Rashmi Joshi | Jun 28, 2022 |

Implications of GST on OLA (ECO) Before and After Amendment

Section 9 (5) of CGST Act 2017 is a charging section under GST for supply of notified services. This section deals with taxability of supply of services, the output tax of which shall be paid by the electronic commerce operator {in short, E-COM} if such services are supplied through it, (even though E-COM is not an actual supplier).

Compulsory Registration u/s 24 (Registration required irrespective of Turnover)

Here, Notified services includes Services by way of Transportation of passengers by a Radio Taxi ,Motor Cab ,Maxi Cab and Motor Cycle therefore provisions of Sec9(5) of CGST is applicable on OLA.

Amendment through Notification N/N 17 / 2021-CT w.e.f 1st Jan 2022 Notified Services include Services by way of Transportation of passengers by a Radio Taxi ,Motor Cab ,Maxi Cab and Motor Cycle, Omni Bus or any other motor vehicle.

Mechanism:

OLA (ECO) collects GST from Passengers on the services provided by Driver (u/s 9(5) As deemed Supplier) and On Convenience Fee from Passengers provided by OLA ( For its own Intermediary Services).

I. When is GST charged on Driver Trip Fee and Convenience Fee ?

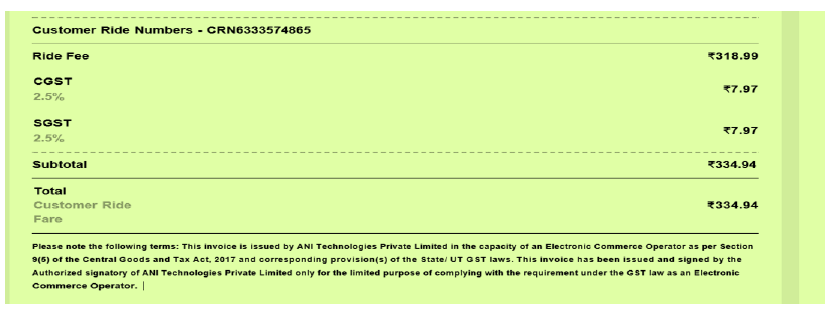

For RIDE FEE:

Ride Fee charged from passengers for Chauffeur/ Driving Services provided by Driver to Ola for passengers via Metered taxi such as Kaali Peeli Taxi, Auto, Bike and E-Rick (E-Rickshaw) are exempt from GST. (See below image of invoice done by Ola to a customer using an Auto ride)

OLA AUTO (OPERATOR/DRIVER)

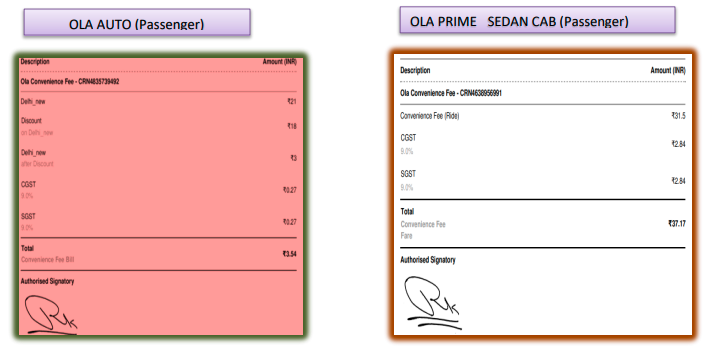

For Convenience Fee

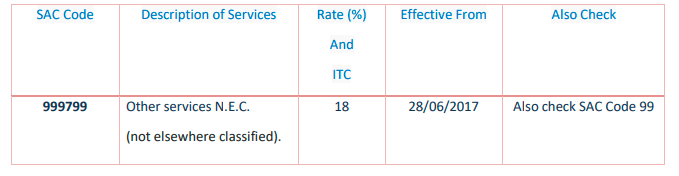

In Case of Convenience Fee GST is applicable on Convenience Fee charged from passengers for availing the intermediary services of OLA through any Vehicle .

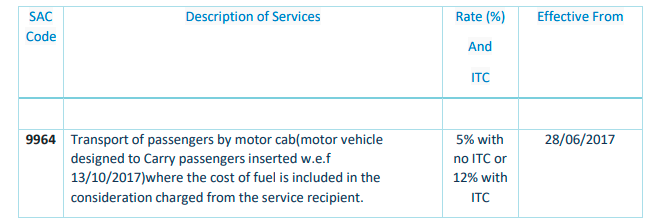

II. Rate of GST Applicable on Ride Fee charged and Convenience Fee? On the DRIVER TRIP INVOICE 5% GST [ 5% IGST OR 2.5% CGST AND 2.5% SGST] is applicable

On OLA’S CONVENIENCE FEE 18% GST [ 18% IGST OR 9% CGST AND 9% SGST]

The definition has now included the terms Omni Bus and Any other Motor Vehicles Thus widenening the scope of the Section.

Omni Bus :Motor vehicle constructed for carrying more than 6 persons (excluding driver).

Any Other Motor vehicle: Any vehicle operating through a Motor .

Impact of These Amendments

For RIDE FEE:

Ride Fee charged from passengers for Chauffeur/ Driving Services provided by Driver to Ola for passengers via Metered taxi such as Kaali Peeli Taxi, Auto, Bike and E-Rick (E-Rickshaw) are not exempt from GST now. (See image below GST is charged on Auto Ride taken in the month of Jan 2022 while Before Jan 2022 it was exempt)

ECO such as Red Bus providing services through an Omni Bus will come in this ambit and will have to act as deemed supplier

OLA AUTO (Passenger)

III. Determination of Place of Supply for the calculation of GST

B2B =Location of such registered Person

B2C= then the place of supply will be the location where the passenger embarks on the conveyance for a continuous journey

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"