Reetu | Mar 3, 2022 |

Illustrations on how e-invoice details will be reflected in the GSTR-1

The Goods and Services Tax Network (GSTN) has released an advisory on the auto-population of e-invoice details into GSTR-1 on the GST Portal dated 3rd March 2022.

E-invoice Details into GSTR-1

1. Generation of e-invoice is mandatory for certain class of taxpayers, as notified by the Government. These taxpayers are required to prepare & issue their e-invoices by reporting their invoice data in the prescribed format (e-invoice schema in FORM GST INV-01) and reporting the same on the Invoice Registration Portal (IRP). Invoices reported successfully on the IRP are given a unique Invoice Reference Number (IRN). The documents (invoices, debit notes, credit notes) reported on the IRP are then transmitted electronically to the GST system and are auto-populated in the respective tables of GSTR-1.

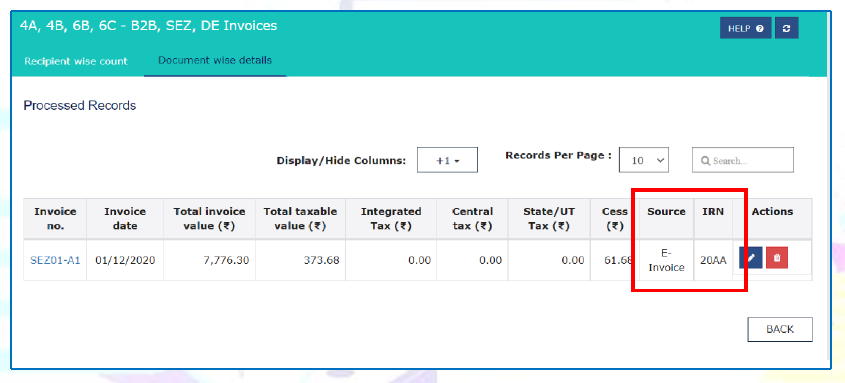

2. Invoices reported successfully on the Invoice Registration Portal (IRP) are given a unique Invoice Reference Number (IRN). After issuance, the e-invoices could be cancelled on the IRP within a specified period after the generation the e-invoice. The documents (invoices, debit notes, credit notes) reported on the IRP are transmitted electronically to the GST system two days after generation & are auto-populated in the respective tables of the GSTR-1 of such taxpayers. These auto-populated documents appear as Saved records in GSTR-1 of the taxpayers, with source of the document mentioned as ‘E-invoice’ & IRN details also mentioned against every record. An illustration & screenshot of this scenario is mentioned below :

Illustration:

Taxpayer reports the e-invoice the IRP & consequently the IRN is generated on 24th November, 2021.This invoice will be auto-populated in GSTR-1 of the taxpayer on 26th November, 2021.

3. In this regard, the following may be noted regarding the auto-population of e-invoices in GSTR-1 :

a. The tax-period of GSTR-1 in which the e-invoice will be auto-populated will be as per the Document Date, irrespective of the date on which the document (invoice, debit note, credit note) was reported on the IRP & the IRN was generated (Date of Generation). An illustration of this scenario is mentioned below :

Illustration:

Taxpayer reports Invoice No. A-253 dated 30th November 2021 on the IRP on 4th December 2021. In this case, the e-invoice details will be reflected in the GSTR-1 for November 2021, even if the IRN is generated in December 2021.

b. If the taxpayer reports the document (invoice, debit note, credit note) on the IRP after filing GSTR-1 for that period, then the e-invoice will not be auto-populated in any subsequent GSTR-1. The Excel file containing the e-invoice details can still be downloaded from the GSTR-1 dashboard for the tax-period to which the document (invoice, debit note, credit note) pertains to. An illustration of this scenario is mentioned below :

Illustration:

Taxpayer reports Invoice No. A-253 dated 30th November 2021 on the IRP on 24th December 2021. The GSTR-1 for November 2021 was already filed on 10th December 2021. Consequently, Invoice No. A253 will not be auto-populated in GSTR-1, and would be available for download in Excel format appearing on the GSTR-1 dashboard for November 2021.

