ITAT Delhi holds that Section 56(2)(viib) does not apply to share issues made to non-resident investors

Meetu Kumari | Jan 21, 2026 |

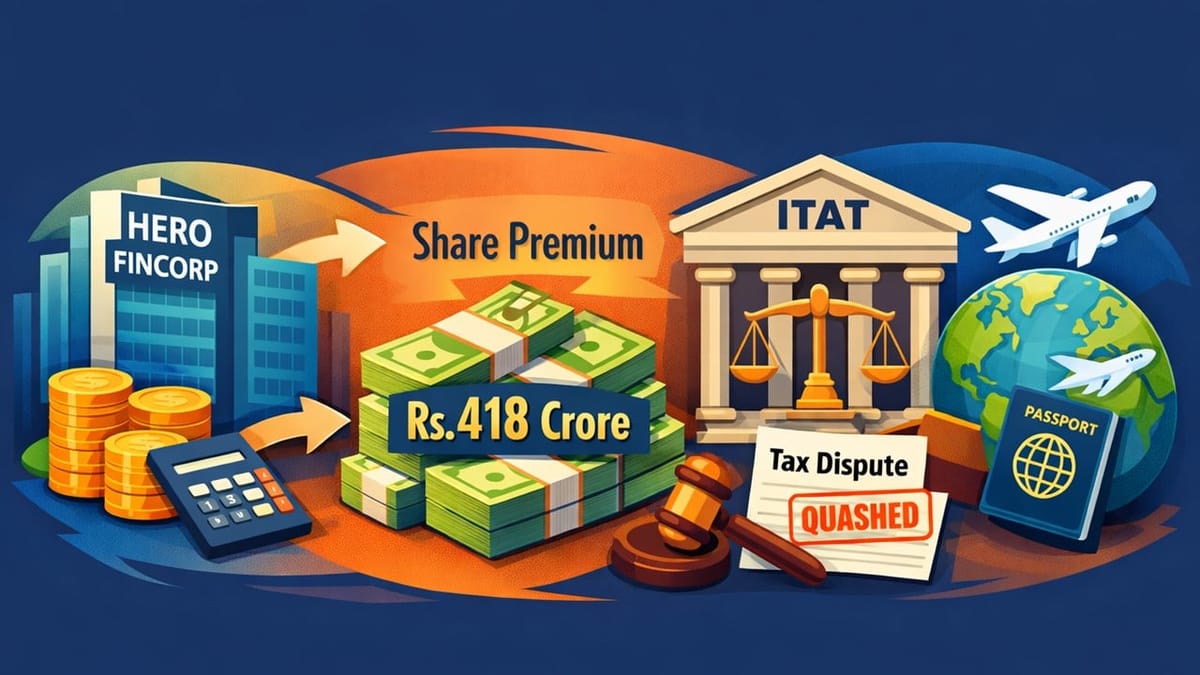

ITAT Quashes Rs. 418 Crore Share Premium Addition for Hero Fincorp: Non-Resident Clause Clarified

Hero Fincorp Ltd., a finance company, filed its return for AY 2017-18, declaring income of about Rs. 280 crore. During the year, it issued equity shares at a premium of Rs. 510.30 per share to two foreign investors. The Assessing Officer rejected the company’s DCF valuation, reworked the share value at Rs. 210 per share, and made an addition of ₹418.66 crore under Section 56(2)(viib).

Thereafter, accepting that the provision applies only to shares issued to residents, the AO rectified the order under Section 154 and deleted the addition. However, the NFAC treated the rectification as non-est and restored the addition, alleging round-tripping.

Main Issue: Whether Section 56(2)(viib) can be applied where share premium is received from non-resident investors, and whether NFAC could ignore a valid rectification order passed by the AO under Section 154.

Tribunal Ruled: The ITAT, after a reference to a Third Member, ruled in favour of Hero Fincorp. The Tribunal held that Section 56(2)(viib) clearly applies only when shares are issued to residents, and since the investors were undisputedly non-residents, the provision had no application.

The Tribunal further held that once the AO himself deleted the addition through a rectification order, the Revenue ceased to be an aggrieved party, and NFAC had no jurisdiction to revive the addition. Therefore, the Rs. 418.66 crore addition was fully deleted, though a minor issue relating to collection charges was remanded for fresh examination.

To Read Full Judgment, Download PDF Given Below

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"