The Shark Tank Famous and former BharatPe CEO Ashneer Grover has shared recently that IT Department asks start-up companies to furnish 3 year ITR of all shareholders.

Reetu | Sep 9, 2023 |

IT Department asks Start-Up companies to furnish 3 year ITR of all shareholders

The Shark Tank Famous Shark and former BharatPe CEO Ashneer Grover has shared recently that IT Department asks start-up companies to furnish 3 year ITR of all shareholders.

Ashneer Grover, who shared the experience of a few businesses, stated that they had received Income Tax notices requesting information regarding shareholders. He specifically mentioned the section of the ITR notice that required start-up enterprises to provide three years of ITR for all shareholders.

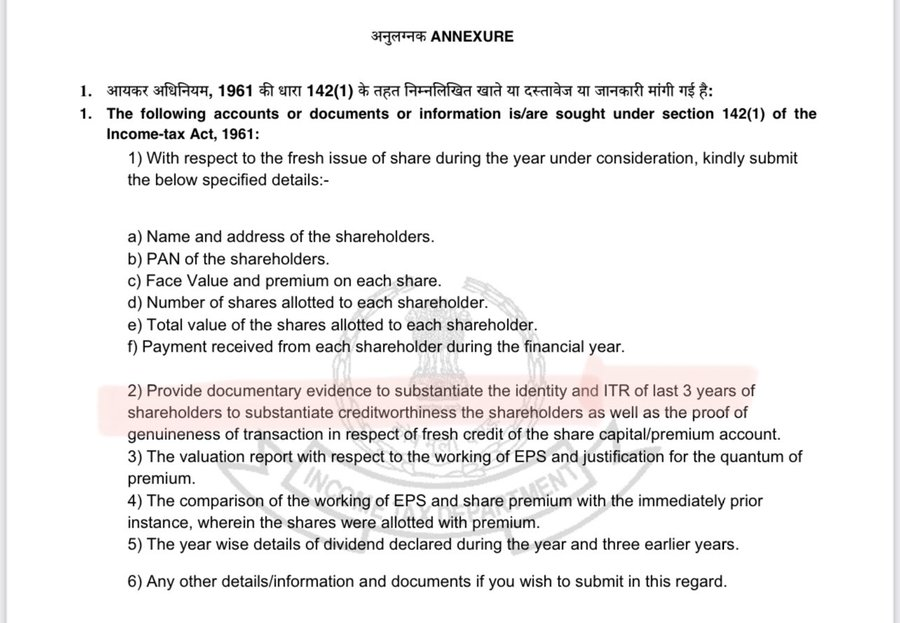

On his official twitter account Ashneer stated that, “In the last 1 month, a number of startups (a few in my portfolio as well) have received Income Tax notices asking to furnish information about shareholders.

Bahut interesting hai – they are asking start-up companies to furnish 3 year ITR of all shareholders. 1) How and why will companies have ITR of shareholders ! 2) Why would a shareholder/individual share their ITR with a private company ?

And reason likha hai ‘to establish creditworthiness of shareholders’ ? Kyun ? Company shareholder ko loan thode nahi de rahi ? Ulta shareholder ne company mein equity daal rakhi hai. Request @FinMinIndia (Ministry of Finance) to please look at it.”

Former Shark Tank India judge also provided a copy of the IT department notice. The IT department requested specific papers in the notification under section 142 (1) of the Income-tax Act.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"