c. If the taxpayer reports the document (invoice, debit note, credit note) on the IRP after manually entering the document in GSTR-1, the manually entered data will not be over-written even if the GSTR-1 is not filed. The Excel file containing the e-invoice details can still be downloaded from the GSTR-1 dashboard of the tax-period to which the document (invoice, debit note, credit note) pertains to. Since the document already exists in GSTR-1 and it is not auto-populated in GSTR-1 from IRP, a message regarding this will be mentioned in the Excel file against the specific document(s). An illustration of this scenario is mentioned below :

Illustration:

Taxpayer reports Invoice No. A-252 dated 15th November 2021 on the IRP on 20th November 2021. However, the taxpayer had already manually added Invoice No. A-252 dated 15th November 2021 in the GSTR-1 before 20th November 2021. In this case, the invoice entered manually in GSTR-1 will not be over-written & could be viewed in the Excel file.

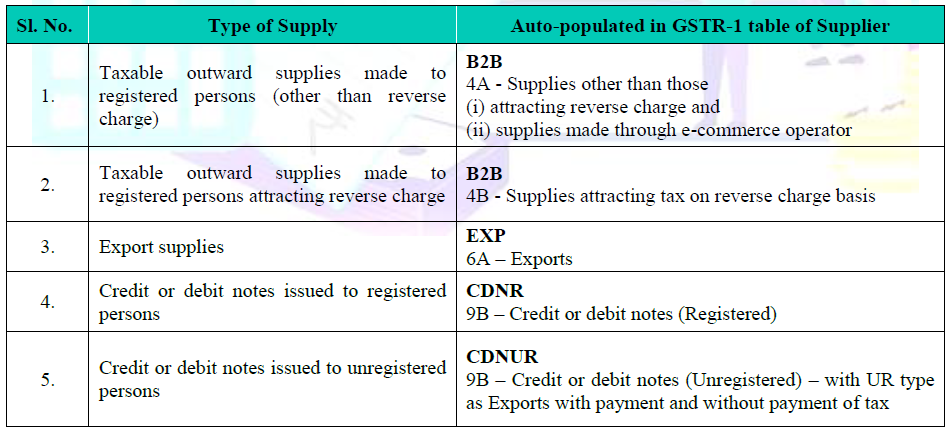

4. Supplies reported in the e-invoices are auto-populated in the following tables of GSTR-1 :

5. GST System aggregates the item-level details reported in the e-invoices at Rate-level for the purpose of auto-population into GSTR-1. For the records auto-populated in GSTR-1 on the basis of e-invoices, the following additional details will also be displayed in GSTR-1 :

a. Source (e-invoice)

b. Invoice Reference Number (IRN)

c. Invoice Reference Number Date (IRN Date)

6. GSTR-1 is a statement of outward supplies which is prepared on the basis of the documents (invoices, debit notes, credit notes) issued by the taxpayers, and is a summary of the same for a given tax-period. Data reported in e-invoices should thus match with the data reported in GSTR-1. Consequently, if a taxpayer edits the data auto-populated in GSTR-1 from e-invoices, such edited documents will be treated as if they were not autopopulated but uploaded separately by taxpayer. Thus, the data auto-populated in the ‘Source’, ‘IRN’ and ‘IRN date’ fields will be deleted by the system in such cases. Taxpayers are thus advised to modify/update the details auto-populated from e-invoices only if they are not as per the actual documents (invoices, debit notes, credit notes) issued by them.

