Income Tax Search and Seizure: Controversy in computing the period of limitation to frame search assessments

CA Mohit Gupta | Jan 3, 2022 |

Income Tax Search and Seizure: Controversy in computing the period of limitation to frame search assessments

Introduction:-

The period of limitation for completion of assessment u/s 153A of the Income Tax Act’1961 for the searches conducted on or before 31st Day of March’2021 is governed by the provisions of Section 153B of the act. Even though the Section 153A of the Income Tax Act’1961 has been made non applicable for the searches initiated on or after the 1st Day of April’2021, the issue is still having vide ramifications for the searches conducted on or before 31st Day of March’2021.

For the sake of brevity, the relevant extract provisions of Section 153B of the act are reproduced herein below:-

“Time limit for completion of assessment under section 153A.

153B. (1) Notwithstanding anything contained in section 153, the Assessing Officer shall make an order of assessment or reassessment,—

(a) in respect of each assessment year falling within six assessment years [and for the relevant assessment year or years] referred to in clause (b) of sub-section (1) of section 153A, within a period of twenty-one months from the end of the financial year in which the last of the authorisations for search under section 132 or for requisition under section 132A was executed;

(b) in respect of the assessment year relevant to the previous year in which search is conducted under section 132 or requisition is made under section 132A, within a period of twenty-one months from the end of the financial year in which the last of the authorisations for search under section 132 or for requisition under section 132A was executed:

……………………………………………………………………………………………

(2) The authorisation referred to in clause (a) and clause (b) of sub-section (1) shall be deemed to have been executed,—

(a) in the case of search, on the conclusion of search as recorded in the last panchnama drawn in relation to any person in whose case the warrant of authorisation has been issued; or

(b) in the case of requisition under section 132A, on the actual receipt of the books of account or other documents or assets by the Authorised Officer.

……………………………………………………………………………………………“

The perusal of the relevant part of Section 153B of the act divulges that:-

(a) in respect of each assessment year falling within six assessment years and for the relevant assessment year or years] referred to in clause (b) of sub-section (1) of section 153A

And

(b) in respect of the assessment year relevant to the previous year in which search is conducted under section 132,

The Assessing Officer shall make an order of assessment or reassessment within a period of twenty-one months (*) from the end of the financial year in which last of the authorization for search was executed.

By virtue of deeming provision in shape of 153B (2) of act, it is laid down in the statute that last of the authorization shall be deemed to be executed on the conclusion of search as recorded in the last panchnama.

* The period of 21 months have been further reduced to 18 months and 12 months, if search is executed during Financial Year commencing on the 1st Day of April’2018 and 1st Day of April’2019 respectively.

The law as contained in Section 153B(1) and 153B(2) , particularily the interpretation of the term used “last authorization” , “conclusion of search” and “last panchnama” and its connected interplay has drawn varied conflicting interpretations and controversy thereby having an important bearing on the period of limitation within which the assessments u/s 153A of the act have to be framed pursuant to a search action u/s 132 of the act. The conflict primarily arises when the execution of authorizations or panchnama falls in two different financial years.

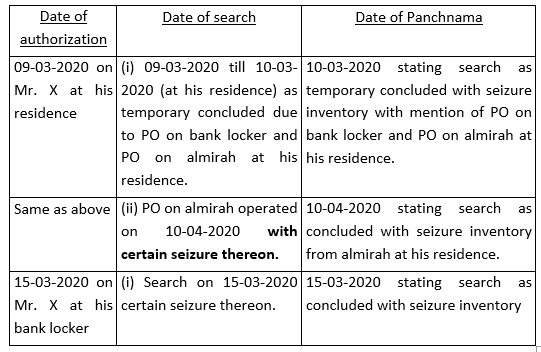

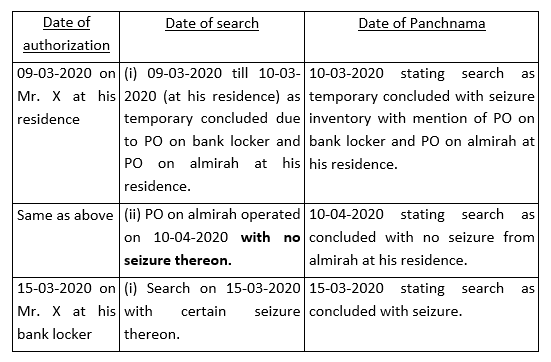

A matrix is hereby prepared putting forth illustrative different scenario(s) in a search action:-

Under this scenario, there can be sub-classifications as under:-

Scenario I(a): Single warrant of authorization issued dated 09-03-2020 in case of Mr. X. The search commenced on on 09-03-2020 and search temporary concluded on 10-03-2020 with a prohibitory order (PO) in respect of an almirah u/s 132(3) of the act. 1st Panchnama drawn on 10-03-2020 showing search as temporary concluded due to PO. The first panchnama also recorded inventory of items seized.

