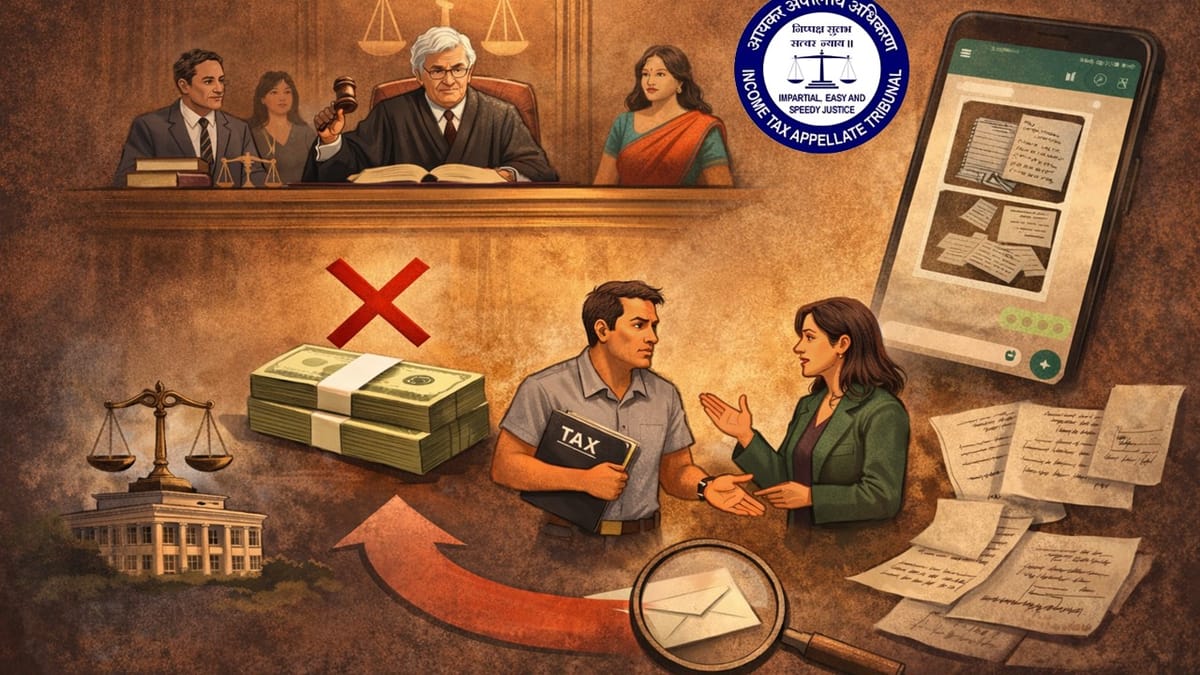

ITAT deleted Rs. 2 crore addition, holding that third-party WhatsApp images and loose notes without independent proof cannot justify an unexplained cash addition.

Saloni Kumari | Dec 19, 2025 |

ITAT Rejects Rs. 2 Crore Cash Addition Merely Based on Third-Party WhatsApp Evidence

The Assistant Commissioner of Income Tax (ACIT) filed the present appeal before the Income Tax Appellate Tribunal (ITAT) Mumbai against Jayesh Umakant Manania, challenging an order passed by the CIT(A)/NFAC on August 29, 2025.

The assessee filed his income tax return for the assessment year 2012-13, declaring the total income of Rs. 3,000,378. The Income Tax Department had conducted a search and survey in the Shri Pankaj Dhanji Goshar and M/s Kalyanji Velji HUF case; the tax department found some mobile phone images and loose notes. The mentioned cash payments clearly mentioned the assessee’s name in them. In conclusion to the findings, the tax department reopened the assessment.

The Assessing Officer relied completely and merely on WhatsApp images and notes, not even of the assessee, but pertaining to some third person. AO assumed that the assessee had paid Rs. 2 crore in cash for booking flats in a real estate project. Based on this, the Assessing Officer made an addition of the same amount to the assessee’s income as an unexplained cash payment under section 69A of the Income Tax Act, even though the documents were not found with the assessee, they were not written by the assessee, and there was no proof of actual cash payment.

When approached by the CIT(A), deleted the addition made by the Assessing Officer (AO) and accepted the appeal of the assessee, ruling in favour of the assessee. The aggrieved Revenue, with the order of CIT(A), filed an appeal before the ITAT Mumbai bench. Before the tribunal, the assessee clearly denied making any of the said cash payments and additionally claimed that no flat was booked in that year, all later payments were made through banking channels, and documents cited all pertained to some third person. Also, the persons named in the documents denied receiving any cash. The alleged recipient was also cross-examined, who again denied receiving cash.

When the tribunal analyzed the arguments of both sides, the tribunal endorsed the ruling of CIT(A) and dismissed the present appeal of Revenue, stating loose papers and phone data of a third party are not strong evidence to make any addition; also, no proof showed that the assessee actually paid cash, the alleged recipients themselves denied receiving money, and the same amount was wrongly added in the hands of the assessee’s brother also. The cited documents without supporting evidence are “dumb documents.” Hence, in the final ruling, the tribunal deleted the addition of Rs. 2 crore made by the AO and dismissed the appeal of the Revenue.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"