledge Portal. The initial pages of the Study Material available at ICAI Official website contains the Study Guidelines which specifies the list of topic-wise exclusions from the scope of syllabus.

Section B: Indirect Taxes

Applicability of the GST law

The provisions of the CGST Act, 2017 and the IGST Act, 2017 as amended by the Finance Act, 2022 including significant notifications and circulars issued and other legislative amendments made, up to 30th April, 2023, are applicable for November 2023 examination.

To Read More Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"