On 02-04-2020, the PO was operated under the same warrant of authorization dated 09-03-2020, with no seizure on account of operation of PO. 2nd Panchnama drawn on 02-04-2020 showing search as concluded. The second panchnama recorded no seizure.

In this scenario, the question arises so far as for the purposes of calculation of limitation u/s 153B, which panchanam should be taken into consideration the 1st one or the 2nd one since no seizure has been made in the 2nd panchnama and a plea may be raised by the person searched citing judicial precedents that the PO has been made only for extension of time limitation by shifting the year.

Scenario I(b): Single warrant of authorization issued dated 09-03-2020 in case of Mr. X. The search commenced on on 09-03-2020 and search temporary concluded on 10-03-2020 with a prohibitory order (PO) in respect of an almirah u/s 132(3) of the act. 1st Panchnama drawn on 10-03-2020 showing search as temporary concluded due to PO. The first panchnama also recorded inventory of items seized.

On 02-04-2020, the PO was operated under the same warrant of authorization dated 09-03-2020, with seizure on account of operation of PO in shape of jewellery. 2nd Panchnama drawn on 02-04-2020 showing search as concluded. The second panchnama recorded seizure of jewellery.

In this scenario, also the question arises so far as for the purposes of calculation of limitation u/s 153B, why should date of 1st panchnama should only be considered ignoring the 2nd panchnama by relying on the decision of the Hon’ble Karnataka High Court in case of C. Ramaiah Reddy v. Asstt. CIT [2012] 20 taxmann.com 781/[2011] 339 ITR 210. The same is discussed in the latter part of this article.

Under this scenario, there can be sub-classifications as under:-

Scenario II(a):

In this scenario, the question arises so far as for the purposes of calculation of limitation u/s 153B, which authorization and panchanam should be taken into consideration. As per the mere reading of Section 153A(1) read with 153(2), the last panchnama of last authorization should be considered i.e. panchnama dated 15-03-2020. But if such an interpretation is applied, the provisions of the scheme of law can be rendered as otiose since effective seizure has been made by virtue of execution of 1st Authorization in shape of 2nd panchnama dated 10-04-2020. There are numerous judicial decisions in favour of this proposition as discussed in the latter part of this article.

Scenario II(b):

In this scenario also the question arises so far as for the purposes of calculation of limitation u/s 153B, as to why the period of limitation should not be reckoned from 10-04-2020 when the search have been stretched till 10-04-2020.

Therefore, undoubtedly these scenario as discussed above suggests that the issue of calculation of limitation period for framing assessments can be a challenging one owing to conflicting judicial decisions and interpretations which is discussed in this article at relevant places.

Going further into the discussion, the provisions of Section 153B(1) of the act requires the Assessing Officer to frame the assessment within 21 months from the date from the end of the financial year in which the last of the authorizations was executed as per Section 132 of the Act. The authorization mentioned in Section 153B is deemed to have been executed when the last panchnama is drawn in relation to any person in whose case the warrant of authorization has been issued. This is in terms of Section 153B (2) (a) of the Act.

The word ‘panchnama’ is not defined in the Act. Even the Code of Criminal Procedure, 1973, the provisions of which relating to search and seizure have been made applicable to the searches and seizures under Section 132 of the Act, does not define the said word. It, however, prescribes the format in which the panchnama is required to be drawn up.

