Deepak Gupta | Apr 10, 2017 |

Income Tax Slab Rates for FY 2017-18 | AY 2018-19

Income Slabs & Income Tax Rates for the Financial Year 2017-18 i.e. Assessment Year 2018-19 (these will be effective on income earned during 01.04.2017 to 31.03.2018) for various categories of Indian Income Tax payers.

Categorized based on age group

| Categorized based on age group | |||

| Particulars | Category | Based on Age | Based on date of Birth |

| Individual-Resident | Non Senior Citizen | Aged below 60 years | Born on or after 01.04.1958 |

| Senior Citizen | Aged 60 or above but below 80 years | Born on or after 01.04.1938 but before 01.04.1958 | |

| Super Senior Citizen | Aged above 80 years | Born before 01.04.1938 | |

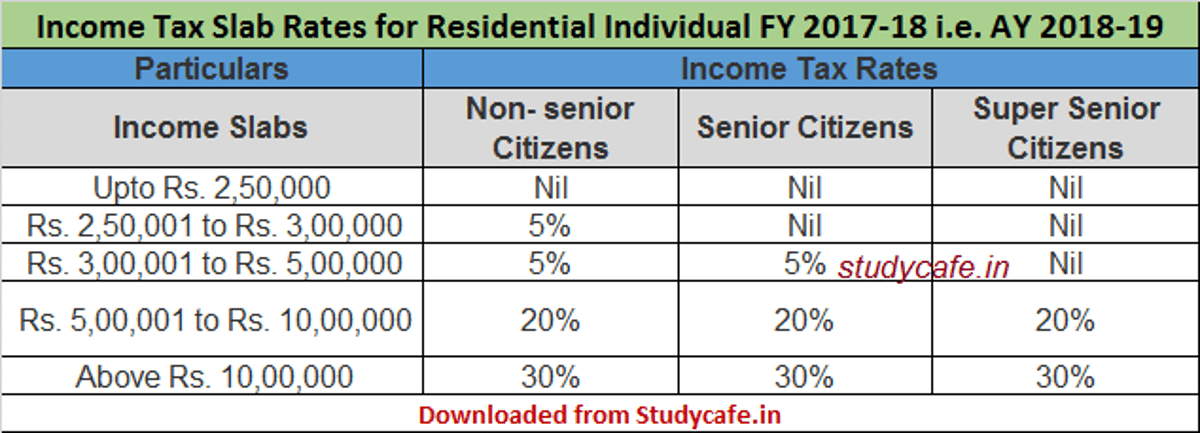

Income Tax Slab Rates for Residential Individual FY 2017-18 i.e. AY 2018-19

| Particulars | Income Tax Rates | ||

| Income Slabs | Non- senior Citizens | Senior Citizens | Super Senior Citizens |

| Upto Rs. 2,50,000 | Nil | Nil | Nil |

| Rs. 2,50,001 to Rs. 3,00,000 | 5% | Nil | Nil |

| Rs. 3,00,001 to Rs. 5,00,000 | 5% | 5% | Nil |

| Rs. 5,00,001 to Rs. 10,00,000 | 20% | 20% | 20% |

| Above Rs. 10,00,000 | 30% | 30% | 30% |

Rebate under section 87A :

Benefits under this section are applicable to individual resident in India whose total income does not exceed Rs. 3,50,000/- .this section provides for a rebate of an amount equal to hundred percent of such income-tax or an amount of Rs. 5000/- (Rs. 2500 from Financial Year 2017-18), whichever is less, from the amount of income-tax.

Surcharge: .

| Surcharge for different Income Tax Slabs for FY 2017-18 i.e. AY 2018-19 | |

| Income Slabs | Rate of Surcharge |

| Upto Rs. 50 lakhs | Nil |

| Above Rs. 50 lakhs upto Rs. 1 crore | 10% |

| Above Rs. 1 crore | 15% |

It is calculated on Income tax payable. However, it is to be noted that the amount of Income Tax and Surcharge should not increase the amount of income tax payable on a taxable income by more than the amount of increase in taxable income. Following are the rates of surcharge applicable for various income slabs

Education Cess including secondary and higher education cess

It is levied at 3% on total income tax and surcharge.

Income Tax Slab Rates for For NRI or HUF or AOP or BOI or AJP FY 2017-18 i.e. AY 2018-19

| Particulars | Assessee |

| Income Slabs | Income Tax Rates |

| Upto Rs. 2,50,000 | Nil |

| Rs. 2,50,001 to Rs. 5,00,000 | 5% |

| Rs. 5,00,001 to Rs. 10,00,000 | 20% |

| Above Rs. 10,0,000 | 30% |

(NRI – Non Resident Individual ; HUF – Hindu Undivided Family ; AOP – Association of Persons ; BOI – Body of Individuals; AJP – Artificial Judicial Persons)

Rebate under section 87A :

Benefits under this section are not applicable to NRI or HUF or AOP or BOI or AJP

Surcharge: .

| Surcharge for different Income Tax Slabs for FY 2017-18 i.e. AY 2018-19 | |

| Income Slabs | Rate of Surcharge |

| Upto Rs. 50 lakhs | Nil |

| Above Rs. 50 lakhs upto Rs. 1 crore | 10% |

| Above Rs. 1 crore | 15% |

It is calculated on Income tax payable. However, it is to be noted that the amount of Income Tax and Surcharge should not increase the amount of income tax payable on a taxable income by more than the amount of increase in taxable income. Following are the rates of surcharge applicable for various income slabs

Education Cess including secondary and higher education cess

It is levied at 3% on total income tax and surcharge.

