The ITAT Bangalore has ruled out that Interest paid by the assessee towards excess claim of refund of duty drawback is not penal in nature.

Reetu | Jul 22, 2023 |

Interest paid by the assessee towards excess claim of refund of duty drawback is not penal in nature: ITAT

The Income Tax Appellate Tribunal(ITAT Bangalore) in the matter of Mahalasa Exports vs. The Income Tax Officer has quoted that Interest paid by the assessee towards excess claim of refund of duty drawback is not penal in nature. Therefore, Explanation 1 to section 37 will not apply and assessee is eligible to claim it as expenditure.

This appeal by the assessee is against the DIN & Order No. ITBA/NFAC/S/250/2022-23/1049570428(1) dated 9.2.2023 of the CIT(Appeals), National Faceless Assessment Centre, Delhi [NFAC], Delhi passed u/s 250 of the Act for the assessment year 2018-19.

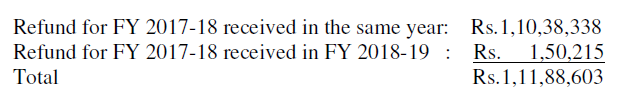

After hearing both the sides, perusing the entire material on record and the orders of the lower authorities, we notice that during the course of assessment proceedings the AO has added back the duty drawback of Rs.1,50,215 which has been received in the subsequent assessment year 2019-20 but pertains to the relevant current assessment year 2018-19. The ld. AR of the assessee submitted that the right to receive occurred in the subsequent year 2019-20 when the customs authority granted the refund of duty drawback, therefore the amount has been offered as income in the subsequent assessment year 2019-20. On going through the reconciliation statement submitted by the assessee before the AO, we note that the refund for FY 2016-17 has been offered as income in the impugned FY 2017-18 which has been accepted by the revenue. On the one hand, the revenue authorities have considered duty drawback & service tax of Rs.22,93,878 as income in the current assessment year which was received by the assessee in the impugned AY 2018-19 whereas it pertained to previous FY 2016-17 relevant to AY 2017-18. On the other hand, the amount of duty drawback and service tax refund of Rs.1,50,215 has been received in the subsequent year, but considered as income in the current FY 2017-18. The amount of Rs.1,11,88,603 has been arrived by the AO as under:-

For the refund of duty drawback the assessee accounts the same when it gets the right to receive the duty drawback which is nothing but mercantile system of accounting. This fact has not been disputed by the revenue authorities in any of the previous years as submitted by the ld. AR. In the peculiar facts and circumstances of the present case, we conclude that the income would be receivable only when the income accrues to the assessee and income would accrue to the assessee only when the assessee gets such a right to receive the income. The assessee would get a right to receive only when it is sanctioned to the assessee by the custom authorities and not when the assessee makes a claim of the same. This view is supported by the judgment of High Court in the case of CIT v. Asea Brown Boveri Ltd (117 Taxman 447) and CIT v. Sriyansh Knitters (P) Ltd. (336 ITR 235). Ground No.2 raised by the assessee on this issue is allowed. Accordingly the alternative ground No.4 does not require any adjudication.

Ground No.5 & 6 is in respect of interest payment of Rs.3,30,674 on excess claim of refund which has been adjusted against the duty drawback for the period for which the assessee benefitted on the excess amount of duty drawback @ 1% instead of 0.15%. The lower authorities have not accepted that the interest paid is part of duty drawback. The ld. AR in this regard referred to Rule 17 which governs the repayment of erroneous or excess payment of drawback and interest which is as under:-

“17. Where an amount of drawback and interest, if any, has been paid erroneously or the amount so paid is in excess of what the claimant is entitled to, the claimant shall, on demand by a proper officer of customs repay the amount so paid erroneously or in excess, as the case may be, and where the claimant fails to repay the amount, it shall be recovered in the manner laid down in sub-section (1) of section 142 of the Customs Act, 1962 (52 of 162) ”.

The above Rule provides refund of excess claim and interest thereon, but it is not in the nature of penalty or fine where the Rule itself provides for payment of principal as well as interest. Hence, in our considered opinion, it should not be considered as penalty or fine. Therefore, the assessee has not violated the provisions of Explanation 1 to section 37(1) of the I.T. Act.

Respectfully, we hold that the interest paid by the assessee towards excess claim of refund of duty drawback is not penal in nature. Therefore, Explanation 1 to section 37 will not apply and assessee is eligible for claiming it as expenditure. Since the assessee has adjusted the interest paid from the refund of export benefit, it will not affect the profitability of the company. Accordingly, this issue raised by the assessee is allowed.

In the result, the appeal by the assessee is partly allowed.

For Official Judgment Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"