7. Outward supplies details other than those reported in on the IRP have to be manually entered in GSTR-1, as earlier. Before filing GSTR-1, taxpayers are advised to review the details of e-invoices auto-populated in specified tables. This can be done by :

a. Viewing online on GST Portal, or

b. Downloading the JSON from GST Portal, or

c. Using APIs through GST Suvidha Providers (GSPs)

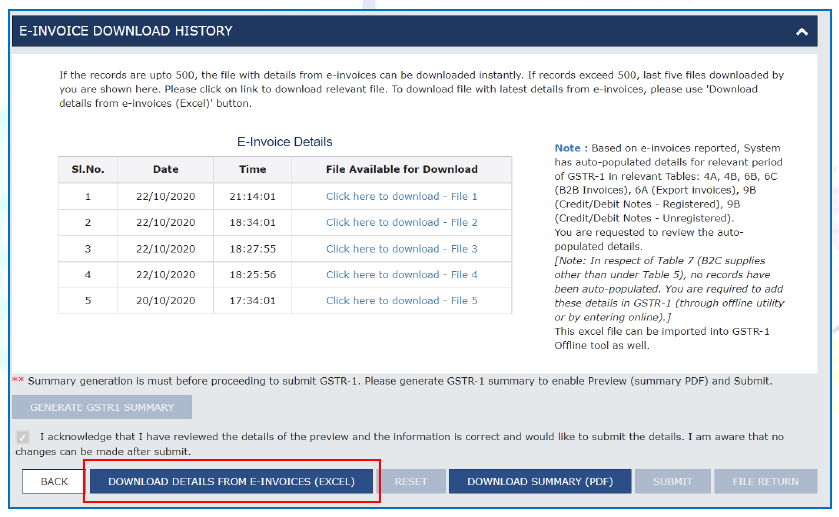

It may to be noted that the auto-populated details in the Excel file available on GSTR-1 dashboard (refer para. 9) are as per the data reported on Invoice Registration Portal (IRP). Any subsequent modifications made by the taxpayer to the auto-populated details in the GSTR-1 tables would not be reflected in this Excel file. Therefore, this Excel file would not serve the purpose of reconciliation, if auto-populated data is changed by the taxpayer at any stage.

8. Documents reported earlier on the Invoice Registration Portal (IRP) can be cancelled within a specified period on the IRP. Upon cancellation, the cancellation data flows to GST system and all cancelled document(s) which were appearing as saved documents in GSTR-1 are deleted from the GSTR-1. The status of the document will be updated in the Excel file, from Valid to Cancelled. In the following scenarios, the document status is updated in the Excel file upon cancellation on IRP, even if no further action is possible in GSTR-1 :

a. GSTR-1 is already filed.

b. Document edited manually by the taxpayer.

c. Document edited by the taxpayer.

d. Document not auto-populated due to error in auto-population.

9. An additional facility of consolidated download of all documents auto-populated from Invoice Registration Portal (IRP) is made available in GSTR-1 dashboard. This Excel file will be available on the GSTR-1 dashboard for the tax-period to which the document (invoice, debit note, credit note) pertains to. This file could be downloaded from the ‘Download details from e-invoice (Excel)’ button on GSTR-1 dashboard.

10. The Excel file contains document-wise details (invoice, debit note, credit note) reported on the Invoice Registration Portal (IRP), and the following details for all documents :

a. Invoice Reference Number (IRN) – 64 string hash

b. Date of Invoice Reference Number (IRN date)

c. e-invoice Status – Valid / Cancelled

d. Date of auto-population/deletion upon cancellation – Date of auto-population into GSTR-1 in case of valid IRN, or, the Date of deletion in case of cancelled IRN, as the case may be

e. GSTR-1 auto-population / deletion status (either of the following) :

→ Auto-populated,

→ Deleted,

→ Auto-population failed,

→ Deletion failed

f. Error in auto-population/ deletion – Error description, if any

11. Taxpayer can use the link ‘e-invoice download history’ to view the list of last five downloaded files. On click of the link, the file will be downloaded. A screenshot of the page containing the Excel file download feature & the ‘e-invoice download history’ is mentioned below :

This can be accessed at:

Returns Dashboard > Selection of Period > Details of outward supplies of goods or services GSTR-1 > Prepare Online

To Read Advisory Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"