The Hon’ble Delhi High Court in case of CIT v. S.K. Katyal [2009] 308 ITR 168/177 Taxman 380 made the following observations:

‘These provisions demonstrate that a search and seizure under the said Act has to be carried out in the presence of at least two respectable inhabitants of the locality where the search and seizure is conducted. These respectable inhabitants are witnesses to the search and seizure and are known as panchas. The documentation of what they witness is known as the panchnama. The word panchnama, refers to a written document. Its type is usually determined by the word which is combined with it as a suffix. Examples being, nikah-nama (the written muslim marriage contract), hiba-nama (gift deed, the word ‘hiba’ meaning – gift), wasiyat-nama (written will) and so on. So a panchnama is a written record of what the panch has witnessed. In Mohan Lal v. Emperor: AIR 1941 Bombay 149, it was observed that the panchnama is merely a record of what a panch sees…

Similarly, the Gujarat High Court in the case of Valibhai Omarji v. The State AIR 1963 Guj 145 noted that :

“(a) panchnama is essentially a document recording certain things which occur in the presence of Panchas and which are seen and heard by them.” Again, in The State of Maharashtra v. Kacharadas D. Bhalgar (1978) 80 Bom LR 396, a panchnama was stated to be a memorandum of what happens in the presence of the panchas as seen by them and of what they heard.

We have examined the meaning of the word “panchnama” in some detail because it is used in Explanation 2(a) to Section 158BE of the said Act although it has not been defined in the Act. A panchnama, as we have seen is nothing but a document recording what has happened in the presence of the witnesses (panchas). A panchnama may document the search proceedings, with or without any seizure. A panchnama may also document the return of the seized articles or the removal of seals. But, the panchnama that is mentioned in Explanation 2(a) to Section 158BE is a panchnama which documents the conclusion of a search. Clearly, if a panchnama does not, from the facts recorded therein, reveal that a search was at all carried out on the day to which it relates, then it would not be a panchnama relating to a search and, consequently, it would not be a panchnama of the type which finds mention in the said Explanation 2(a) to Section 158 BE.”

At this juncture, it is pertinent to mention here is that Explanation 2(a) to Section 158BE is in pari materia with clause 2(a) of Section 153B which reads as under:-

“

Explanation 2.—For the removal of doubts, it is hereby declared that the authorisation referred to in sub-section (1) shall be deemed to have been executed,—

(a) in the case of search, on the conclusion of search as recorded in the last panchnama drawn in relation to any person in whose case the warrant of authorisation has been issued;

———————————————————- “

To understand the gamut of the discussion, let us also understand the purpose of prohibitory order u/s 132(3) of the act read with Section 132(8A) of the act along with legal intent. The provisions of Section 132(3) and 132(8A) are reproduced herein under:-

“132(3) The authorised officer may, where it is not practicable to seize any such books of account, other documents, money, bullion, jewellery or other valuable article or thing, for reasons other than those mentioned in the second proviso to sub-section (1), serve an order on the owner or the person who is in immediate possession or control thereof that he shall not remove, part with or otherwise deal with it except with the previous permission of such officer and such officer may take such steps as may be necessary for ensuring compliance with this sub-section.

Explanation.—For the removal of doubts, it is hereby declared that serving of an order as aforesaid under this sub-section shall not be deemed to be seizure of such books of account, other documents, money, bullion, jewellery or other valuable article or thing under clause (iii) of sub-section (1).”

“132(8A) An order under sub-section (3) shall not be in force for a period exceeding sixty days from the date of the order.”

Therefore, by virtue of Section 132(3) of the act a discretion is vested with the authorised officer to provides where it is not practicable to seize any books of account, other documents, money, bullion jewellery or other valuable article or thing for reasons other than those mentioned in the second proviso to sub-section (1) of Section 132 of the act, then he can serve an order on the owner or the person, who is in immediate possession or control thereof directing him not to remove or part with, except with the previous permission of such officer and such officer has been vested with the power to enforce compliance with the order. The Explanation to sub-section (3) makes it clear the serving of an order aforesaid shall not be deemed to be a seizure of such books of account, other documents, money, bullion, jewellery or other valuable article or thing under clause (iii) of sub-section (1) of the Act. Such an order is known as a restraint order or prohibitory order(PO) in common parlance. Therefore, the said provisions makes out a distinction between a seizure order and a restraint order. Sub-section (8A) of section 132 of the Act makes it clear that an order under sub-section (3) shall not be in force for a period exceeding 60 days from the date of the order. From the tenor of the language used in the said proviso, it is clear that the said restraint order seizes to be operating on the expiry of 60 days from the date of the said order. No express order requiring the withdrawal or cancellation of the said order is required to be passed under the Act. It ceases to exist automatically on expiry of 60 days prescribed.

To Read More Download PDF Given Below :

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"