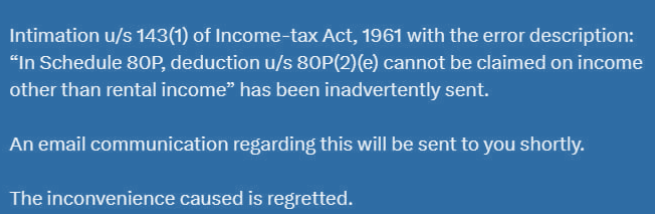

The Income Tax Department has issued clarification that the inaccuracy in the 80P deduction notice was delivered accidentally.

Reetu | Sep 5, 2023 |

Income Tax Department issues Clarification on Notices Mistakenly Sent Under Section 80P

The Income Tax Department has issued clarification that the inaccuracy in the 80P deduction notice was delivered accidentally.

The department has promised taxpayers that an email correspondence would be sent out shortly to address this issue. Meanwhile, taxpayers are advised not to worry and to await additional instructions from the government.

The mistake in the notices was caused by a technical glitch in the department’s system. Because of the issue, notice were sent to taxpayers who claimed deductions under Section 80P even though they were not qualified.

The department has stated that it is working to correct the issue and that impacted taxpayers would not face any penalties. The government has also stated that refunds will be issued to people who have already paid taxes based on the incorrect notices.

The department’s message by email is likely to be sent out within the following two days.

The communication will go into further details regarding the problem and the efforts the department is taking to correct it.

Meanwhile, taxpayers who have received erroneous notice are encouraged not to take any action. They should wait for additional instructions from the department.

Deductions for income or profits of cooperative societies are one of the deductions available under the Income Tax Act, as stipulated in Section 80P.

Individuals, Hindu Undivided Families (HUFs), companies, and firms are all eligible for the Section 80P deduction.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"