Income Tax Slab Rates for Co-operative Society FY 2017-18 i.e. AY 2018-19

| Particulars | Assessee |

| Income Slabs | Income Tax Rates |

| Upto Rs. 10,000 | 10% |

| Rs. 10,000 to Rs. 20,000 | 20% |

| Above Rs. 20,000 | 30% |

Rebate under section 87A :

Benefits under this section is not available to Co operative Society.

Surcharge:

| Surcharge for different Income Tax Slabs for FY 2017-18 i.e. AY 2018-19 | |

| Income Slabs | Rate of Surcharge |

| Upto. Rs. 1 crore | Nil |

| Above Rs. 1 crore | 12% |

It is calculated on Income tax payable. However, it is to be noted that the amount of Income Tax and Surcharge should not increase the amount of income tax payable on a taxable income by more than the amount of increase in taxable income. Following are the rates of surcharge applicable for various income slabs

Education Cess including secondary and higher education cess

It is levied at 3% on total income tax and surcharge.

Income Tax Slab Rates for Firm or Local Authority FY 2017-18 i.e. AY 2018-19

| Particulars | Assessee |

| Income Slabs | Income Tax Rates |

| Taxable Income | 30 % |

Rebate under section 87A :

Benefits under this section is not available to firm or local authority.

Surcharge:

| Surcharge for different Income Tax Slabs for FY 2017-18 i.e. AY 2018-19 | |

| Income Slabs | Rate of Surcharge |

| Upto. Rs. 1 crore | Nil |

| Above Rs. 1 crore | 12% |

It is calculated on Income tax payable. However, it is to be noted that the amount of Income Tax and Surcharge should not increase the amount of income tax payable on a taxable income by more than the amount of increase in taxable.

Education Cess including secondary and higher education cess

It is levied at 3% on total income tax and surcharge.

Income Tax Slab Rates for Domestic Company FY 2017-18 i.e. AY 2018-19

| Particulars | Income Tax Rates | |

| Income Slabs | Turnover upto Rs. 50 crores in P.Y 2015-16 | Turnover above Rs. 50 crores |

| Taxable Income | 25% | 30% |

Rebate under section 87A :

Benefits under this section is not available to domestic company.

Surcharge:

| Surcharge for different Income Tax Slabs for FY 2017-18 i.e. AY 2018-19 | ||

| Income Slabs | Rate of Surcharge | |

| Turnover upto Rs. 50 crores | Turnover above Rs. 50 crores | |

| Upto. Rs. 1 Crore | Nil | Nil |

| Above Rs. 1 Crore to Rs. 10 Crores | 7% | 7% |

| Above Rs. 10 Crores | 12% | 12% |

It is calculated on Income tax payable. However, it is to be noted that the amount of Income Tax and Surcharge should not increase the amount of income tax payable on a taxable income by more than the amount of increase in taxable.

Education Cess including secondary and higher education cess

It is levied at 3% on total income tax and surcharge.

Income Tax Slab Rates for Company other than domestic company FY 2017-18 i.e. AY 2018-19

| Particulars | Assessee |

| Taxable Income | Income Tax Rates |

| Royalties received from Government or an Indian concern in pursuance of an agreement made by it with the Government or the Indian concern after the 31st day of March, 1961 but before the 1st day of April, 1976 | 50% |

| Fees for rendering technical services received from Government or an Indian concern in pursuance of an agreement made by it with the Government or the Indian concern after the 29th day of February, 1964 but before the 1st day of April, 1976, and where such agreement has, in either case, been approved by the Central Government. | 50% |

| Others | 40% |

Rebate under section 87A :

Benefits under this section is not available to company other than domestic company

Surcharge:

| Surcharge for different Income Tax Slabs for FY 2017-18 i.e. AY 2018-19 | |

| Income Slabs | Rate of Surcharge |

| Upto. Rs. 1 crore | Nil |

| Above Rs. 1 crore | 2% |

| Above Rs. 10 crores | 5% |

It is calculated on Income tax payable. However, it is to be noted that the amount of Income Tax and Surcharge should not increase the amount of income tax payable on a taxable income by more than the amount of increase in taxable.

Education Cess including secondary and higher education cess

It is levied at 3% on total income tax and surcharge.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"