The Tribunal upheld that if a case has valid points that need to be examined, then the appeal should not be dismissed just because it was filed late.

Nidhi | Dec 20, 2025 |

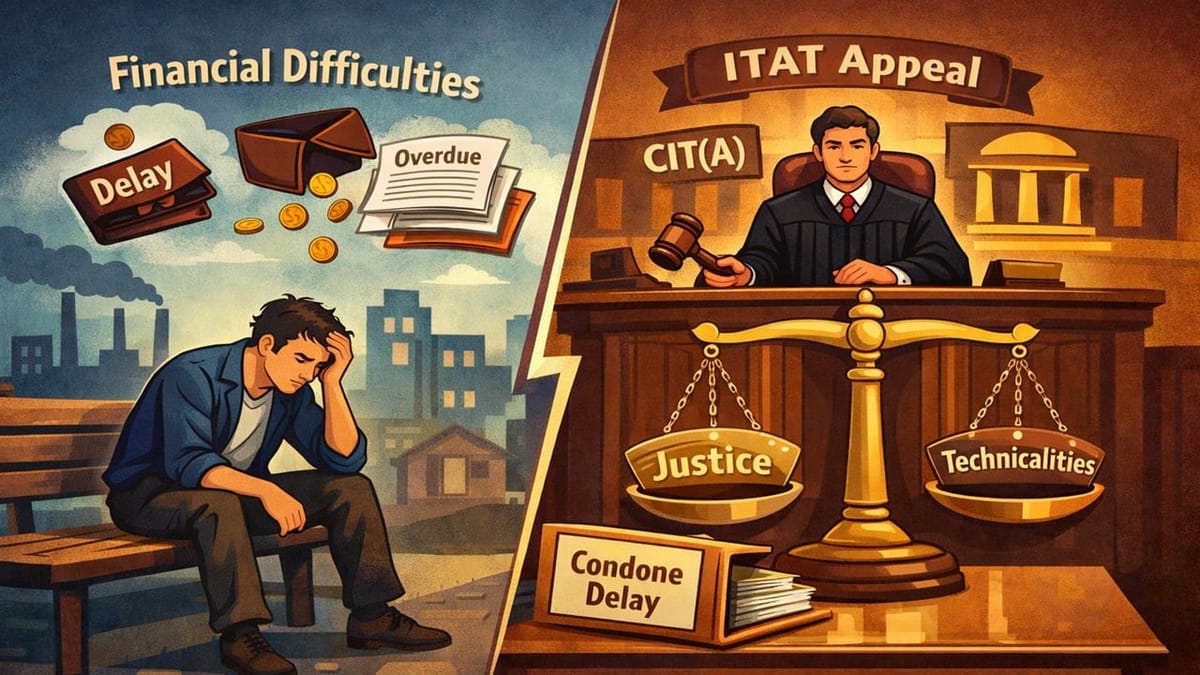

ITAT Directs CIT(A) to Condone Delay Caused Due to Financial Difficulties

The Income Tax Appellate Tribunal (ITAT), Pune, condoned delays in filing an appeal challenging the assessment order and the penalty levied by the income tax authorities.

The assessee company, Ambarwadikar Infrastructure Limited, had filed its income tax return (ITR) for the AY 2016-17, declaring a loss. However, the Assessing Officer reassessed the company’s income, making several additions, including unexplained loans and investments, resulting in a total income of Rs 26,45,49,456.

The company challenged these additions, but there was a delay in filing the appeals. The first appeal challenging the assessment order was delayed by 219 days, and the second appeal, challenging the penalty levied under section 271(1)(c) by the AO, was delayed by 76 days. The assesse explained that the delay was caused due to ongoing legal proceedings, attachment of assets by the Income Tax Department and personal stress of their director due to the death of his family member.

However, despite this, the CIT(A) rejected the appeal, saying that the assessee did not give reasonable cause for the delay. Therefore, the assessee filed an appeal before the ITAT.

The ITAT considered the company’s reasons for the delay and cited several Supreme Court rulings, including Collector, Land Acquisition vs. Mst. Katiji and Inder Singh vs. State of Madhya Pradesh, where it was held that “when substantial justice and technical considerations are pitted against each other, cause of substantial justice deserves to be preferred for the other side cannot claim to have vested right in injustice being done because of a non-deliberate delay”

Further, the tribunal upheld the decision of the Supreme Court’s order, where it was concluded that if a case has valid points that need to be examined, then the appeal should not be dismissed just because it was filed late.

Accordingly, the Tribunal directed the CIT(A) to condone the delay and hear the appeals on merit.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"