Seized handwritten ledgers treated as reliable evidence of unexplained expenditure; Revenue succeeds on interest addition

Meetu Kumari | Jan 16, 2026 |

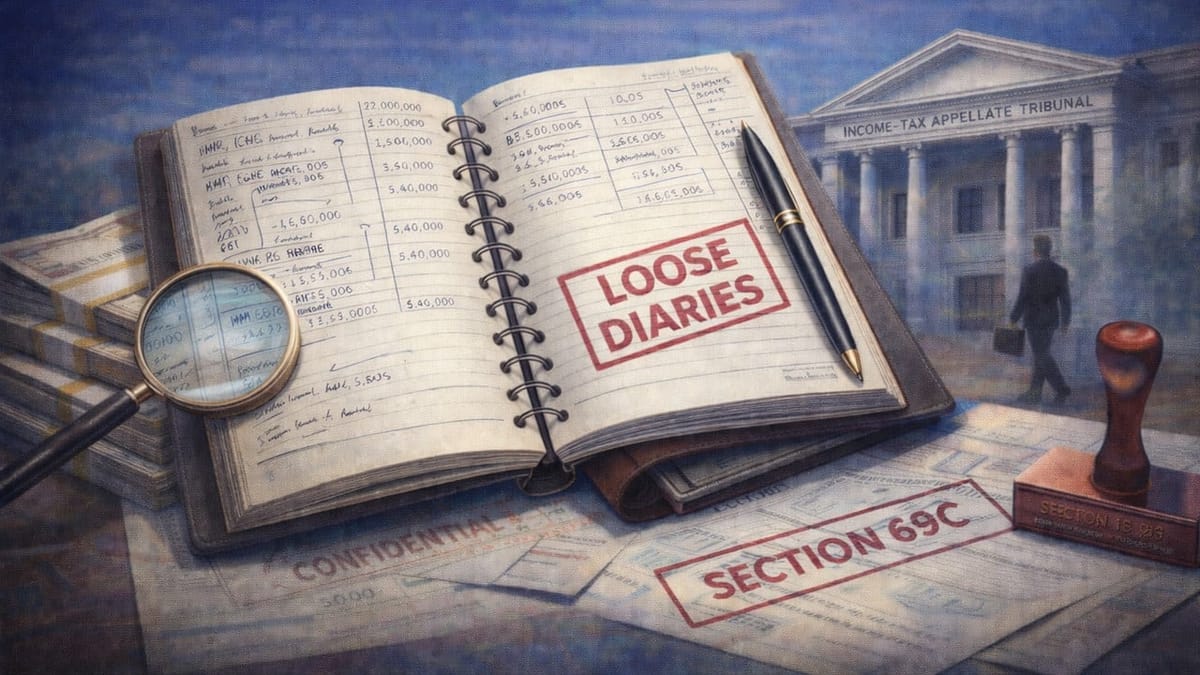

ITAT Ahmedabad Confirms Section 69C Additions Based on Seized Diaries

A search under Section 132 was conducted in the Ratnamani Group, during which handwritten diaries were seized from the residence of Shri Prakash M. Sanghvi. One diary contained a distinct running ledger titled “Mukesh Ratnajyot / Mukeshbhai RJ”, showing year-wise debit and credit entries along with interest calculations.

Reassessment proceedings were initiated against Shri Mukesh Mohanlal Vaghela for multiple assessment years. The Assessing Officer treated the balances shown in the ledger as unexplained expenditure under Section 69C. The assessee denied any connection with the diary, contending that it was a dumb document and that no incriminating material was found on his premises. The Commissioner (Appeals) upheld the additions under Section 69C but deleted the interest component as notional, leading to cross-appeals before the Tribunal.

Main Issue: Whether the seized diary ledger constituted reliable evidence linking the assessee to unexplained expenditure under Section 69C, and whether the recorded interest entries represented real income chargeable to tax.

ITAT Held: The ITAT dismissed all appeals filed by the assessee and upheld the additions under Section 69C. The Tribunal held that the seized diaries were admitted by Shri Prakash M. Sanghvi as records of real transactions and contained a clear, continuous, and specifically named ledger relating to the assessee. The entries were also corroborated by disclosed investments and bank transactions, negating the plea that the documents were dumb or unreliable.

The Tribunal held that unexplained cash outflows incurred by the assessee were independently taxable under Section 69C, attracting the mandatory application of Section 115BBE.

The Tribunal restored the interest addition, holding that systematic interest entries reflected real accrual of income and could not be treated as merely notional. Therefore, all assessee appeals were dismissed, and the Department’s appeal for AY 2020-21 was allowed.

To Read Full Judgment, Download PDF Given Below

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"