The Institute of Chartered Accountants of India(ICAI) has released CA Final Amendments for Nov 2023 Examinations applicable for all subjects including accounting, auditing, taxation, information technology, law and costing etc.

Reetu | Jul 14, 2023 |

ICAI releases Standards/ Guidance Notes/ Legislative Amendments Applicable for Final Examination November 2023

The Institute of Chartered Accountants of India (ICAI) has released CA Final Amendments for Nov 2023 Examinations applicable for all subjects including accounting, auditing, taxation, information technology, law and costing etc.

The ICAI conducts the Chartered Accountancy examinations of Final Course twice in a year i.e. May and November. CA Institute announce the approved list of applicability of Accounting Standards, Guidance Notes and Legislative Amendments for each term of CA Final Exams well in advance before commencement of exams.

Let’s look into the amendments given below:

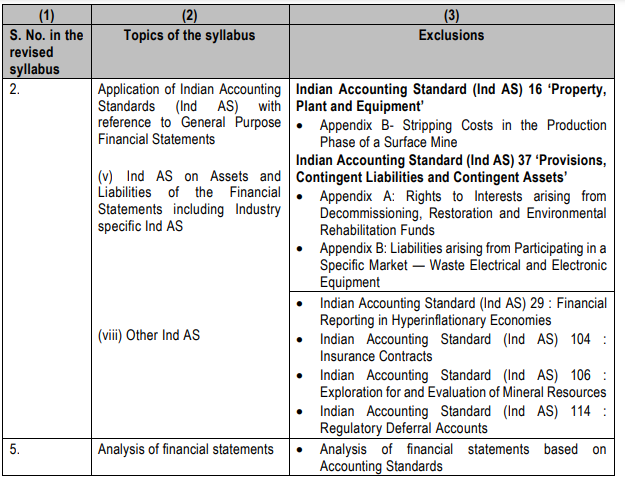

List of topic-wise exclusions from the syllabus

Notes:

(1) October, 2021 edition of the Study Material is relevant for November, 2023 examination. The relevant / applicable topics or content are to be read alongwith the webhosted ‘Corrigendum to Study Material’, if any.

(2) The relevant Amendments / Notifications / Circulars / Rules issued by the Companies Act, 2013 up to 30th April, 2023 will be applicable for November, 2023 Examination. Accordingly, amendments issued by MCA and notified by the Central Government

A. List of topic-wise inclusion in the syllabus

I. List of applicable Statements and Standards:

1. Statement on Reporting under Section 227(1A) of the Companies Act, 1956 (Section 143(1) of the Companies Act, 2013).

2. Framework for Assurance Engagements.

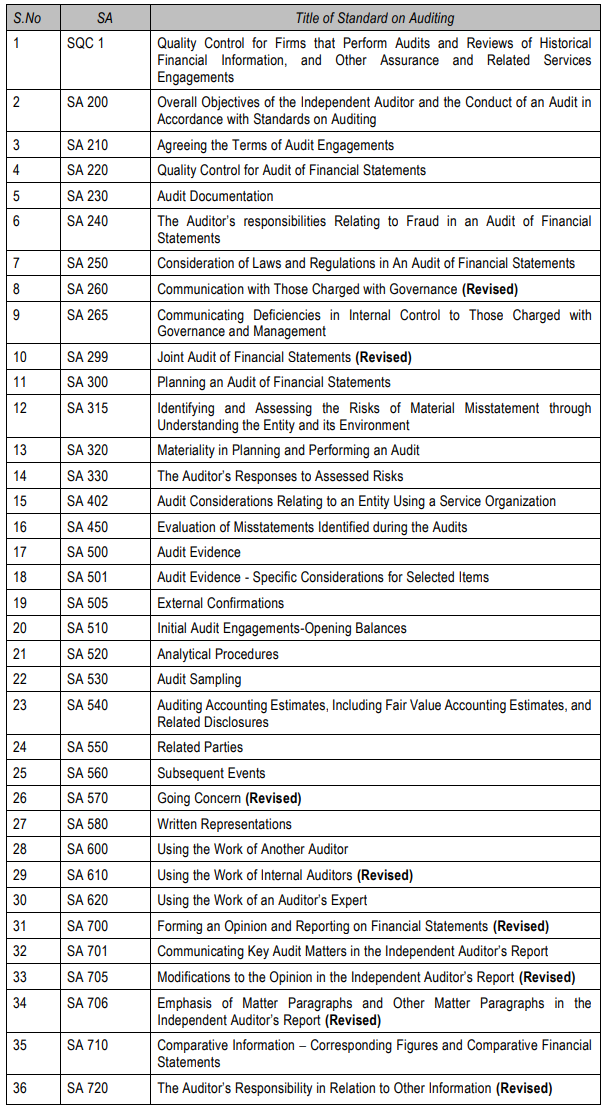

II. List of applicable Engagements and Quality Control Standards on Auditing for November, 2023 Examination:

III. List of applicable Guidance Notes and other publications for November, 2023 Examination:

1. Guidance Note on Audit under Section 44AB of the Income-tax Act.

2. Guidance Note on Audit of Banks.

3. Guidance Note on Audit of Internal Financial Controls over Financial Reporting.

4. Guidance Note on CARO 2020.

IV. Applicability of the Companies Act, 2013 and other Legislative Amendments for November, 2023 Examination:

(i) Students are expected to be updated with the notifications, circulars and other legislative amendments made up to 6 months prior to the examination. Accordingly, the relevant notified Sections of the Companies Act, 2013 and legislative amendments including relevant Notifications / Circulars / Rules / Guidelines issued by Regulating Authority up to 30th April, 2023 will be applicable for November, 2023 Examination. It may be noted that the significant notifications and circulars issued which are not covered in the October 2021 edition of Study Material, would be given as Academic Update in the Revision Test Paper for November, 2023 Examination.

(ii) Companies (Auditor’s Report) Order, 2020 issued by Ministry of Corporate Affairs is applicable for November, 2023 Examination.

(iii) Peer Review Guidelines, 2022 are applicable for November, 2023 Examination.

(iv) Revised Chapter on Professional Ethics based on Code of Ethics 2020 is applicable for November, 2023 Examination.

(v) Applicability of the Amendments to Schedule III to the Companies Act, 2013: The Central Government made certain amendments in Schedule III to the Companies Act, 2013 (vide Notification dated 24th March, 2021), with effect from 1st day of April, 2021.These amendments to Schedule III are applicable for November, 2023 Examination.

(vi) Amendments of Chapter on Audit of NBFCs are applicable for November, 2023 Examination.

To Read More Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"