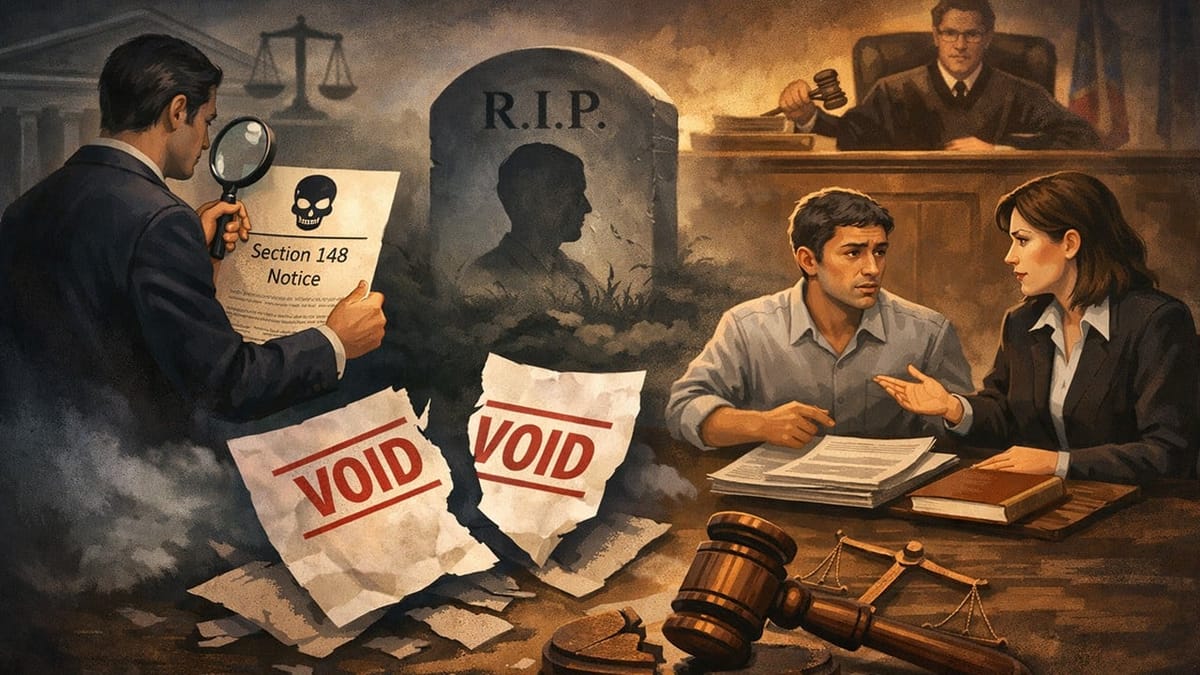

The ITAT held that a reassessment initiated through a Section 148 notice issued in the name of a deceased assessee is void in law, and participation by the legal heir cannot cure this defect.

Saloni Kumari | Dec 25, 2025 |

ITAT Holds Legal Heir’s Participation Cannot Cure Defective Notice Issued in Name of a Dead Person

The ITAT Delhi held that a reassessment notice issued in the name of a deceased person is invalid in law, and participation by the legal heir cannot cure this defect. Accordingly, they declared the entire reassessment proceedings as void.

The present appeal has been filed by the Income Tax Officer (ITO) before the ITAT Delhi, challenging an order dated December 26, 2016, passed by the NFAC Delhi, favoring Shalini Chaudhary Sharma. The case is related to the Assessment Year 2009-10.

The key dispute in the current case was whether CIT(A)/NFAC was right in upholding a notice issued by the Assessing Officer (AO) under Section 148 of the Act as invalid on the grounds that it was issued in the name of a dead person, leading to the treatment of the entire reassessment order as void and null.

The aggrieved tax department argued before the tribunal that despite sending several reminder notices, no one appeared on behalf of the assessee in the personal hearing. Further argued that the assessment was not made on a dead person, as the executor of the will had participated in the proceedings, filed the return, and authorised a chartered accountant to appear. The Department also asserted that the validity of the notice issued under Section 148 was never challenged during assessment proceedings.

The tribunal, after hearing the arguments from both sides, noted that although the department was informed about the death of the assessee, it did not issue any valid notice under Section 148 to the legal heir of the assessee, i.e., the executor. The reassessment notice continued to be issued in the name of the deceased assessee, which is not allowed as per law. The Tribunal further held that participation by the executor or legal heir does not validate an invalid notice.

Based on the aforesaid findings, the tribunal upheld the CIT(A)’s order and held that the entire reassessment proceedings are invalid. In the end, dismissed the appeal of the tax authorities.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"